RBC Mortgage Rates Canada

The Royal Bank of Canada is the largest of Canada’s “Big Six” banks when it comes to assets and market capitalization. With banks in over 30 countries, it is also one of the largest banks in the world. They offer a comprehensive list of financial services across several areas, from retail and commercial banking to wealth management and from capital markets to insurance and mortgages. Their mortgage products are very popular with customers purchasing a home.

Prime Rate | Rate History | Per Term Rates | Features | How To | Pre-approval | Products | FAQ

RBC Prime Rate

RBC’s prime rate is used to calculate interest rates for their products, including their mortgage rates. The prime interest rate impacts variable bank rates, while fixed rates already in place are not affected. The current RBC Royal Bank prime rate is 6.7% which aligns with the going prime rate of most major financial institutions in Canada.

RBC Royal Bank 5-Year Fixed and Variable Rate History

Over the past three years, the RBC’s rate history was as follows:

- Year: 2020 Fixed: 2.99% Variable: 2.45%

- Year: 2021 Fixed: 2.49% Variable: 1.60%

- Year: 2022 Fixed: 4.59% Variable: 3.30%

RBC Bank Mortgage Rates as Per Term

Here are the current rates for RBC Mortgage rates:

RBC Fixed Rates Below

RBC Variable Rates Below

TERM LENGTH

RBC MORTGAGE RATES

CITADEL MORTGAGES RATES

RBC Mortgage Features

RBC offers extra features designed to suit your financial situation, whether you need to relieve financial stress or want to pay down your mortgage sooner without any penalties. These features include:

- RBC Double-Up Payments:

This is a form of mortgage “pre-payment” and one of the easiest ways to pay down your mortgage faster. You choose how much you can afford in to pay in addition to your normal mortgage payments ranging from a minimum of $100 up to matching the full amount of your mortgage payment. When you double up on payments, the amount added helps pay down the principal. This not only help you become mortgage free sooner but also can save tens of thousands of dollars in interest over the duration of your mortgage. - RBC Annual Mortgage Prepayment:

In this case, you can prepay up to 10% of the original principal amount once a year. These prepayments also go towards the principal. As a result, more of your money goes towards the cost of your home, as opposed to the interest that goes to the bank. Over time you save money and also become mortgage free sooner. - RBC Skip A Payment:

This is a real lifesaver when you are short on cash or need a break on your mortgage so you have money to go towards unexpected expenses. The bank allows you to skip your month’s worth of payments once a year. You can skip either four consecutive weekly payments, two consecutive bi-weekly payments, or a single monthly payment depending on your mortgage payment schedule. However, this option does impact how long it takes you to pay down your mortgage. So it’s important to keep in mind that when you do this, the interest missed automatically gets added to your principal. This costs you more money in the long wrong. Remember, interest goes to the bank, while the principal goes directly to the cost of your home. - RBC HomeProtector Insurance:

Mortgage protection insurance is a good idea as it covers your mortgage for various unexpected issues including, disability, long-term illness and death. The premiums don’t increase throughout the life of your mortgage but do add to your mortgage payments. It is optional and does provide peace of mind, but as an add-on, you want to calculate whether you can afford it. Premiums are based on your age, who is covered, and how much coverage you need. Premiums are calculated based on every $1000 of your initial mortgage balance. - Monthly Property Tax Payments:

Paying your property tax with your mortgage is always easier, as the bank pays your property taxes on your behalf. It’s one less thing to worry about. In some cases, it is required you pay the tax with your mortgage, and in others, you have the option to do so.

How to Get an RBC Mortgage

To apply for an RBC mortgage, you can set up an appointment with your local RBC or use their online and over-the-phone options. You can use our RBC document checklist below to ensure you have all the information required for the application process. Also, it often works in your best interest to arrange an appointment with a mortgage specialist as you can discuss your needs and receive advice on the best mortgages for your needs.

RBC Mortgage Pre-Approval

A mortgage pre-approval is always best when buying a home. RBC will pre-approve your mortgage by first running a credit check and then setting a pre-approved rate they hold for you for 120 days. Should interest rates increase as you search for a home, the RBC honours the rate agreed upon at the time of pre-approval. However, if rates increase, the lower rate is honoured. You can apply either in person, online or over the phone.

RBC Mortgage Products

The RBC offers the following specialty mortgage products:

- Investment Property Mortgage:

This mortgage is used when buying an investment property or converting your home into a rental property. With this mortgage, RBC can offer up to 80% of your home’s appraised value. - RBC Vacation Home Mortgage:

If you are interested in buying a vacation or second home, this mortgage finances up to 95% of the appraised value. It depends on whether you already own a home and the purchase price of the second property. - RBC Cash Back Mortgage:

The cashback mortgage provides up to 7% of your mortgage value in cash, to a maximum amount of $20,000. The amount is then added to your mortgage amount, which you pay back as part of your mortgage balance. - RBC Self-Employed Mortgage:

If you are self-employed, a freelancer or own your own business, this is the mortgage for you. The RBC self-employed mortgage allows you to finance up to 80% of the appraised value of your home when you are refinancing and up to 90% when you are purchasing a home. In this case, you likely require additional mortgage insurance when Loan-to-values are higher than 65%. - RBC US Mortgage:

If you are seeking a property in the U.S., the RBC has branches in states such as Georgia, Florida and North Carolina. This makes it easier to get a mortgage if you don’t have a U.S. credit history. As a Canadian bank, RBC leverages your Canadian credit history and your Canadian assets, so you can purchase a U.S. home. - RBC Homeline Plan®:

This easy lending solution combines your traditional mortgage with a HELOC (RBC Royal Credit Line®), allowing you to leverage lower fixed interest rates to protect against possible future interest rate fluctuations. You also have the choice to divide your mortgage into fixed-rate and variable-rate portions if you prefer.

RBC Mortgage Application Checklist

When buying a new home, you require the following documentation to support your mortgage request through the RBC:

- Purchase and sale agreement

- MLS listing with photo

- Name, address, and telephone number of your solicitor/notary

- Savings or investments statement from within the last 90 days

- Sale of an existing property — a copy of the sale agreement

- Gift letter

- Withdrawal from RRSP through Home Buyer’s Plan

- Copy of latest pay slip

- T4

- Letter of employment

- T1 General and Notice of Assessment (NOA) if self-employed

If you currently own a home, you also need the following:

- Recent mortgage statement

- Current homeowner insurance policy

- Most recent property tax bill/statement

- The legal description of your property

Other information:

- Outstanding debt

- Expenses relating to the property, such as taxes, heating costs and condo fees

- Whether you will be using the property to generate income.

- A void cheque for any required payments

FAQ

A: No, they tend to be in the mid-range. For example, while RBCs’ 5-year fixed rate is 5.69%, TD’s is 5.44%, BMO’s is 5.09% and CIBC’s is 6.49%. So it pays to shop around when looking for the lowest rate.

A: You can apply for a mortgage by either setting up an appointment with a mortgage specialist at the bank, filling out a form online, or doing it over the phone.

A: Yes, you do have a right to negotiate your rate. However, RBC is tougher than other banks, and you are less likely to see them bend on their mortgage rates. That said, with fewer home buyers in the market of late, they might be willing to negotiate to get your business.

A: The RBC honours their quoted fixed-rate mortgages for up to 120 days and will reduce the rate should a better rate be available at the time you buy your home.

Find a better mortgage rate

Mortgage Rates British Columbia

Mortgage Rates Saskatchewan

Mortgage Rates Alberta

Mortgage Rates Ontario

Mortgage Rates Nova Scotia

Mortgage Rates New Brunswick

Mortgage Rates Newfoundland

BMO Mortgage Rates

CIBC Mortgage Rates

Scotiabank Mortgage rates

TD Bank Mortgage Rates

RBC Mortgage Rates

Manulife Mortgage Rates

Best Mortgage Bank Rates in Canada

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

5.59%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

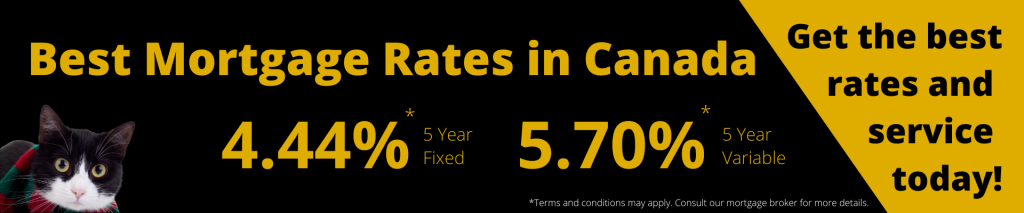

Best Mortgage broker Rates in Canada

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.44%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.89%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.70%

Disclaimer

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.

Let's get started

Find out how much home you can afford

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Start thinking about how much you spend each month, create a budget, and start saving up for your home.

Our Awards