Find the Best Second Mortgage Rates

Today’s Second Mortgage Rates updated as of 07/27/2024 3:20 AM

For a property located in

Second Mortgage Rates Start From*

4.99%

*Second mortgage rates range from 4.99-16.99 with the average rate being 10.99%. Second mortgages carry lender and brokerage fees that range from 2-10% with the average being 6%. Other conditions apply. Rate in effect as of today.

Featured On

What is a Second Mortgage?

A second mortgage is a secured loan that allows homeowners to tap into the equity they’ve built in their property, providing access to additional funds without altering their existing mortgage. This financial tool is particularly popular among Canadians who want to utilize their home equity for various purposes, such as home improvements, debt consolidation, or significant life events.

When you take out a second mortgage, you’re adding an additional loan to a property that already has a mortgage. This is inherently riskier for lenders because they hold a secondary claim on the property’s title. In the event of a default, the lender in the first position is prioritized for repayment from the property sale proceeds. Consequently, the lender in the second position faces a higher risk of not being fully repaid, which is why interest rates for second mortgages are typically higher than those for primary mortgages.

For homeowners with a good credit score and more than 20% home equity, the most cost-effective option for a second mortgage is often a home equity line of credit (HELOC). A HELOC functions as a revolving line of credit, allowing you to borrow against your home’s equity as needed, much like a credit card. On the other hand, for those with weaker credit or less equity, a traditional second mortgage obtained through a trust company or private lender may be necessary.

Why Consider a Second Mortgage?

Unlocking the equity in your home through a second mortgage can provide significant financial advantages. Here’s why many Canadians turn to this option:

- Access to Funds: Tapping into your home’s equity to receive a lump sum of money, which you can use for various purposes.

- Lower Interest Rates: Enjoy the security of interest rates that are generally lower than those for unsecured loans or credit cards, making a second mortgage a reassuringly stable and cost-effective solution.

- Flexible Use: Utilize the funds for home renovations, debt consolidation, tuition fees, medical expenses, or investment opportunities.

- Potential Tax Benefits: Sometimes, the interest you paid on a second mortgage may be tax-deductible (consult with a tax advisor for details).

Second mortgages are versatile financial tools that can be used to consolidate high-interest debt, make significant home improvements, finance education, cover medical expenses, or provide capital for investment purposes. Although the interest rates for second mortgages are typically higher than those for primary mortgages, they are often much lower than the rates associated with credit cards or personal lines of credit. This makes second mortgages a smart choice for those needing substantial additional funds.

When considering a second mortgage, it is crucial to compare rates and terms from various lenders. Citadel Mortgages helps you make an informed decision that best suits your financial needs.

Types of Second Mortgages

When exploring second mortgage options with Citadel Mortgages, you have three primary choices: a Second Mortgage or a Home Equity Line of Credit (HELOC) or a Home Equity Loan. By understanding the differences between these options can help you make the best decision for your financial needs.

Second Mortgage from a Private Lender

Borrowers can also consider a second mortgage from a private lender, an inclusive option that’s more accessible for those with lower credit scores or unique financial situations. These lenders often have more flexible criteria but come with higher interest rates and setup fees.

- Flexible Lending Criteria: More accessible for those with lower credit scores or unique financial situations.

- Higher Interest Rates: Typically higher than traditional mortgages due to increased risk.

Maximum Loan Size for a Private Mortgage

Private lenders typically allow up to 80% LTV, though some may offer more just as up to 95% LTV depending on their criteria. For a home valued at $500,000 with a remaining mortgage of $300,000, you could borrow up to $100,000 as a second mortgage.

$500,000 x 80% = $400,000

$400,000 – $300,000 = $100,000

Home Equity Line of Credit (HELOC)

A HELOC, a flexible and empowering option, might be suitable for current home owners that already have a mortgage with 20% or more equity and great credit. It’s a revolving line of credit that allows you to borrow money up to a your approved credit limit as needed, giving you the freedom to manage your finances. This type of loan is popular among those who want flexible access to funds.

- Revolving Credit: This is a type of credit that allows you to borrow and repay these funds up to your limit, similar to a credit card. As you repay the borrowed amount, your available credit increases, giving you the flexibility to borrow again if needed.

- Variable Interest Rates: Rates fluctuate based on market conditions.

With a HELOC, you’ll make separate payments on both your mortgage and your HELOC, a convenient mortgage option that allows you to manage your mortgage with ease.

Readvanceable Option: Some lenders offer HELOCs as part of a readvanceable mortgage. This means that as you pay down your mortgage, your credit limit for the HELOC increases, giving you access to more funds if needed.

Maximum Loan Size for a HELOC

A HELOC, allows you to borrow up to 65% of your home’s value, combined with your mortgage up to 80%. For example, if your home is valued at $500,000 and your remaining mortgage balance is $300,000, you can borrow up to $100,000 as revolving credit today.

$500,000 x 80% = $400,000

$400,000 – $300,000 = $100,000

Note: The revolving credit portion cannot exceed 65% Loan-to-Value (LTV), so any amount beyond this must be set up as a mortgage or secured term loan. LTV is a financial term that represents the ratio of a loan to the value of an asset purchased.

Home Equity Loan

A Home Equity Loan, also known as a second mortgage, is a lump sum loan secured against your property. This loan is ideal for those who need a specific amount of money for a one-time expense.

- Fixed or Variable Rates: Choose between fixed rates for consistent payments or variable rates.

- Lump Sum Payment: Receive the loan amount in a single lump sum and you repay it in fixed monthly installments.

- Easier Qualification: Suitable for those with lower credit scores or less equity.

Maximum Loan Size for a Home Equity Loan

Some of our private and subprime lenders may allow you to access up to 95% of your home’s equity for a second mortgage. For instance, if your home is valued at $500,000 and you have a remaining mortgage of $300,000, you can take out a home equity loan for up to $175,000.

$500,000 x 95% = $475,000

$475,000 – $300,000 = $175,000

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they'll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

The Differences Between First & Second Mortgages

When you first purchase your home, the mortgage you obtain is your first mortgage, registered in the first position. Suppose you later leverage your home equity through a HELOC or home equity loan, and your first mortgage hasn’t been fully paid off. In that case, this new loan becomes a second mortgage, registered in the second position behind your first mortgage. In case of default, the repayment order is based on their position in line with the collateral.

Why Consider a Second Mortgage?

If you have 20% or more equity in your home, a HELOC or home equity loan can be an intelligent choice to access extra cash. Here’s why:

- Debt Consolidation: Use a second mortgage to consolidate high-interest debts into a single, more manageable monthly payment.

- Preserve First Mortgage Terms: Borrow money without changing the terms of your first mortgage, which is beneficial if you initially secured a low interest rate.

- Access to Funds: Tap into your home’s equity to finance home improvements, education, or cover unexpected expenses.

Potential Risks and Considerations

While second mortgages offer numerous benefits, they also come with risks:

- Higher Interest Rates: Typically higher than those on first mortgages due to the increased risk for lenders.

- Repayment Priority: In case of default, the first mortgage is prioritized for repayment, increasing the risk for second mortgage lenders.

- Property Taxes: If your property taxes go into arrears, the municipality can move into the first position, potentially affecting your loan terms.

Is a Second Mortgage Right for You?

Is a Second Mortgage Right for You? Let’s Find Out Together. Deciding whether a second mortgage is worth it depends on your financial situation and goals. At Citadel Mortgages, we understand that this decision can be complex. That’s why we provide expert advice to help you understand your options and make the best choice. Our experienced mortgage agents will guide you through the process, ensuring you get the most competitive rates and terms.

How Does a Second Mortgage Work?

A second mortgage is what is known as a “secured loan,” as the lender can take your home should you fail to make payments. The equity in your home is the most critical factor in second mortgages, as the equity determines how much money you can access and how much the lender gets should you default. The lender uses the current market value of your home in hand with your mortgage balance to determine how much money they are willing to lend you. As a result, a home appraisal is required to confirm how much your home is worth.

The lender usually charges you for the appraisal and then uses that amount to determine the loan amount based on the maximum limit available in Canada. This is usually no more than 80% unless you apply with a private lender. These loans can go as high as 95%. The amount is calculated based on 80% of the appraised home value less the money owed on your first mortgage. You then pay two separate payments for your first and second mortgage based on your payment schedule. Should you miss payments and default on your second mortgage, the lender can take your home, even if you are up to date on your first mortgage payments.

How to Get a Second Mortgage?

Applying for a second mortgage involves several vital steps to secure the best terms and rates. Here’s a comprehensive guide to help you through the process:

Detailed Second Mortgage Process

- Online Application and Consultation

- Submit an online mortgage application and consult with a licensed mortgage agent specializing in private and second mortgages at Citadel Mortgages.

- Review and Appraisal

- After your consultation, we review your mortgage application and order an appraisal from an accredited and reputable appraiser to confirm the fair market value of your property.

- Verification of Existing Mortgage Balance

- The private lender verifies the amount of the property’s existing mortgage balance(s).

- Equity Assessment

- If you have sufficient equity (at least 20% of the home’s appraised value), you may qualify for a loan up to 85% or 90% of the home’s value.

- Lender Review

- A mortgage application is sent to lenders for review. If approved, a commitment letter is issued.

- Approval Review

- The homeowner(s) and lender review the mortgage approval commitment and decide whether to proceed with the offer.

- Document Signing

- Once the mortgage documents are signed, the lender issues final registration documents to your lawyer.

- Lawyer Meeting

- Your lawyer receives the mortgage documents and all other requested documentation from the lender. An appointment is set to meet with you and sign the final documents.

- Loan Disbursement

- After satisfying the lender’s conditions, the lender disburses the loan amount to your lawyer.

- Fund Release

- The lawyer writes a cheque or deposits the remainder of the loan directly into your bank account.

Why Choose Citadel Mortgages?

At Citadel Mortgages, we are committed to simplifying the second mortgage application process. Our experienced mortgage agents will guide you through each step, ensuring you get the best possible terms and rates tailored to your financial needs. We understand that applying for a second mortgage can be a complex process, and we are here to make it as straightforward as possible for you. With our expertise and personalized service, you can navigate the process with confidence.

Get a Second Mortgage with Citadel Mortgages

At Citadel Mortgages, we understand that there are times when you need a second mortgage. Our tailored Second Mortgage program allows you to access up to 90% of your home equity, even if you have bad credit or low income. . If you have a history of bankruptcy or are currently in a consumer proposal, then you can access up to 80% of your home equity.

Why Choose Our Second Mortgage Program?

- No Minimum Credit Score Required: We believe in giving everyone a chance, regardless of their credit history.

- No Job Verification Needed: We understand that steady income is only sometimes available, and we can work around that.

- Low income Accepted: Your income level won’t hinder your approval process.

- Quick Approval: Get approved fast and access your funds in just 3-5 business days.

- Debt Consolidation: We can help consolidate your debts, making it easier for you to manage your finances.

Benefits of a Second Mortgage with Citadel Mortgages

Our second mortgage program offers several advantages:

- Fast Cash Access: Receive cash quickly, helping you cover immediate expenses or investments in as little as 48-72 hours.

- Debt Relief: Pay off all your debts and work towards becoming debt-free while rebuilding your credit.

- Additional Funds: Get extra cash for home improvements, education, or other financial needs.

Understanding Second Mortgages

A second mortgage is an additional mortgage loan against the equity in your home that already has a mortgage. For lenders, this is riskier than the first mortgage because they are second in line to be paid if the homeowner defaults. As a result, second mortgage rates are typically higher than first mortgage rates.

Who Can Benefit?

Even if you have bad credit or low income, Citadel Mortgages can help. Our expert team specializes in fast second mortgages, ensuring that as long as your home has equity, you can get the approval you need.

How to Apply

Applying for a second mortgage with Citadel Mortgages is simple and straightforward. Here’s how:

- Contact Us: Fill out the form to the right, and our team will contact you to discuss your financial needs and eligibility.

- Submit Documentation: Provide necessary documents, including proof of home equity and identification.

- Get Approved: Receive quick approval and access your funds within 3-5 business days.

Contact Us To Get Approved Now

What Fees Will You Encounter With a Second Mortgage?

When considering a second mortgage, it’s not just about the money you’ll receive, but also about the fees you’ll encounter. Understanding these costs upfront is a powerful tool that puts you in control, helping you evaluate whether the benefits outweigh the expenses. Here are some standard fees you may encounter:

Common Second Mortgage Fees

- Administrative Fees:

- Typically range from $150 to $200.

- These fees cover the cost of processing your mortgage application.

- This is a lender fee

- Legal Fees:

- Generally fall between $2500 and $3,500.

- Legal fees are for the services of a lawyer to handle the mortgage documents and ensure everything is in order.

- You pay for both your lawyer and the lender’s lawyer when closing a second mortgage.

- Home Appraisal Fees:

- Usually between $300 and $600.

- Ussaly an appraisal is required to determine the current market value of your home when applying for a second mortgage, which is essential for securing a second mortgage.

- Please note if your home value is over 1 Million. Usually, the appraisal fee is higher.

- It is important to note that the lender owns the appraisal; you typically do not get a copy.

- Title Search Fees:

- Range from $250 to $500.

- The lawyer conducts a title search to verify that the property has a clear title, ensuring no legal issues could affect the mortgage.

- Private Mortgage Lender Fees:

- Typically, private lender fees range from 1% to 3% of the loan amount.

- Private lenders charge these fees to compensate for the higher risk associated with second mortgages.

- Sometimes, lender fees can be as high as 10-12%; the typical lender fees are 4-6%.

Mortgage Brokerage Fees

Mortgage agents typically charge a brokerage fee because lenders do not compensate them for the time spent on your file. This fee is generally equivalent to the lender’s fee and covers the mortgage agent’s efforts in managing and processing your mortgage application.

Why These Fees Matter

Understanding all the fees associated with a second mortgage is essential for making an informed decision about pursuing one. By evaluating the costs and benefits, you can determine if a second mortgage is right for you.

How Second Mortgage Fees Are Handled

Typically, all fees are included in your mortgage amount, so you do not have to pay them out of pocket. However, if there is insufficient equity in your home or if it is a purchase transaction, you will need to pay these fees separately rather than add them to the mortgage.

At Citadel Mortgages, we provide clear information on all potential fees to ensure you are fully informed. Our goal is to inform you and guide you through the complexities of securing a second mortgage, providing the support you need to make the right decisions.

How Much Can I Borrow on a Second Mortgage?

You can borrow from 65% to 80% of your home’s appraised value minus your current mortgage balance, depending on your credit rating, the type of second mortgage, your home equity available, and the lender. A private mortgage can be as high as 95%.

Refinancing vs. a Second Mortgage

Refinancing is similar to a second mortgage, as you can access up to 80% of your home’s value. However, refinancing impacts your current mortgage as the loan is provided by renegotiating the conditions and increasing the amount owed. Refinancing also comes with penalties for breaking your existing mortgage agreement, whereas a second mortgage is a separate agreement without penalties. As a result, refinancing tends to be the least appealing choice unless current interest rates are equal to or lower than your existing mortgage and will save you more than what you’ll pay in penalties.

HELOC vs. Second Mortgage

A HELOC allows you to draw money from a credit line, while a second mortgage pays you a lump sum with fixed-rate payments on that sum each month. You also need a good credit score for a HELOC, whereas a second mortgage is easier to get as they have higher interest rates and are not as strict with their lending policies.

Discover Your Best Current Second Mortgage Rates

Understanding How to Get a Second Mortgage with Bad Credit

Second Mortgages for Bad Credit Explained

Having bad credit doesn’t automatically disqualify you from getting a second mortgage. While traditional lenders may be hesitant, options are still available through private lenders and specialized mortgage programs. Here’s what you need to know:

- Private Lenders:

- Unlike traditional banks, private lenders are often more flexible with their lending criteria. They focus more on the value of your property and the equity available rather than just your credit score and income. This makes it easier for individuals with bad credit to secure a second mortgage.

- Higher Interest Rates:

- You can expect higher interest rates due to the increased risk associated with bad credit, expect higher interest rates on a second mortgage than those with good credit. However, these rates are typically lower than unsecured loan rates, making second mortgages a more cost-effective option.

- Shorter Terms and Smaller Loans:

- Second mortgages for bad credit often come with shorter terms and smaller loan amounts. This can be beneficial if you need a manageable repayment plan or a specific amount of money for a short-term need.

Benefits of a Second Mortgage for Bad Credit

- Debt Consolidation:

- One of the primary uses of a second mortgage is to consolidate high-interest debts into a single, more affordable monthly payment. This can help you manage your finances better and improve your credit score.

- Home Improvements:

- Use the funds from a second mortgage to make necessary home improvements, increasing the value of your property and enhancing your living conditions.

- Emergency Funds:

- A second mortgage can provide quick access to funds for an emergency or unexpected expense.

Second Mortgage Rates

Factors Affecting Second Mortgage Rates

- Home Equity: Your home’s equity significantly impacts the interest rate.

- Loan Amount: The size of the second mortgage affects the rate offered.

- Creditworthiness: Your credit history can influence the interest rate, even if approval is primarily based on equity.

Property Value and Risk

- Collateral Value: The interest rate is largely determined by your property’s value, which serves as collateral.

- Market Conditions: If property values decline, the lender’s risk increases, potentially affecting the interest rate.

Interest Rate Range

- Typical Rates: Second mortgage rates usually range from 4.99% to 16.99%, based on the lender’s risk assessment.

Second Mortgage Payment Options

Understanding Second Mortgage Payments

Second mortgage payments are typically structured around interest-only payments, with most lenders offering a monthly payment schedule. However, at Citadel Mortgages, we offer flexible payment options to suit your financial needs.

Payment Structures

- Interest-Only Payments: Most second mortgage lenders focus on interest-only payments, keeping your monthly obligations lower.

- Monthly Payment Schedule: The standard payment schedule is monthly, making it easier to manage your finances.

Flexible Payment Options

- Prepaid Interest Payments: We work with private lenders who allow you to prepay the interest for the entire term or a portion of the term. This option can help manage your budget and provide financial flexibility.

What Documents Do You Need For Your Second Mortgage?

To ensure a smooth and efficient second mortgage closing process for please prepare the following documents:

Essential Documents

- Current Mortgage Information Statement:

- Must be dated the same month as your application submitted for approval.

- If you do not have one, contact your mortgage lender and request an emailed copy.

- Most Recent Property Tax Statement:

- Obtain the latest statement from your local city hall if you do not have it on hand.

- Most Recent Notice of Assessment (NOA):

- May be required to show no income tax owing.

- Any owed income tax must be paid out from the new second mortgage upon closing.

Additional Documentation

- Other documents may be needed based on your unique situation. Our experienced mortgage agents at Citadel Mortgages will assist you in identifying and gathering any additional paperwork required to complete your second mortgage application.

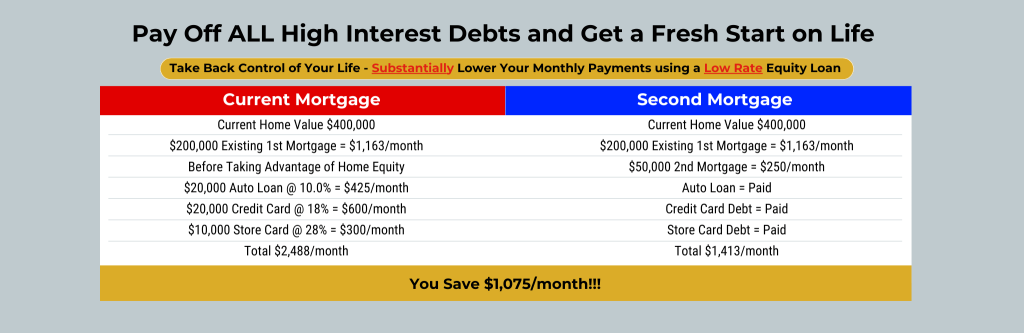

How Much Can You Save on Monthly Payments with a Second Mortgage?

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages for second mortgages!

Use Our Second Mortgage Calculator Today!

Understanding Your Second Mortgage Options

Using a second mortgage calculator can help you determine the potential costs and benefits of taking out a second mortgage. At Citadel Mortgages, we provide a comprehensive second mortgage calculator designed to give you accurate insights into your borrowing potential and monthly payments.

Benefits of Using Our Second Mortgage Calculator

- Accurate Estimates: Get precise calculations on your potential second mortgage amount based on your home’s equity, current mortgage balance, and other financial factors.

- Financial Planning: Understand your monthly payment obligations and how they fit into your overall budget.

- Interest Rate Comparison: Compare different interest rates to see how they affect your monthly payments and total loan cost.

- Loan Scenarios: Explore various loan scenarios to determine the best option for your financial needs.

How to Use the Second Mortgage Calculator

- Enter Your Home’s Current Value: Provide an estimate of your home’s current market value.

- Current Mortgage Balance: Input the remaining balance on your first mortgage.

The second mortgage calculator will then produce an estimate for you, please be sure to contact one of our mortgage brokers at Citadel Mortgages to help you get approved today!

Frequently Asked Questions on Second Mortgage

When you apply for a second mortgage, the lender will perform a hard credit check to evaluate your credit score and assess your creditworthiness. Your credit score and credit history play a crucial role in determining the interest rate for your second mortgage. Be mindful that multiple credit inquiries from different lenders can negatively impact your credit score.

For personalized advice on securing a second mortgage and understanding the impact on your credit, reach out to Citadel Mortgages. Our experts are here to guide you through the process and help you find the best terms.

It depends on the lender. The best second mortgage rates in Canada are HELOCS, followed by home equity loans and then private loans.

Typically, processing and approving a second mortgage can take at least 30 days.

You can get a second mortgage with bad credit by paying higher interest rates or having someone co-sign the loan. You can also consider a private lender, but will have to pay more than double the interest rates in most cases.

Even if you are up to date on your first mortgage payments, the lender can start foreclosure proceedings to take your home if you fail to make payments on your second mortgage.

You require at least 20% to purchase a second home in Canada.

While a second mortgage can provide a way to pay off high-interest debts or fund significant renovation projects, it might not always be the best financial decision. You may have more affordable alternatives if you have substantial home equity or a good credit score.

Why Consider Alternatives?

- Lower Interest Rates: With a strong income and credit score, you might qualify for lower interest rates on personal loans or home equity lines of credit.

- Home Equity Loans: A home equity loan can be cost-effective if you have significant equity.

- Refinancing: Refinancing your existing mortgage might offer better terms and rates, potentially saving you money in the long run.

Conclusion

Before opting for a second mortgage, exploring all your financial options is crucial. This way, you can be reassured that you’re choosing the most affordable and beneficial solution for your needs.

A second mortgage in Canada is usually a 1 year interest only term.

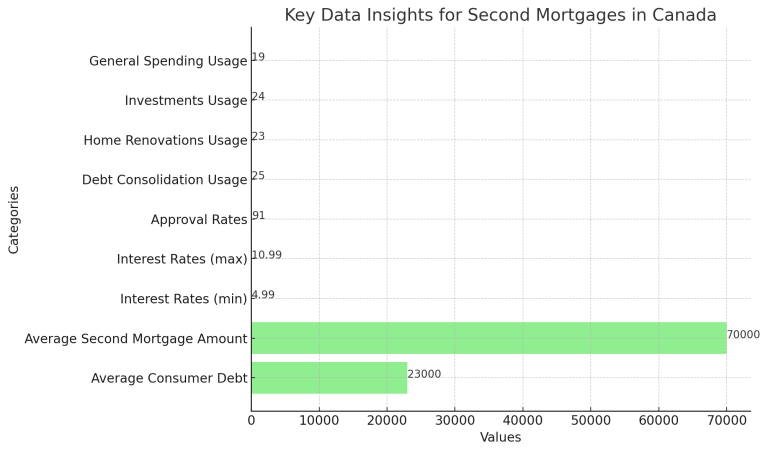

Second Mortgage Canada Stats

Key Insights on Second Mortgages in Canada

Understanding the landscape of second mortgages in Canada can help you make informed decisions. Here are some key statistics:

Financial and Demographic Data

- Average Consumer Debt: The average consumer debt in Canada is $23,000.

- Average Second Mortgage Amount: The average amount for a second mortgage in Canada is $70,000.

- Interest Rates: Second mortgage interest rates in Canada typically range between 4.99% and 10.99%.

- Approval Rates: Over 91% of homeowners in Canada with an LTV (Loan-to-Value) ratio of less than 75% are eligible for a second mortgage.

- Usage Purposes: Common uses for second mortgages include debt consolidation (25%), home renovations (23%), investments (24%), and general spending (19%).

Borrower Demographics

- Credit Scores: While second mortgages are often available to those with lower credit scores, better credit scores can result in more favorable interest rates.

- Home Equity: The amount of equity in a home significantly impacts the approval and terms of a second mortgage.

Data Accuracy and Updates

This information is based on the most up-to-date statistics available, sourced from various reliable resources, including Canada’s National Statistics Agency. While we strive to keep our data current, these figures may change as new information becomes available.

Data for the Graph

- Average Consumer Debt: $23,000

- Average Second Mortgage Amount: $70,000

- Interest Rates: 4.99% to 10.99%

- Approval Rates: 91%

- Usage Purposes:

- Debt Consolidation: 25%

- Home Renovations: 23%

- Investments: 24%

- General Spending: 19%

Discover Your Best Current Second Mortgage Rates

Final Thoughts

Obtaining a second mortgage has its advantages and disadvantages. Second mortgages offer the opportunity to access the equity in your home for purposes like consolidating debt, making home improvements, or funding the down payment on a second home.

It’s important to note that a second mortgage represents a significant financial commitment in addition to your existing payments, which can impact your debt-to-income ratios. Second mortgages typically carry higher interest rates compared to your first mortgage, as lenders must account for the increased risk of being in a secondary position. Contact the experts at Citadel Mortgages for personalized advice to determine if a second mortgage is suitable for your situation!

For tailored guidance and competitive rates, get in touch with Citadel Mortgages. Our team will assist you throughout the process and support you in making sound financial decisions.

Why Choose Citadel Mortgages

At Citadel Mortgages, we pride ourselves on offering expert, client-focused mortgage solutions that stand out in the industry. Here’s why you should choose us:

Expertise Across Canada

Our mortgage brokers are licensed and certified across multiple provinces, providing exceptional advice and service tailored to your unique needs. Our mortgage brokers are committed to delivering the highest standards of professionalism and expertise.

Client-Focused Service

Unlike traditional commission-based models, our mortgage agents are evaluated based on client satisfaction and the quality of their advice. This ensures that you receive impartial guidance on the best mortgage options for your situation.

Competitive Rates

Citadel Mortgages offers competitive rates that help you save money over the life of your mortgage. Our team works diligently to find the most favorable terms to suit your financial goals.

Transparent and Seamless Process

We are dedicated to transforming the mortgage industry by offering a transparent, seamless process. Our 100% digital platform ensures that you can manage your mortgage application from start to finish with ease and confidence.

Commitment to Excellence

At Citadel Mortgages, our mission is to provide a positive, empowering, and transparent property financing experience. We simplify the mortgage process to make it as straightforward and stress-free as possible.

Contact Us Today

For personalized advice and the best mortgage rates in Canada, contact our licensed and knowledgeable mortgage experts at Citadel Mortgages.

Discover Your Best Current Second Mortgage Rates

Client Success Stories

Our clients always come first. Our goal is to help you get the best advice and mortgage solutions for your needs. Citadel Mortgages was formed to help you achieve your financial home success so allow us to help you today. Speak to one of our mortgage agents today!

See current second mortgage rates by provinces

- Ontario Second Mortgage Rates

- Alberta Second Mortgage Rates

- Manitoba Second Mortgage Rates

- Saskatchewan Second Mortgage Rates

- Prince Edward Island Second Mortgage Rates

- Newfoundland Second Mortgage Rates

- British Columbia Second Mortgage Rates

- New Brunswick Second Mortgage Rates

- Nova Scotia Second Mortgage Rates

- Quebec Second Mortgage Rates

See current second mortgage rates by city

- Calgary mortgage rates

- Chatham mortgage rates

- Edmonton mortgage rates

- Halifax mortgage rates

- Markham mortgage rates

- Montreal mortgage rates

- Ottawa mortgage rates

- Quebec City mortgage rates

- Regina mortgage rates

- Saskatoon mortgage rates

- Toronto mortgage rates

- Vancouver mortgage rates

- Victoria mortgage rates

- Winnipeg mortgage rates