Get the Best Mortgage rates in Newfoundland

Featured On

MORTGAGE RATES IN Newfoundland

Your dream of owning a home in Newfoundland requires careful financial planning. Because so many factors impact your ability to pay your mortgage, it’s essential to understand how interest rates affect monthly payments. To help you make smarter mortgage decisions, we offer a comprehensive mortgage guide and an overview of the Newfoundland real estate market.

Best Newfoundland and Labrador Mortgage Rates - Fixed Mortgage Rates

To help you get a better grasp of the rates being offered by major Newfoundland lenders, we’ve put together this overview for fixed-rate mortgages with the rates and monthly mortgage payments based on a $380,000 mortgage:

Rate

Provider

Payment/month

5.04%

CIBC

$2,308

5.09%

RBC

$2,319

5.09%

BMO

$2,319

5.74%

Tangerine

$2,468

4.89%

Laurentian Bank

$2,274

5.09%

TD Bank

$2,319

5.19%

HSBC

$2,341

5.74%

Scotiabank

$2,468

6.49%

National Bank

$2,645

Best Newfoundland and Labrador Mortgage Rates - Variable Mortgage Rates

Here is a look at variable interest rates based on a $380,000 mortgage:

Rate

Provider

Payment/month

6.39%

BMO

$2834.47

6.45%

RBC

$2876.79

6.54%

CIBC

$2905.18

6.90%

Tangerine

$2933.69

6.15%

HSBC

$2933.69

6.65%

TD Bank

$2948.00

6.65%

Laurentian Bank

$3122.17

6.74%

National Bank

$3300.77

6.90%

Scotiabank

$3300.77

Newfoundland Mortgage Rate Comparison

It can also be helpful to understand how different terms impact the average rates you’ll see for insured fixed and variable mortgages in Newfoundland. The term refers to the duration of the mortgage. Once the term ends, you’ll have to renew your mortgage based on the current interest rates.

Fixed

- 1 year: 5.19%

- 3 year: 4.99%

- 5 year: 4.59%

Variable

- 1 year: NA

- 3 year: 5.85%

- 5 year: 5.75%

Newfoundland and Labrador Housing Market

According to the Newfoundland and Labrador Association of REALTORS®, the number of homes sold in May was 403 units, a drop of 31.3% year over year and 7% below the five-year average. However, sales were 6% above the 10-year average. When looking specifically at St. John’s, activity dropped by 36.2% year over year compared to overall provincial activity, which decreased by 28.9%.

The average home price was $281,900 for a single-family home which was up by 3.2% from 2022. Increases were also seen in townhouse/row units at $284,900, up 6.3%, and an increase of 7.2% to $226,000 for apartments. In St. Johns, prices rose by 3.5% to an average of $324,600. In the province, however, the average price saw a decrease of 8.1% year over year. Increases are likely related to decreases in listings, down 11.2% from 2022.

Current mortgage rates in Newfoundland in 2023

Current mortgage rates in Newfoundland in 2023 are as follows:

Rate

Insured

80% LTV

80% LTV

Uninsured

1-year Fixed rate

5.19%

5.19%

5.19%

5.19%

2-year Fixed rate

5.32%

5.32%

5.32%

5.32%

3-year Fixed rate

4.99%

5.24%

5.24%

5.24%

4-year Fixed rate

4.64%

5.24%

5.24%

5.24%

5-year Fixed rate

4.59%

4.89%

4.89%

5.44%

7-year Fixed rate

5.69%

5.74%

5.74%

5.74%

10-year Fixed rate

5.09%

6.00%

6.00%

6.00%

3-year Variable rate

5.85%

6.95%

6.95%

6.95%

5-year Variable rate

5.75%

6.15%

5.80%

6.25%

Lowest Mortgage Rates in Newfoundland and Labrador

When looking for the lowest mortgage rates in Newfoundland and Labrador, expect higher rates than those in larger cities and provinces. With a small population of about 520,000, rates are less competitive. There is also a smaller median household income, in hand with higher unemployment. When combined with lower average house prices, buyers in the area present a higher risk to lenders. There are also fewer lenders and brokers in the area, reducing negotiating power. All these local challenges mean you will see slightly higher rates than those seen in other areas of the country.

How to Get the Best Mortgage Rate in Newfoundland

Working with a Newfoundland mortgage broker makes shopping for a mortgage easier. Mortgage brokers work with Canadian lenders, including banks, credit unions, and private lenders, and consider your finances to recommend the type of lender most likely to offer you the best rates. Instead of going directly to several banks, you can use the knowledge of a single, unbiased mortgage expert and use their relationships to find the best mortgage product for your needs and financial circumstances.

Frequently Asked Questions About Mortgages in Newfoundland

Yes. When dealing directly with lenders, you only have access to their mortgage offerings, which limits your choices. You are also at the mercy of their standards, which means if you have unique financial or credit considerations such as a low credit rating, not having an established credit history, or being self-employed, you are less likely to find a lender to approve your application. If you do get approval, you are also more likely to be charged a higher interest rate because you present a higher risk. A mortgage broker helps you overcome these challenges and find the right mortgage for your circumstances.

Your savings can be substantial. For example, if your mortgage is $500,000 with a 20-year amortization period, over your first 5-year term, you pay $79,028 in interest with a 3.5% mortgage compared to just $73,250 for a 3.25% rate. Over just five years, you save $5,778. Imagine the savings over the entire life of your mortgage!

As with other provinces in Canada, the Big Six banks tend to dominate the market. You also have several large credit unions competing for your business. Most of the major lenders are located in St. Johns. Regardless of where you plan to buy your home, your best bet is to review sites like Citadel to look at current rates and who will likely offer you the best mortgage.

Mortgage brokers are less widespread in Newfoundland and Labrador than in larger provinces in Central and Western Canada. However, Citadel is licensed nationally, offering one of the best options when shopping for a mortgage in Newfoundland.

t really depends on your home location. However, when looking at an average in Newfoundland based on current housing prices, the typical mortgage is about $258,000.

The best bank rate in Newfoundland is CIBC’s fixed rate of 5.04%.

Find the best mortgage rates from Citadel Mortgages. Get yours approved today!

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

5.59%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

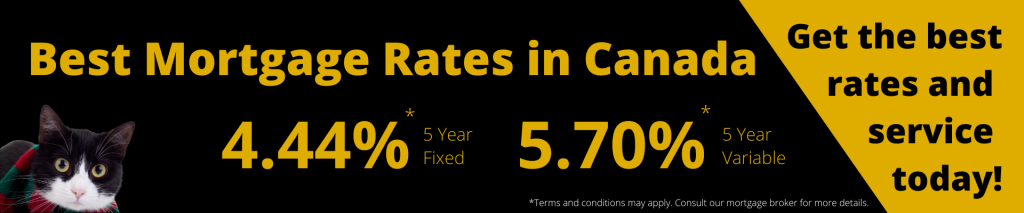

Best Mortgage Rates in Canada

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.44%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.89%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.70%

Mortgage Rates British Columbia

Mortgage Rates Saskatchewan

Mortgage Rates Alberta

Mortgage Rates Ontario

Mortgage Rates Nova Scotia

Mortgage Rates New Brunswick

Mortgage Rates Newfoundland

BMO Mortgage Rates

CIBC Mortgage Rates

Scotiabank Mortgage rates

TD Bank Mortgage Rates

RBC Mortgage Rates

Manulife Mortgage Rates

Let's get started

Find out how much home you can afford

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Start thinking about how much you spend each month, create a budget, and start saving up for your home.

Our Awards

DISCLAIMER

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.