Scotiabank Mortgage Rates Canada

As one of Canada’s Big Six banks, Scotiabank is the third largest bank in Canada. It has established itself as an international bank, with branches throughout Latin and Central America, the Caribbean, and some parts of Asia. It offers a wide selection of services, with the majority of its earnings coming from Canadian banking. Scotiabank has over 900 branches across Canada and 2600 worldwide.

Prime Rate | Variable Rates | Fixed Rates | Per Term Rates | Rate History | Pre-approval | Checklist | Features

How To | Pros & Cons | FAQ

Scotiabank Prime Rate

Scotiabank’s prime rate aligns with the other Big Six banks at 6.7%. Scotiabank uses the prime rate to guide its decisions on its loan and mortgage rates. As well the prime rate also determines the interest rate for its variable mortgages, which rises and falls with the prime.

Scotiabank Variable Mortgage Rates

The variable mortgage rates are based on Scotiabank’s Prime Rate. The mortgage rate won’t go above the cap rate, which is the highest interest rate the bank will charge you. It’s important to understand the cap rate for variable mortgages. Despite being impacted by fluctuating interest rates, you still pay a fixed payment based on the cap rate. This payment doesn’t change. Instead, the changing interest rates impact how much of your payment goes toward the principal. The lower the interest rate, the more of your payment goes to your principal.

Scotiabank Fixed Mortgage Rates

Scotiabank fixed mortgage rates have a set interest rate and mortgage payment for the full term of your mortgage. So, if you have a 5-year fixed-rate mortgage, you pay the same monthly payment for five years. However, once that term ends, your mortgage is up for renewal. At that time, your interest rates change based on current Scotiabank interest rates, which then impacts your monthly payments.

Scotiabank Mortgage Rates as Per Term

Fixed Rates Below

Variable Rates Below

Apparently, Scotiabank does not advertise its best mortgage rates on its website. So, it’s important to ask about their mortgage rates and what they are willing to offer you at the pre-approval stage. If you already have a house on offer, you should still ask about their best rates to ensure you don’t miss out.

TERM LENGTH

SCOTIABANK RATES

CITADEL MORTGAGES RATES

Scotiabank 5-Year Fixed and Variable Rate History

Here is a brief history of Scotiabank mortgage rates over the past three years:

- Year: 2020 Fixed: 2.14% Variable: 2.65%

- Year: 2021 Fixed: 2.49% Variable: 1.75%

- Year: 2022 Fixed: 5.84% Variable: 3.90%

Scotiabank Mortgage Pre-Approval

Scotiabank’s eHome app allows you to get an online exclusive rate guarantee and download a letter of pre-approval in a matter of minutes. Pre-approval should be the first step you take when buying a home, as it tells you:

- If you are eligible for a mortgage

- How much the lender will offer you

- The interest rate you’ll lock into for 120 days during your search

Scotiabank Mortgage Application Checklist

Before applying for a Scotiabank mortgage, you’ll need the following documents:

- Two forms of Government identification

- Proof of income

- Proof of down payment

- Letter of employment from current employer

- Proof of assets

- Debt and savings information

- Agreement of Sale

- Copy of Deed

- Job Letter

- Recent Payment Slip

- Land & Building Tax and Water Rates

Self-employed individuals require one of the following for proof of income:

- Income Tax Returns for the last two years

- Audited Financial Statements for the last two years

- Financial Statements for the last two years prepared by an Accountant on the Bank-Approved Panel

- Any official document issued by the Government indicating the income, such as Notices of Assessment for the past two years

Scotiabank Mortgage Features

Most banks offer similar features focused on helping you pay down your mortgage faster, reducing interest or, in some cases, even missing a payment each year. Scotiabank offers the following mortgage features:

- Scotiabank Match-A-Payment:

This feature allows you to “match” a monthly mortgage payment by doubling how much you pay that month. This is an excellent feature, as when you increase your mortgage payments, you reduce your mortgage principal, so you pay less interest over time. This can save you a pretty sum of money over the years and you also pay down your mortgage faster. - Scotiabank Miss-A-Payment:

This is a very important feature as it gives you a break from paying your monthly mortgage payment. It is a great option if you are facing financial challenges, or you wish to put the money towards something else. However, you can only use this feature if you have doubled a payment at least once in your term. Keep in mind that missing a payment takes you longer to pay off your mortgage, and you also end up paying more interest for the mortgage term. Also, any additional fees added to your mortgage, such as mortgage insurance or property taxes, are still owed for the month. - Scotiabank’s Annual Mortgage Prepayment Privileges:

If you have a closed mortgage that charges a penalty to pay off your mortgage sooner, or you wish to refinance, you are given an annual mortgage prepayment privilege that allows you to pay off 15% of your mortgage principal penalty-free. This helps pay down your mortgage faster. - Monthly Property Tax Payments:

If you are a first-time homebuyer, have a shaky credit history or have certain mortgage terms, you are likely going to have to pay your property taxes along with your mortgage payment each month. However, if you are not required to make these payments, you can still have Scotiabank collect your taxes monthly and make the tax payments for you. It’s not a big deal but does make life easier. - Mortgage Protection Insurance:

All banks offer some sort of mortgage insurance products to their mortgage customers. The premiums add more to your mortgage payments, but you also get coverage for issues such as critical illness, disability, and death. Scotiabank mortgage protection insurance is offered at the time you sign your mortgage, and the premiums applied will never increase. Your premiums are based on your age, and the older you are, the more you will pay. There are no medical assessments, and your premiums are broken down into life and critical illness contributions. Scotiabank also offers a 30-day risk-free period allowing you to cancel within the first 30 days for a full refund. Coverage is calculated per $1000 of your mortgage principal.

How to Get the Best Scotiabank Mortgage Rate

As mentioned above, Scotiabank does not advertise its best mortgage rates. Therefore, you want to ask if they can do better. Keep in mind banks tend to reserve their best rates for clients with an exceptional credit history, but it never hurts to ask. In this case, it’s best to set up an appointment with one of their Home Financing Advisors so that you can speak face-to-face with a representative. They will help you understand what the bank is willing to offer based on your specific financial situation.

The higher your credit score and the better your credit history, the more likely the advisor is to be willing to go to bat for you. Another strategy is to go prepared with research about interest rates so you can lay out all the comparable mortgages being offered by the competition. It never hurts to leverage your knowledge to show them you are willing to walk to get the best rate. Avoid sharing information about smaller lenders, as Big Six banks don’t feel obligated to compete with those lenders.

Scotiabank Pros & Cons

As mentioned above, Scotiabank does not advertise its best mortgage rates. Therefore, you want to ask if they can do better. Keep in mind banks tend

Before you decide on the bank you’d like to do business with, it’s important to consider the pros and cons of their mortgage products. Here are the pros and cons of Scotiabank mortgages:

Pros

- Offers a very user-friendly online banking app, eHome, to make it easier to apply for your mortgage and get pre-approved

- If you are uncertain about mortgage insurance, they offer a 30-day money-back guarantee if you change your mind

- They offer comparable features to the other Big Six banks

Cons

- Mortgage rates tend to be higher compared to the other Big Six banks

- For their miss-a-payment feature, you have to have a doubled payment in the current mortgage term

FAQ

A: No. In fact, Scotiabank has the highest rates compared to the other Big Six Canadian banks. For the 5-year fixed interest rate, Scotiabank sits at 6.34%, while RBC and CIBC are at 5.04%, BMO is at 5.09%, and TD is at 5.14%.

A: Scotiabank makes it easy to apply for a mortgage with the following three options to suit your needs:

- Applying online using Scotiabank eHOME mortgages

- Setting up an appointment with a Scotiabank Home Financing Advisor

- Using a Scotia-Approved Broker

A: Yes. You can always try to negotiate a better mortgage rate. Because Scotiabank’s interest rates are the highest out there, you might stand a chance of them offering a lower rate if you show them what other banks offer. Also, as mentioned, they tend not to advertise their best rates, so it’s worth asking if they can do better.

Find a better mortgage rate

Mortgage Rates British Columbia

Mortgage Rates Saskatchewan

Mortgage Rates Alberta

Mortgage Rates Ontario

Mortgage Rates Nova Scotia

Mortgage Rates New Brunswick

Mortgage Rates Newfoundland

BMO Mortgage Rates

CIBC Mortgage Rates

Scotiabank Mortgage rates

TD Bank Mortgage Rates

RBC Mortgage Rates

Manulife Mortgage Rates

Best Mortgage Bank Rates in Canada

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

5.59%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

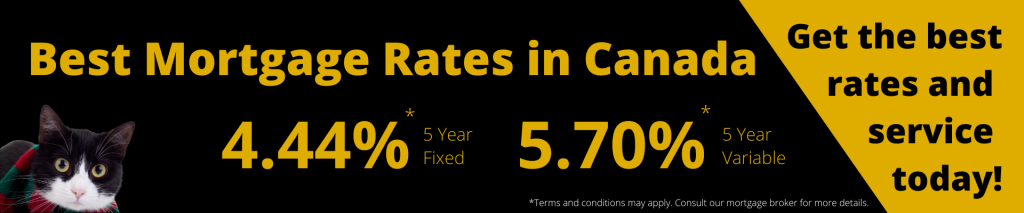

Best Mortgage broker Rates in Canada

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.44%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.89%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.70%

Disclaimer

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.

Let's get started

Find out how much home you can afford

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Start thinking about how much you spend each month, create a budget, and start saving up for your home.

Our Awards