Manulife Mortgage Rates

Featured On

Manulife Bank of Canada Mortgage Rates

Manulife Bank is managed by Canadian insurance and financial service company Manulife Financial. They offer a comprehensive line of mortgage products many Canadians might not think to access when shopping for a mortgage. However, as one of the largest financial institutions in Canada, Manulife could be the answer for your mortgage solution. Their financial operations offer insurance, banking, and wealth management solutions, making them an ideal candidate when searching for a mortgage.

Today, navigating the rollercoaster ride of interest rates is made even more complicated by the inflation challenges we are experiencing in 2023. Manulife’s customizable mortgage options help make the most of changing Manulife mortgage rates depending on the level of risk you can tolerate. Here is an overview of Manulife mortgage rates to help you make an informed decision for your mortgage needs.

compare manulife mortgage rates

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

5.59%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.44%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.89%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.70%

Manulife Mortgages Review

Manulife offers two types of mortgages:

1. Manulife One

A Manulife One mortgage is their “one-stop-shop” mortgage that provides comprehensive services to meet your specific banking and lending needs. This can be an excellent option if you don’t like your current bank or are not particularly tied to their services. Choosing Manulife One allows you to get a better interest rate and quicker access to further credit if you need it. In addition, with everything connected, including your mortgage financing, a Home Equity Line of Credit (HELOC), and transaction account, it makes it easier to manage your finances.

For example, you can apply your savings to your mortgage and access your home equity when you need extra money. As a result, you can pay off your mortgage sooner if your financial situation changes for the better without worrying about penalties that other lenders apply for early repayment. Also, it uses a daily interest calculation, allowing any deposits you make to counterbalance your debt temporarily.

The best thing about the Manulife One option is that as a readvanceable mortgage, it is highly customizable in ways you wouldn’t think possible for a mortgage. For example, they allow you to set up a fixed mortgage and then have a subaccount at a variable rate, so if interest rates fall below the fixed rate, you can choose to apply your payments using your variable rate.

There are two potential ways to set up your Manulife One banking:

I. Consolidate: You can consolidate your accounts at a single rate of interest or

II. By project: You can assign interest rates based on different financial needs.

When you decide you need to access your HELOC for something like home improvements, your interest rate is at the HELOC rate. The more you pay on your mortgage balance, the more credit you have available.

2. Manulife Select

With Select Mortgages, you can customize your mortgage and “portion” it using the best interest rates, terms, and payment schedules to suit your needs. As a result, if you want to allot a specific portion to a variable mortgage, you can limit the risk of having your entire mortgage subject to rising rates yet still take advantage of lower rates for that portion of your mortgage.

You have up to five portion options, including the choice to set up some portions with a closed mortgage and others as open. By using this strategy, you can pay down your mortgage faster when you have access to unexpected funds such as a tax refund, a raise, a better job, etc., and increase your payments without worry of prepayment penalties. In addition, this completely customizable option allows you to do things your way based on the risk you are willing to take.

Manulife Bank Background

Manulife was founded in 1887 by Sir John A. Macdonald. Not only was he Manulife’s President, but also the first Prime Minister of Canada. The institute began expanding in 1893, starting in the Caribbean, and shortly after to Asia in 1897 and then the United States in 1903. They continued to grow in the 1980s and 1990s with multiple mergers and acquisitions. The acquisition of U.S.-based John Hancock Financial Services in 2004 was the largest acquisition to date, making Manulife the largest life insurer in Canada and the second largest in North America. It is now the fifth-largest life insurer in the world.

- The oil and gas industry

- Homeowners’ financial health at the start of the pandemic

- Policy actions the province took to help bridge recovery from the pandemic

- The Alberta labour market’s post-pandemic recovery

- Interest rates for the individual

Manulife Bank Prime Rate

Manulife’s prime rate is 6.70%, aligning with the current Bank of Canada rate. A prime rate is essential as it tells you the best rate the lender will offer their ideal client with an exceptional credit score and limited debt for credit products such as credit cards. Manulife is either the same or slightly lower than other Canadian bank primes. For example, TD’s prime rate is currently 6.85%, so shopping around is always worthwhile when looking for a mortgage provider.

Manulife Bank Fixed & Variable Mortgage Rates

Here are the going rates for Manulife fixed and variable mortgage rates:

TERM LENGTH

MANULIFE RATES

CITADEL MORTGAGES RATES

There are also some unique mortgage options for first-time and select clients under their 5-year offering, including:

Manulife Bank 5-Year Fixed and Variable Rate History

Since 2020, Manulife’s 5-year fixed rates in August were as follows:

- 2020: 3.05%

- 2021: 2.49%

- 2022: 5.64%

Manulife Bank Mortgage Features

Because Manulife readvanceable mortgages are so customizable, their features are quite different than what you’d find at a traditional bank. As a result, you aren’t contending with issues regarding things like prepayment allowances at a set number of payments or prepayment limits. So, instead of looking at individual features, penalties, prepayment options, etc. like you would for a traditional bank, you choose how you want to pay your mortgage, whether it is weekly, bi-weekly, semi-monthly, or monthly payments and then customize your mortgage based on either the Mortgage One or Select Mortgage options.

You control whether you want to speed up or slow down your payments based on your financial situation. In addition, your choices don’t come with added costs or penalties like other mortgages. As a result, when managed right, you can either improve your cash flow or save money over the life of your mortgage by reducing the interest paid and increasing your payment frequency.

Two additional considerations for Manulife Mortgages, include:

1. Property Tax Payment:

You might be expected to include your property taxes with your mortgage payments in some cases. Manulife then pays your taxes on your behalf. If not, you can request this option, so you don’t have to worry about making payments to your municipality. In addition, the taxes are included as part of your monthly payments, so you don’t have to budget for them as an additional expense.

2. Mortgage Protection Insurance:

Mortgage protection insurance is always worth considering as it ensures your mortgage is paid should you pass away or become unable to work. Because Manulife offers an insurance line, it is easy for Manulife Financial to provide a comprehensive insurance package for mortgages up to $1 million for people between 18 to 64. You can try it on for size to see how it impacts your expenses and cancel after 60 days with a money-back guarantee. This stands out from other lenders that might offer a 30-day trial period but not a money-back guarantee.

Manulife One

Manulife One mortgages are what are known as “readvanceable” mortgages. They automatically combine your mortgage with a line of credit so you can access the equity in your home as it builds. At the same time, as your payments are made, your credit in your HELOC rises, allowing you to borrow more money as your equity builds. In addition, you only pay interest if you choose to make a withdrawal on your line of credit. Your HELOC is there when you need it without applying for more credit like you would with a traditional mortgage.

Manulife One Pros & Cons

There are several advantages and disadvantages to Manulife One, including:

Pros:

- If you find your debt is increasing and the interest rates on that debt is high, you can use your HELOC to pay off those balances and have one low-interest consolidated loan to pay each month.

- You have access to credit without having to apply with different lenders, which is convenient while also helping to keep your credit score intact.

- When you make a deposit, it pays down your debt immediately, so you pay less interest.

- Your all-in-one account reduces banks fees allowing you to make automatic transfers, write cheques, make Interac for payments, use telephone or internet banking for bill payments, and of course, make deposits and withdrawals.

- You have one account to view all your banking.

- You have more control over how you want to pay down your mortgage.

- You can use money from your HELOC for investments.

Cons:

- You have to pay legal fees to transfer to another lender.

- You lose negotiating power at renewal time due to the costs to pay to transfer to another lender.

- If you aren’t smart with how you use the revolving options, you can end up taking forever to pay down your mortgage and end up paying much more in interest over the life of your mortgage.

Always keep in mind there are many mortgage products available before settling on the first lender you see! Find the best mortgage rates from Citadel Mortgages. Get yours approved today!

BEST MORTGAGE BANK RATES IN CANADA

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

5.59%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

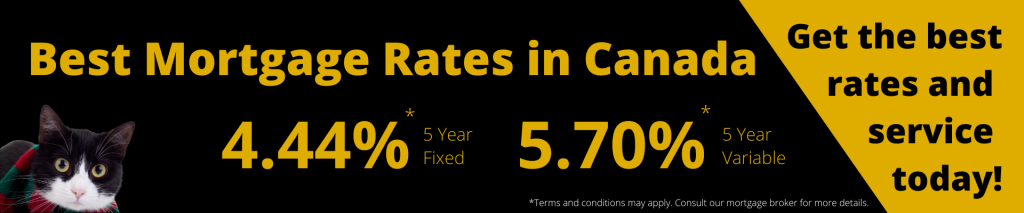

Best Mortgage Rates in Canada

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.44%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.89%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.70%

Mortgage Rates British Columbia

Mortgage Rates Saskatchewan

Mortgage Rates Alberta

Mortgage Rates Ontario

Mortgage Rates Nova Scotia

Mortgage Rates New Brunswick

Mortgage Rates Newfoundland

BMO Mortgage Rates

CIBC Mortgage Rates

Scotiabank Mortgage rates

TD Bank Mortgage Rates

RBC Mortgage Rates

Manulife Mortgage Rates

Let's get started

Find out how much home you can afford

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Start thinking about how much you spend each month, create a budget, and start saving up for your home.

Our Awards

DISCLAIMER

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.