GET some of the LOWEST MORTGAGE RATES IN Ontario

Featured On

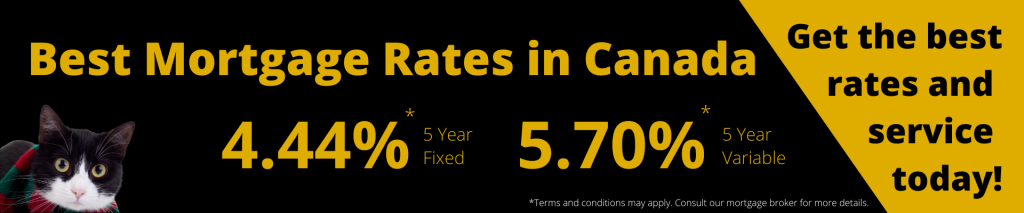

BEST MORTGAGE RATES IN Ontario

Ontario has been one of Canada’s most competitive real estate markets for years. Today, with the addition of rising interest rates, the market has levelled out, but the interest rates present a new challenge for home buyers. This guide will help you navigate the complicated landscape of Ontario mortgages to help you find the best mortgage rates to meet your home-buying goals.

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.44%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.89%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.70%

Mortgage Rate Trends in Ontario

Today, mortgage rates in Ontario present a challenge for home buyers. With the Bank of Canada piling on increase on top of increase, mortgage rates followed an upward trajectory, quickly moving away from historical lows experienced during the pandemic. However, at the end of 2022, the Bank of Canada watched as inflation rates dropped, putting increases on hold. As a result, mortgage rates flattened out and will hopefully begin to drop as we enter 2024.

Ontario Mortgage Performance

Ontario mortgage performance is the best in Canada. Using the percentage of mortgages in arrears as a critical indicator, Ontario sits at just 0.08% compared to Saskatchewan’s highest rate of 0.62%. Ontario is also below Canada’s rate of 0.17%. Banks consider a mortgage in arrears when the payments are three or more months behind.

The Canadian Bankers Association (CBA) measures the rate based on the number of accounts in arrears compared to the total mortgages reported from CBA member banks. The more mortgages there are in arrears, the more the economy lags. Mortgage defaults tend to be caused by rising interest rates and employment conditions that create lost income situations for homeowners.

Types of Mortgages Available in Ontario

As with the rest of Canada, Ontario mortgages can be broken down based on the type of interest rate and whether the mortgage is open or closed.

Variable interest vs. fixed rate interest mortgages

A fixed interest rate does not fluctuate throughout the mortgage term. You also pay the same amount for each payment. Typically, the fixed interest rate is higher than a variable interest rate to help banks balance out potential increases over the mortgage term. A variable interest rate fluctuates throughout the entire term of the mortgage as it is influenced by Canada’s prime interest rates. You can see a lower interest rate at the start of your term compared to fixed-rate interest mortgages.

However, although a decrease in interest rates provides an opportunity to save money over the life of your mortgage, increased interest rates cost you money. If you do not have a fixed payment for your variable interest rate, your payments will also rise and fall. Again, a decrease will improve your monthly cash flow, while an increase could put you at risk of defaulting on your mortgage if the payments become unmanageable.

Combination interest rate

You can also opt for a hybrid or combination mortgage, which portions part of your mortgage with a fixed interest rate and the remainder with a variable interest rate. This reduces risk, allowing you to take advantage of possible interest decreases without bearing the full impact if the interest rates rise.

Open vs. closed mortgages

Closed mortgages apply limits to how you pay your mortgage. As a result, your “prepayment” options to add additional payments to your mortgage are limited. Because prepayments allow you to pay your mortgage down more quickly, the bank applies a penalty to help recoup their lost interest. Most lenders offer a minimum amount of additional prepayment opportunities allowing you to contribute a limited percentage to your mortgage once a year.

The benefit of a closed mortgage is that they tend to have lower interest rates than an open mortgage. Open mortgages provide more flexibility to “prepay” more toward your mortgage. You’ll usually pay more interest, but you can counterbalance the higher interest by paying down your mortgage more quickly.

TERM LENGTH

High Ratio - Purchase/Transfers

insured -

Purchase/Transfers

Uninsurable

Refinance

(down payment<20%)

home<$1M & amortization≤25-yr

home>$1M & amortization>25-yr

CLICK ON THE RATES ABOVE TO APPLY NOW

Ontario’s Housing Market Trend

Ontario will likely record strong quarterly sales in 2023 despite seeing the softest sales year since the early 2000s. Trends are influenced by the increase in interest rates and seller hesitancy related to fears that prices are lower than they have been in the past. However, prices are rising year over year, despite not hitting record highs.

Moving toward 2024, Ontario should experience sales recovery as interest rates drop. However, falling interest rates and an increasing population will help create more demand, increasing prices. As a result, this could limit the strength of a comeback, keeping sales below pre-pandemic levels.

How to Get the Best Mortgage Rate in Ontario?

Although many buyers think of their bank as the best choice for a mortgage, it pays to shop around. When you stick to a single bank, your options are limited based on the bank’s mortgage products. However, working with a mortgage broker helps you find the best mortgage rates in Ontario. They access dozens of mortgage products available in Ontario to find the best mortgage rates.

They consider your personal finances and mortgage preferences and use that to search for mortgages that meet your needs. Brokers are not tied to any one lender, which means you can see the best options available from a diverse cross-section of lenders. As a result, you can make an informed decision and take advantage of the lowest interest rates to save you money over the life of your mortgage.

5-Year Fixed Mortgages in Ontario

Here is an overview of the best 5-year fixed mortgages in Ontario. Please click the rate to apply!

LENDER

TERM LENGTH

LENDER RATES

CITADEL MORTGAGES RATES

TERM LENGTH

LENDER RATES

CITADEL MORTGAGES RATES

Mortgage Calculators

Before you decide to buy a home, it makes sense to assess your financial situation. Mortgage calculators allow you to quickly estimate your mortgage payments based on the type of mortgage, interest rate, down payment and purchase price to decide if you can afford a mortgage. You can also use various types of mortgage calculators that provide in-depth summaries to explain how much interest you’ll pay over the life of your mortgage. You can test different rates and purchase prices to create the ideal budget. You can also assess whether your income will pass the stress test for mortgage approval.

Frequently Asked Questions About Mortgages in Nova Scotia

Most experts predict mortgage rates have peaked and will not see another increase in 2023.

The average mortgage rate for an insured 5-year mortgage rate in Ontario is 4.29% fixed interest rates and 6% for variables.

Increased interest rates are the typical strategy the Bank of Canada uses to help combat inflation. As we saw in 2022, a series of increases more than doubled the interest rates we enjoyed during the pandemic. As inflation rates slowed, the Bank eased up on increases, and we are now seeing the prime rate flatten out. However, since prime rates drive mortgage rates, if we experience inflation again, the Bank of Canada will increase the prime, leading to mortgage rate increases across Canada. Ideally, the inflation rate should not rise above 3%.

Canada’s prime rate sits at 6.70%. How the prime rate impacts mortgage rates depends on the type of mortgage. Variable mortgages use the prime rate to guide increases and decreases and determine the rate you’ll be offered when you sign your mortgage. Fixed mortgage rates, on the other hand, are based on yields in the bond market. When yields are high, it costs banks more money; therefore, they will increase their fixed rates when yields are high and lower them if yields are low.

TD Bank has the best mortgage rate at 4.89%, 1.45% lower than the highest rate available in Ontario of 6.49% at Scotiabank

Here is an overview of current mortgage rates in Ontario:

Lender Fixed Variable

Butler Mortgage 4.19% 5.49%

Neo Financial 4.29% 6.60%

Nesto 4.29% 5.45%

Pine 4.34% 5.55%

RateHub/Canwise 4.44% 5.70%

QuestTrade 4.49% 5.60%

Rocket Mortgage 4.49% 5.75%

Equitable 4.54% 5.80%

Dominion Lending 4.54% N/A

Mortgage Alliance 4.54% 5.80%

First National 4.69% 5.55%

Laurentian 4.69% 6.70%

PACE 4.74% 5.95%

Alterna Savings 4.74% 5.95%

YNCU 4.79% N/A

HSBC 4.79% 5.90%

DUCA 4.89% 6.70%

TD 4.89% 6.45%

CIBC 4.94% 6.20%

BMO 4.99% 6.39%

First Ontario 5.09% 6.50%

Canadian Western 5.09% N/A

CMLS 5.29% 7.20%

Simplii Financial 5.49% 6.55%

Caisse Alliance 5.49% N/A

National Bank 5.54% 6.50%

RBC 5.54% 6.50%

Desjardins 5.54% 6.50%

Manulife 5.69% N/A

Tangerine 5.74% 6.65%

Motusbank 5.79% 6.75%

Down payments are based on the purchase price as follows:

- $500,000 or less: Minimum 5% of the purchase price

- $500,000 to $999,999: Minimum 5% of the first $500,000 of the purchase price and 10% for the portion of the purchase price above $500,000

- $1 million or more: Minimum 20% of the purchase price

Before you start your house hunt, find the best mortgage rates from Citadel Mortgages. Get yours approved today!

Best Mortgage Bank Rates in Canada

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

5.59%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

Best Mortgage broker Rates in Canada

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.44%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.89%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.70%

Mortgage Rates British Columbia

Mortgage Rates Saskatchewan

Mortgage Rates Alberta

Mortgage Rates Ontario

Mortgage Rates Nova Scotia

Mortgage Rates New Brunswick

Mortgage Rates Newfoundland

BMO Mortgage Rates

CIBC Mortgage Rates

Scotiabank Mortgage rates

TD Bank Mortgage Rates

RBC Mortgage Rates

Manulife Mortgage Rates

Let's get started

Find out how much home you can afford

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Start thinking about how much you spend each month, create a budget, and start saving up for your home.

Our Awards

DISCLAIMER

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.