5-Year Variable Mortgage Rates Canada | Best Mortgage Rates 2025

Find the Best Mortgage Rates in Canada

Today’s Mortgage Rates updated as of October 7, 2025 1:58 pm

For a property located in

5-year fixed*

3.84

5-year Variable*

3.85

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

What Are 5-Year Variable Mortgage Rates?

A 5-year variable mortgage rate offers interest rates that fluctuate based on the lender’s prime lending rate over a five-year term. Unlike fixed rates, your monthly payments or interest allocation may change if the Bank of Canada adjusts its policy rate. This option is ideal for borrowers who are comfortable with some level of risk and want to benefit from potential rate decreases.

Whether you’re a first-time homebuyer, refinancing, or renewing your mortgage, understanding current trends and available options helps you make informed financial decisions.

This guide focuses on helping you navigate the Ontario mortgage market, offering insights into current rates, strategies for securing the best deal, and regional trends.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

Why Choose a 5-Year Variable Mortgage Rate?

Opting for a 5-year variable mortgage rate comes with distinct advantages:

1. Potential Savings

- Variable rates are often lower than fixed rates, leading to potential savings if rates remain stable or decline.

2. Flexibility

- Many lenders allow you to switch to a fixed rate during your term, offering additional security if needed.

3. Long-Term Opportunity

- With a five-year term, you can take advantage of favorable market conditions over a longer period.

Learn more about today’s best mortgage rates in Canada.

Current 5-Year Variable Mortgage Rates in Canada

| Lender | 5-Year Variable Rate (%) | Features |

|---|---|---|

| Big 5 Banks (Average) | 5.10% – 5.40% | Standard variable-rate terms |

| Online Lenders | 5.00% – 5.30% | Competitive rates with lower fees |

| Credit Unions | 5.05% – 5.35% | Personalized service, flexible repayment terms |

Read about how fixed and variable rates compare on the Government of Canada website.

How Do Variable Rates Work?

Variable rates are tied to the lender’s prime rate, which changes based on the Bank of Canada’s policy rate decisions. Here’s how it works:

- Floating Interest Rate: Payments may fluctuate if rates increase or decrease.

- Fixed Payment Option: Some lenders offer fixed payments where the portion applied to interest changes with the rate.

- Risk vs. Reward: Borrowers benefit from lower rates when the prime rate drops but face higher costs if rates rise.

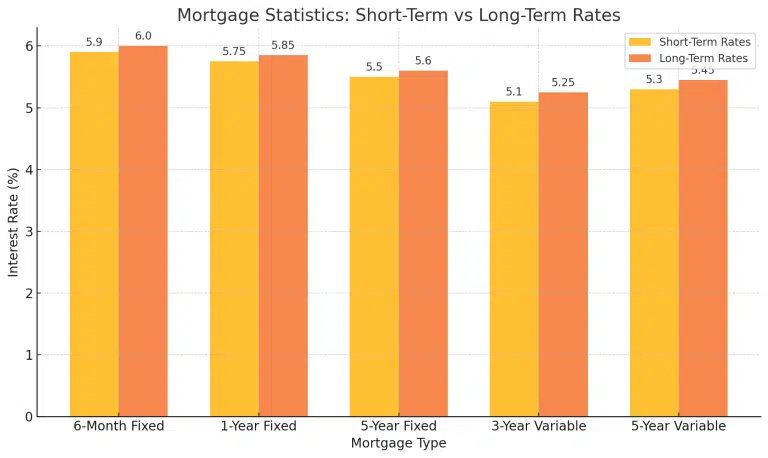

Mortgage Statistics for Variable Rates

| Metric | 5-Year Variable | National Average |

|---|---|---|

| Average Rate (2024) | 5.25% | 5.50% – 6.50% |

| Typical Loan Size | $370,000 | $390,000 |

| Approval Time | 3–7 Business Days | 3–7 Business Days |

Why Choose Citadel Mortgages for a 5-Year Variable Rate?

At Citadel Mortgages, we specialize in finding flexible and competitive mortgage solutions tailored to your needs.

What We Offer

Comprehensive Lender Network:

- Access the best rates from Canada’s leading banks, credit unions, and private lenders.

Personalized Guidance:

- Tailored advice to help you navigate rate fluctuations with confidence.

Custom Mortgage Plans:

- Flexible options that align with your financial goals and tolerance for risk.

Hassle-Free Process:

- Seamless approvals and exceptional customer service ensure a smooth experience.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

Compare 5 Year Variable Mortgage Rates In Canada

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

Eligibility Criteria for a 5-Year Variable Mortgage

To qualify for the best 5-year variable mortgage rates, borrowers should meet these requirements:

1. Strong Credit Score

- A credit score of 680 or higher is typically needed for competitive rates.

2. Stable Income

- Proof of consistent income, such as pay stubs, T4 slips, or NOAs for self-employed individuals, is required.

3. Down Payment

- A minimum of 5% for insured mortgages and 20% for uninsured mortgages is necessary.

4. Debt-to-Income Ratios

- Gross Debt Service (GDS) ratio ≤ 35% and Total Debt Service (TDS) ratio ≤ 42%.

5. Risk Tolerance

- Borrowers should be financially prepared for potential rate increases during the term.

Who Should Consider a 5-Year Variable Mortgage?

A 5-year variable mortgage is best suited for:

Market Watchers:

- Ideal for those who anticipate stable or declining rates over the next five years.

Long-Term Planners:

- Great for borrowers comfortable with variable payments and a longer-term commitment.

Flexible Borrowers:

Perfect for those who may want to convert to a fixed rate if needed.

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Let us simplify the process and help you secure approval quickly and stress-free!

Lowest 5 Year Variable Mortgage Rates In Canada

Documents Needed for Mortgage Approval in Canada

- Government ID: Driver’s license, passport, or permanent resident card.

- Proof of Income: Recent pay stubs, T4 slips, or self-employment income proof.

- Employment Verification: Letter from your employer detailing salary and position.

- Down Payment Proof: Bank statements or proof of savings.

- Credit Report Authorization: Permission for lenders to access your credit history.

Additional Documentation

- Other documents may be needed based on your unique situation. Our experienced mortgage agents at Citadel Mortgages will assist you in identifying and gathering any additional paperwork required to complete your second mortgage application.

Get a Mortgage with Citadel Mortgages

Navigate Interest Rate Trends with Confidence: Mortgage Solutions Tailored for You

At Citadel Mortgages, we recognize how important it is to stay informed about changing mortgage interest rates. Whether you’re purchasing your first home, refinancing, or renewing your mortgage, we’re here to guide you through the process with solutions that suit your financial needs, even in fluctuating rate environments.

Why Choose Our Mortgage Solutions?

Flexible Mortgage Options

From fixed to variable rates, we offer tailored solutions that help you secure the most competitive interest rates for your situation.

Expert Guidance on Rate Trends

Our team monitors the Canadian mortgage market to provide insights on current rates, helping you make informed decisions.

Approval Regardless of Credit History

We focus on finding solutions, even if you’ve faced credit challenges or financial setbacks.

Low-Income Friendly Options

Income constraints shouldn’t hold you back. We specialize in making homeownership accessible for Canadians in various financial situations.

Streamlined Application Process

Enjoy a smooth experience with quick approvals and clear communication every step of the way.

Benefits of Working with Citadel Mortgages

Rate Lock Protection

Secure today’s interest rates to avoid surprises if rates increase before your mortgage closes.

Debt Relief Options

Consolidate high-interest debt into a single, lower-interest mortgage payment, saving you money and simplifying your finances.

Customizable Payment Plans

Choose flexible payment terms that fit your budget, whether you prefer the stability of a fixed rate or the potential savings of a variable rate.

Quick Fund Access for Refinancing

Refinance your mortgage to tap into your home’s equity for renovations, debt consolidation, or investment opportunities.

Contact Us To Get Approved Now

Citadel Mortgages 5 Year Variable Mortgage Rates

5-Year Variable vs. Other Mortgage Terms

| Feature | 5-Year Variable | 5-Year Fixed | 3-Year Variable |

|---|---|---|---|

| Term Length | 5 Years | 5 Years | 3 Years |

| Interest Rate | Lower Potential | Stable | Lower Potential |

| Payment Stability | Fluctuates | Stable | Fluctuates |

| Flexibility | High | Moderate | Higher |

| Best For | Market Watchers | Long-Term Stability | Short-Term Planners |

Benefits of Monitoring the Target Overnight Rate

Staying updated on the Bank of Canada’s target overnight rate helps homeowners and buyers:

- Plan Financially: Understand how potential rate changes may affect your monthly payments.

- Refinance Strategically: Take advantage of lower rates when refinancing an existing mortgage.

- Lock in Competitive Rates: Secure a fixed rate before anticipated rate increases.

- Avoid Surprises: Prepare for potential increases in borrowing costs.

Bank of Canada Rate Announcements for 2025

The Bank of Canada schedules eight interest rate announcements annually, providing updates on monetary policy.

- Next Announcement: Check the official Bank of Canada Rate Schedule for the next update.

Should You Choose Fixed or Variable Rates in 2025?

With the Bank of Canada targeting inflation control, many Canadians face the dilemma of choosing between fixed and variable mortgage rates.

| Feature | Fixed Rate | Variable Rate |

|---|---|---|

| Payment Stability | Consistent payments for the term | Payments fluctuate with the prime rate |

| Interest Costs | Slightly higher but predictable | Lower initially but may increase |

| Risk Tolerance | Ideal for risk-averse borrowers | Suitable for those comfortable with rate changes |

| Market Outlook | Best if rates are expected to rise | Best if rates are expected to fall |

FAQs: 5-Year Variable Mortgage Rates

How often do variable rates change?

Rates change based on adjustments to the Bank of Canada’s policy rate, typically a few times per year.

Are 5-year variable rates riskier than fixed rates?

Yes, as payments or interest costs can increase if rates rise. However, they offer potential savings if rates drop or stay low.

Can I switch from a variable to a fixed rate during the term?

Most lenders allow this option, though terms and conditions may apply.

Is a 5-year variable mortgage a good option for first-time buyers?

It can be, particularly for those comfortable with potential payment fluctuations and aiming for lower initial rates.

Use Our Mortgage Calculator Today!

Understanding Your Mortgage Options

Use our mortgage calculator to gain a clearer picture of what you can expect in terms of monthly payments, interest costs, and amortization schedules. Simply input your loan amount, interest rate, and amortization period to get started. This tool provides estimates to help you make informed decisions as you explore different mortgage options.

Benefits of Using Our Mortgage Calculator

- Accurate Estimates: Get precise calculations on your potential second mortgage amount based on your home’s equity, current mortgage balance, and other financial factors.

- Financial Planning: Understand your monthly payment obligations and how they fit into your overall budget.

- Interest Rate Comparison: Compare different interest rates to see how they affect your monthly payments and total loan cost.

- Loan Scenarios: Explore various loan scenarios to determine the best option for your financial needs.

Final Thoughts: 5-Year Variable Mortgage Rates in Canada

A 5-year variable mortgage rate offers an excellent combination of flexibility and potential savings, making it an appealing choice for Canadian homeowners and buyers who are comfortable with fluctuating interest rates. With a five-year term, you have the opportunity to benefit from lower initial rates while maintaining the option to switch to a fixed rate if market conditions change.

This option is particularly advantageous for market watchers, long-term planners, and those willing to take on some risk for the potential reward of lower payments. However, it’s essential to assess your financial goals, risk tolerance, and ability to handle possible rate increases before committing to a variable mortgage.

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

Why Choose Citadel Mortgages

At Citadel Mortgages, we pride ourselves on offering expert, client-focused mortgage solutions that stand out in the industry. Here’s why you should choose us:

Expertise Across Canada

Our mortgage brokers are licensed and certified across multiple provinces, providing exceptional advice and service tailored to your unique needs. Our mortgage brokers are committed to delivering the highest standards of professionalism and expertise.

Client-Focused Service

Unlike traditional commission-based models, our mortgage agents are evaluated based on client satisfaction and the quality of their advice. This ensures that you receive impartial guidance on the best mortgage options for your situation.

Competitive Rates

Citadel Mortgages offers competitive rates that help you save money over the life of your mortgage. Our team works diligently to find the most favorable terms to suit your financial goals.

Transparent and Seamless Process

We are dedicated to transforming the mortgage industry by offering a transparent, seamless process. Our 100% digital platform ensures that you can manage your mortgage application from start to finish with ease and confidence.

Commitment to Excellence

At Citadel Mortgages, our mission is to provide a positive, empowering, and transparent property financing experience. We simplify the mortgage process to make it as straightforward and stress-free as possible.

Contact Us Today

For personalized advice and the best mortgage rates in Toronto, contact our licensed and knowledgeable mortgage experts at Citadel Mortgages.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.