💡 Second Mortgage vs. HELOC in Canada: Which One’s Right for You?

When deciding on life insurance, one key decision is whether to choose a single or joint policy.

Today’s Mortgage Rates updated as of July 5, 2025 10:06 pm

5-year fixed*

5-year Variable*

*Insured loans. Other conditions apply. Rate in effect as of today.

At Citadel Mortgages, we make homeownership simple. Whether you’re buying your first home, refinancing, or exploring investment opportunities, we offer tailored solutions to meet your needs. With access to Canada’s top lenders, innovative financial products, and expert guidance, we help you secure the best mortgage rates quickly and stress-free.

Lock in a 6-month fixed rate for unmatched stability and flexibility in today’s ever-changing market. Enjoy peace of mind now, with the freedom to explore even better mortgage options down the road. Your perfect rate starts here!

Find the Right Mortgage Solution for You Click below to get started:

Our Featured Rates

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

(5-years interest savings with Citadel Mortgages)**

(Interest savings with Citadel Mortgages)

(5-years interest savings with Citadel Mortgages)**

(Interest savings with Citadel Mortgages)

With over a decade of experience, our mortgage brokers are dedicated to simplifying the mortgage process and securing the best solutions for your financial goals.

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Whether it’s a fixed-rate, variable-rate, or specialty mortgage, we’ve got you covered.Let us simplify the process and help you secure approval quickly and stress-free!

We go beyond mortgages with:

Often during your mortgage journey, you will run into bank specialists and other mortgage agents or brokers that will tell you what you want to hear, so you give them the documents required to get your approval. While we understand you as a client want to hear you will get the lowest rate, please be aware that unless any mortgage broker or bank specialist has been given all the required documents and has fully underwritten your file, any rates offered are just quotes and not firm approval. Many times we find clients have been told what they want to hear because either the client has forced the mortgage broker or bank specialist to say to them the lowest rate, or they have just been told that to try and make the deal more effortless, but only to get to closing day to have the lender pull out of the deal!

Imagine you are at the lawyers to find out your deal was not approved because of something they found in your file; this happens often. This is why we ask for all the required documents upfront at Citadel Mortgages to ensure things like this do not happen at closing. We understand not all clients want to follow our award-winning process, which is OK with us; it just means we can not work together.

Have you ever wondered why you have to provide more documents to a mortgage broker in Canada than to your own bank? It’s a common question asked by clients who are beginning their mortgage journey, and we have an answer for you.

Mortgage brokers are intermediaries who work with multiple lenders to find you the best deal for your mortgage. Unlike your bank, which has access to your financial information, mortgage brokers don’t have access to your financial history or any other information that might help them determine your creditworthiness.

Therefore, to obtain a mortgage from a lender, brokers need to gather as much information as possible about your financial situation. This includes details about your income, employment history, credit history, savings, assets, and debts. Gathering this information helps brokers to understand your financial capacity and identify the best lenders and products for you.

Moreover, lenders also require a thorough verification process to ensure the accuracy of the information provided by clients. In addition, they are required to follow strict regulatory guidelines to prevent money laundering and fraudulent activities. Therefore, brokers must obtain all required documents to present a complete and accurate application to the lenders.

In contrast, your bank has access to your financial information, and therefore, you don’t have to provide as much documentation. However, you might not always get the best deal from your bank since they are only offering their own products. Working with a mortgage broker gives you access to multiple lenders and products, increasing your chances of finding the best deal for your unique situation.

At Citadel Mortgages, we understand that providing so many documents can be overwhelming. However, we work hard to make the process as seamless as possible for you. Our award-winning process ensures that we collect all the required documents upfront, reducing the risk of any delays or issues during the mortgage process.

If you’re ready to start your mortgage journey, contact us today, and our team of experts will guide you through the process and help you find the best mortgage deal for you.

As an award-winning national brokerage across Canada, we have been featured in the National Post, Financial Post, Toronto Sun, Ottawa Citizen, CMP Mortgage and many more. So, what type of experience do you wish to have? One where you hear what you want only to have issues maybe later or the latter where we are honest and only provide you with the correct information once your apporved?

We ask you to trust our award-winning process and allow us to collect all the documents so we can help you in your mortgage journey!

Don’t believe us read our client reviews and read our national articles as we offer the best service and mortgage rates for your mortgage journey!

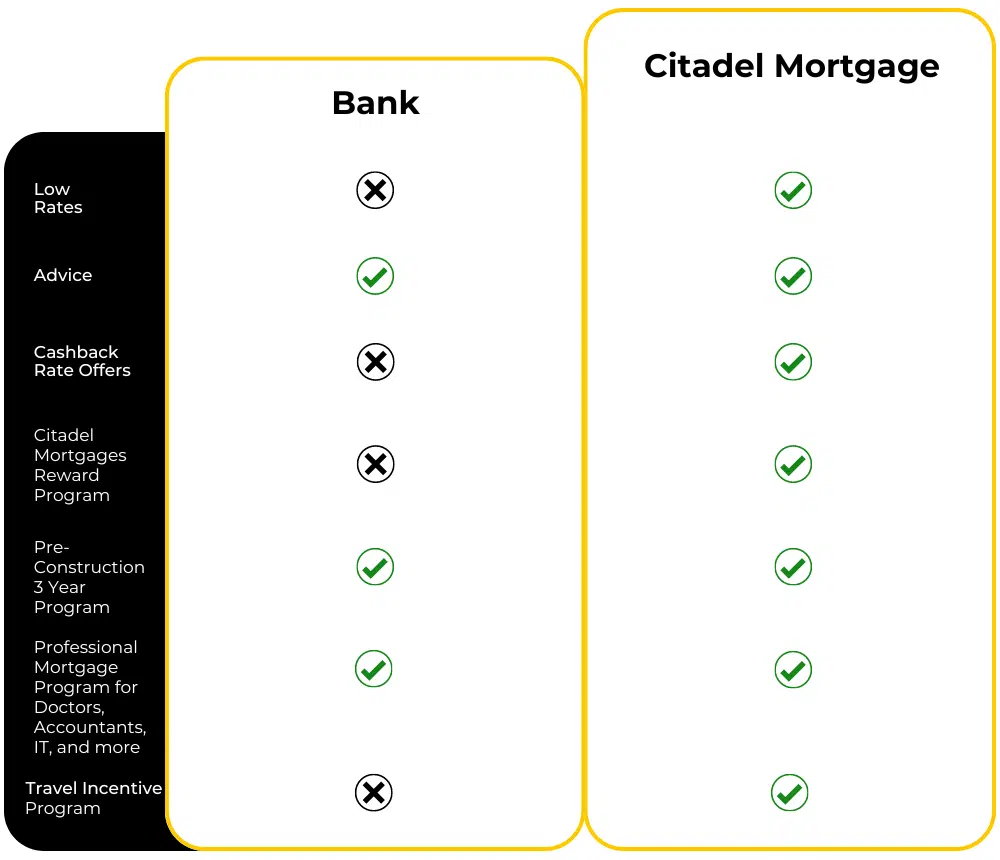

When it comes to speed, transparent advice, and low mortgage rates, we excel. Discover how we compare to big banks and brokers in Canada.

With Citadel Financial Wealth Group, we offer:

Through Simply Approved Mortgages, our licensed U.S. brokerage, we help Canadians invest in U.S. real estate.

See how you can save and become mortgage-free sooner

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.

We offer a wide range of mortgage solutions to meet every requirement:

First-Time Homebuyer Mortgages

Mortgage Refinancing

Second Mortgages

Reverse Mortgages

Halal Mortgages

Speed up your mortgage approval by providing the correct documents upfront. The sooner we receive everything we need, the sooner we can work on securing an exact rate for you—not just a rate quote. Visit our Mortgage Document Checklist page to see exactly what’s required to help you get approved today

When was the last time you got a second opinion on your home insurance? Apply now for a no-obligation quote and save today!

Unlock a high-interest account tailored to your everyday banking needs. Experience great features, unparalleled flexibility, and exceptional rates on all your money!

Experience comprehensive protection with our Mortgage Insurance, offering full coverage including term life, critical illness, and disability coverage.

Our clients always come first. Our goal is to help you get the best advice and mortgage solutions for your needs. Citadel Mortgages was formed to help you achieve your financial home success so allow us to help you today. Speak to one of our mortgage agents today!

When deciding on life insurance, one key decision is whether to choose a single or joint policy.

When deciding on life insurance, one key decision is whether to choose a single or joint policy.

When deciding on life insurance, one key decision is whether to choose a single or joint policy.

Concerns around health, mortality, and keeping your loved ones safe remain top of mind

Joint life insurance is a single policy covering two people, often spouses or common-law partners.

Copyright © 2018 Citadel Mortgages

Head Office – 150 King Street West 2nd Floor Suite 335, Toronto, ON M5H 1J9

Alberta Office – 421 7th Avenue S.W., 30th Floor, Calgary, Alberta, T2P 4K9

Nova Scotia Office – 1701 Hollis Street, Suite 800 Halifax, NS B3J 3M8

Saskatchewan Office – 2010 – 11th Avenue 7th Floor Regina Saskatchewan S4P0J3

Newfoundland Office – 1 Church Hill – Suite 201-522 St. John’s Newfoundland A1C 3Z7

New Brunswick Office – 500 St George Street, Moncton NB, E1C 1Y3

British Columbia Office – 900-2025 Willingdon Avenue, Burnaby BC, V5C 0J3

Manitoba Office – 330 St. Mary Avenue, Winnipeg, MB, R3C 3Z5

Disclaimer

Citadel Mortgages operates an information-based website designed to display mortgage rates from its trusted partners. While we strive to present accurate and up-to-date information, we cannot guarantee the precision of the rates or other details provided at all times. Citadel Mortgages assumes no liability for errors, inaccuracies, or damages resulting from the use of the information on this site. Terms and conditions apply, and it is essential to consult directly with a licensed mortgage broker for personalized advice and accurate details about specific products and services. Please note that the rates displayed are for informational purposes only and may differ from actual rates offered.

Citadel Mortgages is licensed to operate in the following jurisdictions:

Instant Approval, Conditional Approval, Pre-Approval

All approvals are subject to credit and underwriting approval. Not all borrowers will qualify for conventional or equity financing. The receipt of an application does not constitute a financing approval or guarantee of an interest rate. Restrictions apply. The Annual Percentage Rate (APR) is subject to underwriting and approval, and fees and terms may vary. Contact us for the most current rates and further information about specific products. OAC (On Approved Credit).

We remain committed to delivering outstanding service, transparency, and ethical practices. Please note that some rates are province-specific and may change without notice. Rates may not be available in Quebec; please contact us directly to confirm availability and approval.

All rights reserved.

Esso and Price Privileges are trademarks of Imperial Oil Limited. Imperial Oil, licensee. Mobil and Speedpass+ are trademarks of Exxon Mobil Corporation or one of its subsidiaries. Imperial Oil, licensee. For terms and conditions, visit Terms