Get the Best Mortgage rates in Alberta

Featured On

BEST MORTGAGE RATES IN Alberta

When buying a home, you want to make smart financial decisions for your mortgage. Many factors impact your mortgage, whether related to your credit history and finances or the current mortgage rates and products available. Finding the best mortgage rates in Alberta is easier with this comprehensive overview and mortgage rate guide to help you find the best mortgage deal to pursue your home ownership dreams.

MORTGAGE RATES ALBERTA

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

5.59%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

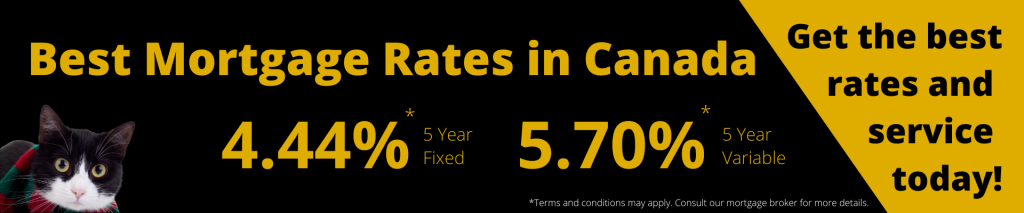

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.44%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.89%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.70%

Mortgage Rate Trends in Alberta

Here’s a quick look at how Alberta mortgage rate trends compared to National trends since 2016.

Lowest Nat’l 5yr

-

2020 - 2.29%

-

2019 - 2.66%

-

2018 - 3.50%

-

2017 - 2.84%

-

2016 - 2.51%

Lowest Alberta 5yr

-

2020 - 2.29%

-

2019 - 2.66%

-

2018 - 3.39%

-

2017 - 2.84%

-

2016 - 2.31%

Lowest Nat’l 5yr

-

2020 - 2.10%

-

2019 - 2.80%

-

2018 - 2.76%

-

2017 - 2.24%

-

2016 - 2.25%

Lowest Alberta

-

2020 - 2.07%

-

2019 - 2.82%

-

2018 - 2.76%

-

2017 - 2.12%

-

2016 - 1.95%

Although the differences might appear very small at first glance, it’s important to remember that even a single point difference dramatically impacts the amount of interest you’ll pay over the entire life of your mortgage. That said, interest rates alone aren’t the only thing to consider when choosing a mortgage. Therefore, always discuss how every condition of a mortgage impacts your flexibility to pay your mortgage down faster.

Alberta Mortgage Performance

Mortgage performance in Alberta has seen some rough days due to the province’s reliance on an often-struggling oil and gas industry. This was particularly felt in the past two years as the pandemic impacted oil prices in 2020. Today, coming out of the pandemic, we now see an issue with mortgage delinquency. For a mortgage to be considered delinquent, it must be 90 days past due. Alberta’s delinquency rate in 2022 reached 0.47%, second only to Saskatchewan’s 0.60%. Canada’s overall arrears rate was just 0.17% last year, and the highest arrears rate seen in Canada was 0.64% in 1992. Influences impacting Alberta mortgage performance include:

- The oil and gas industry

- Homeowners’ financial health at the start of the pandemic

- Policy actions the province took to help bridge recovery from the pandemic

- The Alberta labour market’s post-pandemic recovery

- Interest rates for the individual

ALBERTA’s Housing Market

Luckily home prices in Alberta are some of the lowest in cities across Canada. You are looking at a difference of tens or even hundreds of thousands of dollars compared to cities such as Toronto, Calgary, and Vancouver. For example, in April 2023, average prices were $1.1 million in Toronto, $1.6 million in Vancouver, and $548K in Calgary compared to just $497K in Alberta.

Butler Mortgage

Fixed Rate

4.19%

Variable Rate

5.49%

Neo Financial

Fixed Rate

4.29%

Variable Rate

5.60%

Nesto

Fixed Rate

4.29%

Variable Rate

5.45%

Pine

Fixed Rate

4.34%

Variable Rate

5.55%

RateHub/Canwise

Fixed Rate

4.44%

Variable Rate

5.70%

QuestTrade

Fixed Rate

4.49%

Variable Rate

5.60%

Rocket Mortgage

Fixed Rate

4.49%

Variable Rate

5.75%

Equitable

Fixed Rate

4.54%

Variable Rate

5.80%

Dominion Lending

Fixed Rate

4.54%

Variable Rate

N/A

Mortgage Alliance

Fixed Rate

4.54%

Variable Rate

5.80%

connectFirst

Fixed Rate

4.64%

Variable Rate

N/A

First National

Fixed Rate

4.69%

Variable Rate

5.55%

Laurentian

Fixed Rate

4.69%

Variable Rate

6.70%

Servus Credit Union

Fixed Rate

4.74%

Variable Rate

N/A

HSBC

Fixed Rate

4.79%

Variable Rate

5.90%

TD

Fixed Rate

4.89%

Variable Rate

6.45%

CIBC

Fixed Rate

4.94%

Variable Rate

6.20%

BMO

Fixed Rate

4.99%

Variable Rate

6.39%

ATB

Fixed Rate

5.09%

Variable Rate

6.45%

Canadian Western

Fixed Rate

5.09%

Variable Rate

N/A

CMLS

Fixed Rate

5.29%

Variable Rate

7.20%

Simplii Financial

Fixed Rate

5.49%

Variable Rate

6.55%

National Bank

Fixed Rate

5.54%

Variable Rate

6.50%

RBC

Fixed Rate

5.54%

Variable Rate

6.50%

Desjardins

Fixed Rate

5.54%

Variable Rate

6.50%

Manulife

Fixed Rate

5.69%

Variable Rate

N/A

Tangerine

Fixed Rate

5.74%

Variable Rate

6.65%

Motusbank

Fixed Rate

5.79%

Variable Rate

6.75%

Tangerine

Fixed Rate

5.79%

Variable Rate

6.75%

Canada Life

Fixed Rate

6.34%

Variable Rate

6.70%

Investors Group

Fixed Rate

6.34%

Variable Rate

6.70%

Scotiabank

Fixed Rate

6.34%

Variable Rate

7.15%

How to Get the Best Mortgage Rate in Alberta?

Shopping for a mortgage in Alberta is always easier with the help of a licensed mortgage broker. The Alberta Mortgage Brokers Association (AMBA) is an excellent resource to help you shop for an experienced broker like Citadel. Mortgage brokers work with Canadian banks and other lenders without bias towards one product or another. They listen to your needs and consider your finances and credit to help determine where you are most likely to get the best mortgage rates in Alberta.

When dealing directly with the lender, you can only access their specific mortgage products, limiting your choices. The type of lender you deal with can also impact how likely you are to be approved for a mortgage based on the level of risk the lender feels you present. Therefore, working with a mortgage broker is often best as it exposes you to various mortgage options regardless of your credit history or other circumstances, such as being self-employed.

Find Alberta’s Best Mortgage Rates

When looking for Alberta’s best mortgage rates, there are several other things to consider including:

- Fixed vs. variable rates: A fixed rate’s payments and interest rates remain the same over the term of your mortgage, while variable rates rise and fall based on Canada’s prime rate.

- Open vs. closed: An open mortgage has fewer limitations on your ability to switch up how often or the amount you pay for your mortgage payments. In contrast, a closed mortgage applies penalties if you wish to make changes beyond the conditions offered when you sign.

- Term: The mortgage term relates to the years the conditions and interest rate apply. You must renew your mortgage at the end of each term.

- Payment frequency: Payment frequency refers to how often you make your mortgage payments. Although the monthly payment tends to be the go-to, you can speed up or slow down your payments. For example, when you speed up your payments to weekly or biweekly, you can pay down your mortgage faster, while making monthly or bimonthly payments takes longer.

Best Big Bank Rates in Alberta

Here is a quick comparison of the Alberta mortgage rates for Canada’s big five banks:

Lender

TD 5-year

Fixed Rate

4.89%

Variable Rate

6.45%

Lender

CIBC 5-year

Fixed Rate

4.94%

Variable Rate

6.20%

Lender

BMO 5-year

Fixed Rate

4.99%

Variable Rate

6.39%

Lender

RBC 5-year

Fixed Rate

5.54%

Variable Rate

6.50%

Lender

Scotiabank

Fixed Rate

6.34%

Variable Rate

7.15%

Right now, you’ll get the most value from TD, but you need to review their features and understand the differences between closed and open mortgage options to ensure the mortgage is the right choice. Also, these rates are available to credit-worthy borrowers with good credit scores and strong credit and financial histories. As a result, they aren’t the rates offered to all applicants.

Best 5-year Variable Rates in Alberta

Looking at the overall 5-year variable rates in Alberta, here are the top Alberta lenders with rates under 5.50%:

- Nesto: 5.45%

- Butler Mortgage: 5.49%

- Rocket Mortgage, First National, and Pine: 5.55%

- Neo Financial and QuestTrade: 5.60%

- RateHub/Canwise: 5.70%

- Equitable and Mortgage Alliance: 5.80%

- HSBC: 5.90%

Alberta Mortgage Calculators

Mortgage calculators are the best tool to help you decide how much you can afford for your home purchase price. The basic calculators allow you to enter the following information and then calculate your monthly payment amounts:

- Mortgage amount

- Alberta mortgage rate

- Amortization period (the number of years you plan to pay your mortgage off)

- Payment frequency (weekly, bi-weekly, monthly, or semi-monthly

- Terms (how many years the rate is offered)

- Down payment amount

The calculator then tallies the numbers and provides a summary with the following information:

- The amount of each payment

- How many payments you’ll make over the amortization period

- How much interest you’ll pay over the life of your mortgage

- How much you’ll pay over the first term period of your mortgage

Some calculators will tally other mortgage-related numbers for you, including:

- Stress test calculators to help determine if you’ll qualify for a mortgage

- Affordability calculators to tally your mortgage-related monthly expenses

- Renewal calculators to figure out your new costs at the latest interest rates

The best overall Alberta mortgage calculator is the federal government’s, as it is easy to use and provides a thorough, easy-to-understand summary. In addition, you can switch up any of the numbers to find the best mortgage strategy by checking how various house prices and Alberta mortgage rates impact your monthly expenses and ability to pay down your mortgage more effectively.

Frequently Asked Questions About Mortgages in ALBERTA

Top mortgage brokers in Alberta include:

- Citadel Mortgages

- Dominion Lending Centres

- TMG, the Mortgage Group

- M3 Mortgage Group

When looking at major cities in Alberta, based on a 20% down, 30-year amortization, 2.50% 5-year mortgage rate with monthly payment schedules, the typical mortgage amounts in Alberta are as follows:

- Calgary: $411,700 @ $1,844 per payment

- Edmonton: $315,000 @ $1,411 per payment

- Lethbridge: $268,197 @ $1,201 per payment

- Across all of Alberta: $310,500 @ $1,391 per payment

Alberta mortgage rates are 5.50% 5-year variable and 4.39% for a 5-year fixed.

At the time this was written, the best bank rate available was the TD 5-year fixed rate at 4.89%

Luckily, since the economy stabilized over the past few months, it is unlikely there will be further hikes in 2023. We will also hopefully see rate cuts as we enter 2024.

When looking for a mortgage in Alberta, find the best mortgage rates from Citadel Mortgages. Get yours approved today!

BEST MORTGAGE BANK RATES IN ALBERTA CANADA

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

5.59%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

Best Mortgage Rates in Canada

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.44%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.89%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.70%

Mortgage Rates British Columbia

Mortgage Rates Saskatchewan

Mortgage Rates Alberta

Mortgage Rates Ontario

Mortgage Rates Nova Scotia

Mortgage Rates New Brunswick

Mortgage Rates Newfoundland

BMO Mortgage Rates

CIBC Mortgage Rates

Scotiabank Mortgage rates

TD Bank Mortgage Rates

RBC Mortgage Rates

Manulife Mortgage Rates

Let's get started

Find out how much home you can afford

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Start thinking about how much you spend each month, create a budget, and start saving up for your home.

Our Awards

DISCLAIMER

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.