Reverse Mortgage Rates Canada | Compare Rates from Top Lenders for 2025

Find the Best Reverse Mortgage Rates in Canada

Today’s Reverse Mortgage Rates updated as of October 9, 2025 9:57 am

For a property located in

*Rates can change at anytime. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Reverse Mortgage Rates in Canada: Compare the Best Rates for 2025

Reverse mortgage rates in Canada vary depending on factors such as your home’s value, location, and the chosen lender. This guide will provide a detailed overview of current reverse mortgage rates, factors influencing those rates, and tips to secure the best deal.

We’ll also give you a detailed breakdown of the latest rates from leading providers, including HomeEquity Bank, CHIP Reverse Mortgage, Bloom Reverse Mortgage, and Equitable Bank Reverse Mortgage.

What Are Reverse Mortgage Rates?

Reverse mortgage rates are the interest rates applied to funds borrowed against your home’s equity. Unlike traditional mortgages, reverse mortgages allow homeowners aged 55+ to access their home equity without the need for monthly repayments. The loan is repaid when the home is sold or the homeowner moves out permanently.

For more details on how reverse mortgages work, visit the Financial Consumer Agency of Canada (FCAC).

Factors Affecting Reverse Mortgage Rates

Type of Rate:

- Fixed Rates: Offer stability with consistent payments over the term.

- Variable Rates: Fluctuate with market conditions, offering potential savings if rates decrease.

Loan-to-Value Ratio (LTV):

The percentage of your home’s value that you can borrow. Higher LTVs may lead to slightly higher rates.Home Value and Location:

Urban areas often qualify for better rates due to higher property values and demand.Market Conditions:

Economic factors such as the Bank of Canada’s interest rate policy influence reverse mortgage rates.

Get An Estimate

See How Much You Can Borrow Today!

Who Qualifies for a Reverse Mortgage in Canada?

To qualify, you must meet the following criteria:

- Age Requirement: You and your spouse (if applicable) must be 55 years or older.

- Home Ownership: Your home must be your primary residence.

- Sufficient Equity: The amount you can borrow depends on your home’s appraised value, location, and your age.

For more information on eligibility, visit CMHC’s Reverse Mortgage Guide.

Current Reverse Mortgage Rates in Canada 2025

Reverse Mortgage Rate Comparison Chart

| Lender | Fixed Rates | Variable Rates | Administrative Fees |

|---|---|---|---|

| HomeEquity Bank | 7.00% – 8.95% | 6.65% – 8.50% | $1,795 |

| Equitable Bank | 7.25% – 9.10% | 6.90% – 8.75% | $995 |

| Bloom Financial | 6.95% – 9.00% | 6.75% – 8.80% | $1,495 |

Reverse mortgages offer a great way for Canadian homeowners aged 55 and older to access the equity in their homes. Below is a comparison of reverse mortgage options from two leading lenders in Canada: HomeEquity Bank and Equitable Bank. Bloom is another reverse mortgage lender option as well here in Canada.

HomeEquity Bank (CHIP Reverse Mortgage)

Rates Overview:

- HomeEquity Bank reverse mortgage rates are usually some of the lowest rates in Canada.

- They offer both fixed and variable reverse mortgage rates.

Why Choose HomeEquity Bank?

HomeEquity Bank offers the well-established CHIP Reverse Mortgage, allowing homeowners in Winnipeg to access up to 55% of their home’s equity. One of the standout features is the no-negative-equity guarantee, which ensures that you will never owe more than the value of your home when it’s sold. This provides peace of mind while offering financial flexibility to meet your needs.

Learn more about their offerings at HomeEquity Bank.

Equitable Bank Reverse Mortgage

Rates Overview:

- Equitable Bank has super aggressive pricing on reverse mortgage rates along with more fixed and variable term options.

Why Choose Equitable Bank?

Equitable Bank offers some of the most competitive rates in the reverse mortgage market. With both fixed and variable rate options, homeowners in Winnipeg can choose a plan that aligns with their financial goals. Equitable Bank’s flexible loan structure allows borrowers to tailor their reverse mortgage for debt consolidation, home improvements, or supplementing retirement income.

For more details, visit Equitable Bank’s Reverse Mortgage Page.

Bloom Reverse Mortgage

Rates Overview:

Bloom Financial provides competitive reverse mortgage rates in Canada, offering both fixed and variable rate options. These flexible rates ensure that homeowners can choose a plan tailored to their financial goals.

Why Choose Bloom Financial?

Bloom Financial specializes in helping Canadian homeowners aged 55 and older access up to 55% of their home’s equity in tax-free cash. One of Bloom’s standout features is its no-negative-equity guarantee, which ensures that you’ll never owe more than the fair market value of your home when it’s sold. This safeguard provides peace of mind and financial flexibility, allowing you to achieve your goals without the burden of monthly mortgage payments.

Learn more about Bloom Financial’s reverse mortgage solutions at Bloom Reverse Mortgage Page.

Key Features of Each Lenders:

- No Monthly Payments Required: Repay the loan only when you sell your home, move, or pass away.

- Flexible Payout Options: Receive funds as a lump sum, in installments, or as a combination.

- Maintain Homeownership: Retain full ownership and stay in your home for as long as you wish.

Both HomeEquity Bank and Equitable Bank offer reverse mortgages designed to help Canadian homeowners tap into their home equity safely and effectively. Comparing their rates and features allows you to make an informed decision tailored to your financial situation.

CURRENT REVERSE MORTGAGE RATES IN CANADA

Get An Estimate

See How Much You Can Borrow Today!

How to Secure the Best Reverse Mortgage Rates

Compare Multiple Lenders

Evaluate rates from providers such as HomeEquity Bank, Equitable Bank, and Bloom to find the best deal.Work with a Mortgage Broker

A broker can help negotiate competitive rates and terms tailored to your needs.Consider Rate Lock Options

Locking in a rate during the application process can protect you from potential increases.Maintain a Low LTV

Borrowing a smaller percentage of your home’s equity can lead to more favorable rates.

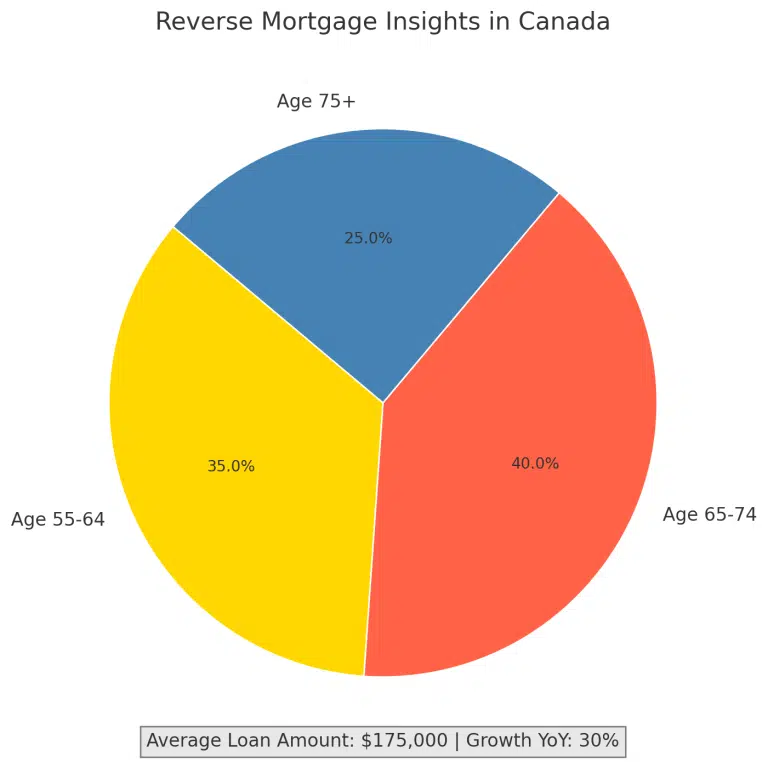

Reverse Mortgage Statistics

Understanding the market trends and usage patterns for reverse mortgages can help you make informed decisions. Here are key statistics:

- Market Growth: The reverse mortgage market in Canada has grown by 10% annually over the past five years.

- Average Loan Amount: The average reverse mortgage in Canada is approximately $175,000.

- Borrower Age: The majority of reverse mortgage borrowers are aged 65-75.

Reverse mortgages have become an increasingly popular financial tool among Canadian homeowners aged 55 and older, allowing them to access the equity in their homes without selling the property. Below are key statistical insights into the reverse mortgage landscape in Canada:

Market Growth and Size

Outstanding Reverse Mortgage Debt: As of 2022, the total outstanding reverse mortgage debt in Canada surpassed $6 billion, reflecting a significant increase in demand for this financial product.

Annual Growth Rate: HomeEquity Bank, a leading provider of reverse mortgages in Canada, reported a 30% increase in demand for its CHIP Reverse Mortgage product in 2022 compared to the previous year.

Demographic Trends

- Aging Population: The growing number of Canadians entering retirement age has contributed to the increased uptake of reverse mortgages, as more seniors seek to supplement their income by tapping into home equity.

Loan Characteristics

Average Reverse Mortgage Amount: The average reverse mortgage amount in Canada is approximately $175,000.

Loan-to-Value (LTV) Ratios: Canadian homeowners can typically access up to 55% of their home’s appraised value through a reverse mortgage, depending on factors such as age, property value, and location.

Interest Rates: Reverse mortgage interest rates in Canada are generally higher than traditional mortgage rates, often ranging between 6.59% and 7.29% for fixed terms as of late August 2024.

Usage of Funds

- Common Uses: Homeowners utilize reverse mortgage funds for various purposes, including debt consolidation, home renovations, healthcare expenses, and supplementing retirement income.

Regional Insights

- Provincial Uptake: Provinces like Ontario and British Columbia have seen substantial increases in home values, leading to a higher uptake of reverse mortgages as homeowners leverage increased equity.

Lender Landscape

- Primary Providers: The Canadian reverse mortgage market is primarily served by two lenders: HomeEquity Bank, offering the CHIP Reverse Mortgage, and Equitable Bank, providing its own reverse mortgage products.

These statistics highlight the growing significance of reverse mortgages in Canada’s financial landscape, offering seniors a viable option to access their home equity and enhance their financial well-being during retirement.

How Much Does a Reverse Mortgage Cost in Canada?

Reverse mortgages provide financial flexibility, but it’s crucial to understand the associated costs. Below is a breakdown of typical fees and costs from leading Canadian reverse mortgage providers.

Common Reverse Mortgage Fees

Interest Rates

- Fixed: 6.50% – 8.95%

- Variable: 6.25% – 8.75%

Appraisal Fee

- $300 – $600 depending on the property and location.

Legal Fees

- $1,000 – $2,000, covering the cost of reviewing and finalizing loan documents.

Administrative Fees

- Ranges from $1,495 – $1,795.

Prepayment Penalties

- May apply if you repay the loan early.

Bank-Specific Fees

HomeEquity Bank (CHIP Reverse Mortgage)

- Appraisal Fee: $300 – $500

- Legal Fees: $1,000 – $2,000

- Administrative Fee: $1,795

- Prepayment Penalty: Applies if the loan is paid within the first three years.

Equitable Bank Reverse Mortgage

- Appraisal Fee: $350 – $600

- Legal Fees: $1,500

- Administrative Fee: $995

- Prepayment Penalty: Tiered penalties depending on loan term.

Bloom Reverse Mortgage

- Appraisal Fee: $300 – $500

- Legal Fees: $1,000 – $1,500

- Administrative Fee: $1,495

- Prepayment Penalty: Flexible repayment options with reduced penalties.

CHIP REVERSE MORTGAGES IN CANADA

The CHIP Reverse Mortgage could be what you need. It’s a sensible and straightforward way to unlock the value in your home and turn it into cash to enjoy life on your terms.

FAQs About Reverse Mortgage Rates

Are reverse mortgage rates higher than traditional mortgage rates?

Yes, reverse mortgage rates are typically higher because they involve more risk for the lender. However, they offer unique benefits, such as no monthly payments.

Can reverse mortgage rates change over time?

Yes, variable rates fluctuate with the market, while fixed rates remain constant for the loan term.

How do I know which rate type is right for me?

It depends on your financial goals. Fixed rates offer predictability, while variable rates can provide savings if market rates drop.

Can I apply if my spouse is under 55?

No, both you and your spouse must be at least 55 years old to qualify for a reverse mortgage in Canada.

Can I lose my home with a reverse mortgage?

No, as long as you meet your obligations, such as keeping your property taxes and insurance up to date, you can stay in your home for life.

What happens if the loan exceeds the home’s value?

Canadian reverse mortgages come with a no negative equity guarantee, meaning you’ll never owe more than the value of your home.

How is the reverse mortgage repaid?

The loan is typically repaid when you sell your home, move into long-term care, or pass away.

BENEFITS OF A CHIP REVERSE MORTGAGE ARE:

You receive the money from the reverse mortgage tax-free. It is not added to your taxable income, so it doesn’t affect Old Age Security (OAS) or Guaranteed Income Supplement (GIS) government benefits you may receive.

What is a reverse mortgage, and how does it work?

It is a loan secured against the value of your home, but unlike a traditional Home Equity Line of Credit (HELOC) or a second mortgage, you are not required to make monthly mortgage payments for as long as you keep living in your home. You always maintain ownership and control of your home.

Get An Estimate

See How Much You Can Borrow Today!

Why Choose Citadel Mortgages and Your Reverse Mortgage Rates?

At Citadel Mortgages, we work with Canada’s top lenders to provide you with competitive reverse mortgage rates and personalized service. Here’s what we offer:

- Expert Guidance: Navigate the complexities of reverse mortgages with ease.

- Tailored Solutions: Get a plan that fits your financial goals.

- Competitive Rates: Access the best rates from HomeEquity Bank, Equitable Bank, and Bloom.

Reverse Mortgage Calculator

Understanding your reverse mortgage potential is easier with our Reverse Mortgage Calculator. This tool provides an instant estimate of how much equity you can access based on:

- Your Age

- Home Value

- Location

- Loan-to-Value Ratio (LTV)

How to Use the Reverse Mortgage Calculator:

- Enter Your Home’s Current Market Value.

- Input Your Age and Your Spouse’s Age (if applicable).

- Receive an Estimate of the Amount You Can Borrow.

Try the Citadel Mortgages Reverse Mortgage Calculator today to explore your options!

Final Thoughts on reverse mortgages rates

Reverse mortgages offer a unique way for Canadian seniors to access their home equity without selling their property. By comparing rates and understanding the factors that influence them, you can make an informed decision that supports your financial goals. Contact Citadel Mortgages today to explore your options and secure the best reverse mortgage rate.

See Reverse Mortgages By City

See Reverse Mortgages By Bank

Get An Estimate

See How Much You Can Borrow Today!