Reverse Mortgages HomeEquity Bank Canada | Trusted Home Equity Solutions for Seniors

Find the Best HomeEquity Bank Reverse Mortgage Rates in Canada

Today’s Reverse Mortgage Rates updated as of October 8, 2025 1:03 pm

For a property located in

*Rates can change at anytime. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

HomeEquity Bank: Canada’s Leading Provider of Financial Solutions for Seniors

HomeEquity Bank is a trusted financial institution in Canada, specializing in innovative financial products tailored for homeowners aged 55 and older. With over 30 years of experience, HomeEquity Bank offers services designed to help Canadian seniors unlock the value of their homes and enhance their retirement lifestyle with a reverse mortgage.

About HomeEquity Bank

Headquartered in Toronto, Ontario, HomeEquity Bank is one of Canada’s leading financial institutions focused exclusively on providing reverse mortgages and other home equity solutions. The bank’s flagship product, the CHIP Reverse Mortgage, has helped thousands of Canadian homeowners achieve financial flexibility without the need to sell their homes..

For more details on how reverse mortgages work, visit the Financial Consumer Agency of Canada (FCAC).

Why Choose HomeEquity Bank?

Proven Expertise

HomeEquity Bank has been in the business for over three decades, offering reliable and secure financial products to Canadian seniors.Customer-Centric Approach

With a commitment to transparency and customer satisfaction, HomeEquity Bank ensures a seamless experience from application to fund disbursement.Flexible Financial Solutions

Beyond reverse mortgages, HomeEquity Bank offers various tools and resources to help clients make informed financial decisions.No Negative Equity Guarantee

A hallmark of their reverse mortgage product, ensuring borrowers never owe more than the fair market value of their home when sold.

Products Offered by HomeEquity Bank

While CHIP Reverse Mortgage is their most well-known product, HomeEquity Bank offers a range of other financial solutions tailored to Canadian seniors:

Home Equity Line of Credit (HELOC)

A flexible credit solution allowing you to access your home equity as needed.Income Advantage Program

A steady stream of income tailored for retirees, providing financial security during retirement.Educational Resources

HomeEquity Bank provides tools, calculators, and guides to help clients understand their financial options.

HomeEquity Bank’s Impact on Canadian Seniors

Key Statistics

- Market Leader: HomeEquity Bank holds the largest market share in Canada’s reverse mortgage industry.

- Loan Disbursement: Over $6 billion in reverse mortgage funds provided to Canadian seniors.

- Customer Satisfaction: Rated highly for customer support and transparency.

How HomeEquity Bank Supports Seniors

Financial Independence

HomeEquity Bank helps seniors achieve financial independence by providing flexible loan solutions that align with their lifestyle and retirement goals.Staying in Your Home

The bank’s products are designed to allow seniors to remain in their homes while enjoying the benefits of unlocked equity.No Monthly Payments

With their reverse mortgage product, seniors can access funds without the burden of monthly payments.

HomeEquity Bank’s Digital Tools and Resources

HomeEquity Bank offers a variety of online tools to help Canadian seniors make informed financial decisions:

- Reverse Mortgage Calculator: Provides an estimate of how much equity you can access.

- Educational Guides: Detailed resources explaining the benefits and considerations of home equity solutions.

- Customer Support Portal: Access to personalized assistance and account management.

Current Reverse Mortgage Rates at Homeequity bank

As of 2025, HomeEquity Bank reverse mortgage offers some of the most competitive reverse mortgage rates in Canada:

- Fixed Rates: 7.25% – 9.10%

- Variable Rates: 6.90% – 8.75%

For the latest rate updates, visit HomeEquity Bank Reverse Mortgage Rates.

HOMEEQUITY BANK REVERSE MORTGAGE RATES

Get An Estimate

See How Much You Can Borrow Today!

Eligibility for HomeEquity Bank Reverse Mortgage

- Age: 55 or older

- Primary Residence: Your home must be your primary residence

- Home Equity: Meet HomeEuity Bank’s criteria for property valuation and location

Use the HomeEquity Bank Reverse Mortgage Calculator to get a personalized estimate.

Reverse Mortgage Fees at HomeEquity Bank

HomeEquity Bank offers various financial products, including the CHIP Reverse Mortgage, each associated with specific fees. Here’s an overview of the common fees:

1. Appraisal Fee:

- Amount: Typically ranges from $300 to $500.

- Purpose: Covers the cost of a professional property appraisal to determine your home’s current market value.

2. Legal Fees:

- Amount: Approximately $1,000 to $2,000.

- Purpose: Covers the cost of independent legal advice and services required to process the mortgage.

3. Administrative/Closing Fee:

- Amount: Generally $1,795, though it may vary based on individual circumstances.

- Purpose: Covers administrative costs, including document preparation and processing.

4. Prepayment Charges:

- Amount: Varies depending on the timing and amount of prepayment.

- Purpose: Applied if you choose to repay the mortgage partially or in full before the end of the term.

5. Conversion Fee:

- Amount: $500.

- Purpose: Charged for processing a request to convert your CHIP Open Reverse Mortgage to a standard CHIP Reverse Mortgage.

6. Default Administration Fee:

- Amount: $250.

- Purpose: Applied if there is a default on the mortgage terms.

7. Discharge Fee:

- Amount: $300.

- Purpose: Covers the cost of discharging the mortgage from the property’s title upon full repayment.

Please note that these fees are subject to change and may vary based on individual circumstances. For the most accurate and up-to-date information, it’s advisable to consult directly with HomeEquity Bank or refer to their official fee schedule.

Common Uses for HomeEquity Bank Reverse Mortgage Funds

- Debt Consolidation

- Home Renovations

- Healthcare Expenses

- Supplementing Retirement Income

- Financial Assistance for Family

Get An Estimate

See How Much You Can Borrow Today!

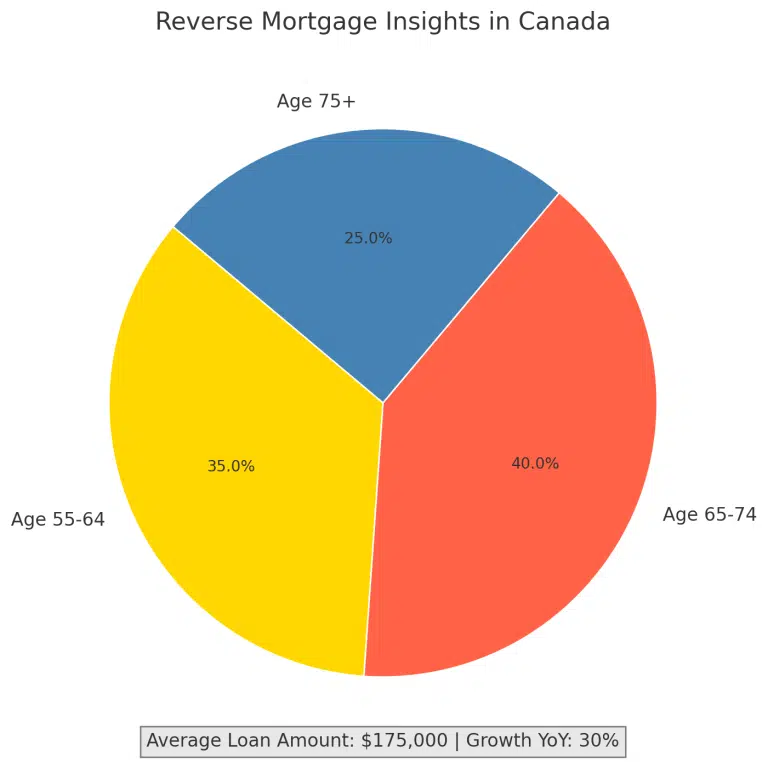

Reverse Mortgage Statistics

Understanding the market trends and usage patterns for reverse mortgages can help you make informed decisions. Here are key statistics:

Key Statistics

- Average Loan Amount: $175,000

- Year-Over-Year Growth: 30%

- Homeowner Eligibility: 90% of homeowners with sufficient equity qualify.

- Usage Breakdown:

- Debt Consolidation: 25%

- Home Renovations: 23%

- Retirement Income: 30%

- General Spending: 22%

Age Distribution of Reverse Mortgage Holders

- Age 55-64: 35%

- Age 65-74: 40%

- Age 75+: 25%

FAQs About HomeEquity Bank

Is HomeEquity Bank regulated in Canada?

Yes, HomeEquity Bank is federally regulated and operates under strict compliance guidelines to ensure the safety and security of its clients

How does repayment work with a reverse mortgage?

The loan is typically repaid when you sell your home, move into long-term care, or pass away. You or your estate won’t owe more than the home’s fair market value at the time of sale.

What sets HomeEquity Bank apart from other banks?

HomeEquity Bank specializes exclusively in home equity solutions for seniors, offering tailored products and expert guidance.

Can I apply if my spouse is under 55?

No, both you and your spouse must be at least 55 years old to qualify for a reverse mortgage in Canada.

Can I lose my home with a reverse mortgage?

No, as long as you meet your obligations, such as keeping your property taxes and insurance up to date, you can stay in your home for life.

What happens if the loan exceeds the home’s value?

Canadian reverse mortgages come with a no negative equity guarantee, meaning you’ll never owe more than the value of your home.

How is the reverse mortgage repaid?

The loan is typically repaid when you sell your home, move into long-term care, or pass away.

Are there penalties for early repayment?

Yes, prepayment penalties may apply. However, HomeEquity Bank offers flexible repayment options to minimize costs.

Get An Estimate

See How Much You Can Borrow Today!

Why Work with Citadel Mortgages and HomeEquity Bank?

At Citadel Mortgages, we’re proud to partner with HomeEquity Bank to provide the best financial solutions for Canadian seniors. Here’s why you should choose us:

- Expert Guidance: Our mortgage specialists help you navigate HomeEquity Bank’s offerings.

- Competitive Rates: We ensure you access the most competitive rates and terms.

- Seamless Experience: From application to fund disbursement, we make the process smooth and stress-free.

HomeEquity Bank Reverse Mortgage Calculator

Understanding your reverse mortgage potential is easier with our Reverse Mortgage Calculator. This tool provides an instant estimate of how much equity you can access based on:

- Your Age

- Home Value

- Location

- Loan-to-Value Ratio (LTV)

How to Use the Reverse Mortgage Calculator:

- Enter Your Home’s Current Market Value.

- Input Your Age and Your Spouse’s Age (if applicable).

- Receive an Estimate of the Amount You Can Borrow.

Try the Citadel Mortgages Reverse Mortgage Calculator today to explore your options!

Final Thoughts on reverse mortgages HomeEquity Bank

An HomeEquity Bank Reverse Mortgage offers Canadian homeowners a secure, flexible way to unlock their home equity. Whether you’re planning for retirement, managing debt, or funding home improvements, this financial tool provides the freedom to live comfortably without monthly payments.

Contact Citadel Mortgages today to explore how an HomeEquity Bank Reverse Mortgage can work for you.

See Reverse Mortgages By City

See Reverse Mortgages By Bank

Get An Estimate

See How Much You Can Borrow Today!