CHIP Reverse Mortgage Canada | Unlock Your Home Equity with HomeEquity Bank

Find the Best CHIP Reverse Mortgage Rates in Canada

Today’s Reverse Mortgage Rates updated as of October 8, 2025 9:36 pm

For a property located in

*Rates can change at anytime. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

CHIP Reverse Mortgage: Unlock Tax-Free Home Equity with HomeEquity Bank

The CHIP Reverse Mortgage by HomeEquity Bank is Canada’s leading reverse mortgage solution, specifically designed for homeowners aged 55 and older. With CHIP, you can access up to 55% of your home’s value without monthly payments, providing you with the financial flexibility to live comfortably while staying in your home as part of a reverse mortgage.

What Is a CHIP Reverse Mortgage?

The CHIP Reverse Mortgage is a loan that allows Canadian homeowners to convert a portion of their home equity into tax-free cash. Unlike traditional loans, it doesn’t require monthly payments. The loan, along with interest, is repaid only when you sell your home, move out, or pass away.

For more details on how reverse mortgages work, visit the Financial Consumer Agency of Canada (FCAC).

Current CHIP Reverse Mortgage Rates

As of 2025, CHIP reverse mortgage offers some of the most competitive reverse mortgage rates in Canada:

- Fixed Rates: 7.25% – 9.10%

- Variable Rates: 6.90% – 8.75%

For the latest rate updates, visit CHIP Reverse Mortgage Rates.

CHIP Reverse Mortgage Rates

Get An Estimate

See How Much You Can Borrow Today!

Why Choose HomeEquity Bank’s CHIP Reverse Mortgage?

Canada’s Most Trusted Provider

With over 30 years of experience, HomeEquity Bank has helped thousands of Canadians access their home equity safely and securely.No Negative Equity Guarantee

You’ll never owe more than your home’s value when it’s sold. This guarantee ensures that your financial future is secure.Flexible Payout Options

Choose from lump sum, scheduled payments, or a combination to fit your financial goals.Tax-Free Funds

Your reverse mortgage payments are tax-free and won’t affect government benefits such as Old Age Security (OAS) or Guaranteed Income Supplement (GIS).Stay in Your Home

Retain ownership and continue living in your home while accessing its value.

Use our Reverse Mortgage Calculator to get an estimate of your borrowing potential.

Reverse Mortgage Fees with CHIP Reverse mortgage

Here’s a breakdown of typical fees associated with an CHIP Reverse Mortgage:

- Appraisal Fee: $300 – $500

- Legal Fees: $1,000 – $2,000

- Administrative Fee: $1,795

- Prepayment Penalties: Applicable if repaid early

Get An Estimate

See How Much You Can Borrow Today!

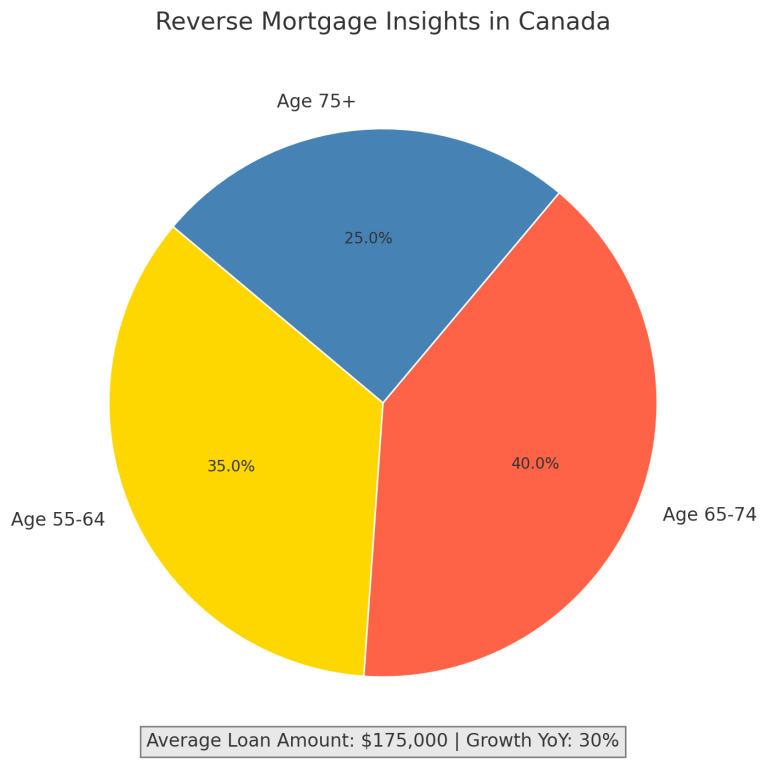

CHIP Reverse Mortgage Statistics

Understanding the market trends and usage patterns for reverse mortgages can help you make informed decisions. Here are key statistics:

Key Statistics

- Average Loan Amount: $175,000

- Year-Over-Year Growth: 30%

- Homeowner Eligibility: 90% of homeowners with sufficient equity qualify.

- Usage Breakdown:

- Debt Consolidation: 25%

- Home Renovations: 23%

- Retirement Income: 30%

- General Spending: 22%

Age Distribution of Reverse Mortgage Holders

- Age 55-64: 35%

- Age 65-74: 40%

- Age 75+: 25%

Who Qualifies for a CHIP Reverse Mortgage?

Eligibility is simple:

- Age: You and your spouse must be 55 or older.

- Primary Residence: Your home must be your primary residence.

- Home Value: Your home must meet HomeEquity Bank’s valuation criteria.

- Use the CHIP Reverse Mortgage Calculator to see how much you can borrow.

Common Uses for CHIP Reverse Mortgage Funds

- Debt Consolidation

Simplify your finances and lower your overall interest rates. - Home Renovations

Upgrade or modify your home to suit your retirement needs. - Healthcare Costs

Cover unexpected medical expenses or long-term care. - Supplementing Retirement Income

Boost your income for a more comfortable lifestyle. - Helping Family

Support your children or grandchildren financially.

FAQs About CHIP Reverse Mortgages

Are CHIP reverse mortgages safe?

Yes, CHIP reverse mortgages in Canada are regulated by federal and provincial laws. Lenders like HomeEquity Bank and Equitable Bank offer government-backed solutions with no negative equity guarantees.

How does repayment work with a reverse mortgage?

The loan is typically repaid when you sell your home, move into long-term care, or pass away. You or your estate won’t owe more than the home’s fair market value at the time of sale.

Why get a reverse mortgage?

Here are some examples of how clients commonly use it:

- eliminate debt payments

- help a child or grandchild with a down payment on a home

- purchase a new home (right-sizing instead of having to downsize the home)

- increase cash flow to improve lifestyle (e.g., vacation, new car)

- pay healthcare costs

- pay for an unexpected expense (e.g. home repairs)

Can I apply if my spouse is under 55?

No, both you and your spouse must be at least 55 years old to qualify for a reverse mortgage in Canada.

Can I lose my home with a reverse mortgage?

No, as long as you meet your obligations, such as keeping your property taxes and insurance up to date, you can stay in your home for life.

What happens if the loan exceeds the home’s value?

Canadian reverse mortgages come with a no negative equity guarantee, meaning you’ll never owe more than the value of your home.

How is the reverse mortgage repaid?

The loan is typically repaid when you sell your home, move into long-term care, or pass away.

Are there penalties for early repayment?

Yes, prepayment penalties may apply. However, Equitable Bank offers flexible repayment options to minimize costs.

Get An Estimate

See How Much You Can Borrow Today!

Why Choose Citadel Mortgages for Your CHIP Reverse Mortgage?

At Citadel Mortgages, we’re dedicated to helping you find the best financial solutions. Our partnership with HomeEquity Bank allows us to offer the CHIP Reverse Mortgage with competitive rates and personalized service.

CHIP Reverse Mortgage Calculator

Understanding your reverse mortgage potential is easier with our Reverse Mortgage Calculator. This tool provides an instant estimate of how much equity you can access based on:

- Your Age

- Home Value

- Location

- Loan-to-Value Ratio (LTV)

How to Use the Reverse Mortgage Calculator:

- Enter Your Home’s Current Market Value.

- Input Your Age and Your Spouse’s Age (if applicable).

- Receive an Estimate of the Amount You Can Borrow.

Try the Citadel Mortgages Reverse Mortgage Calculator today to explore your options!

Final Thoughts on CHIP reverse mortgages

An CHIP Reverse Mortgage offers Canadian homeowners a secure, flexible way to unlock their home equity. Whether you’re planning for retirement, managing debt, or funding home improvements, this financial tool provides the freedom to live comfortably without monthly payments.

Contact Citadel Mortgages today to explore how an Equitable Bank Reverse Mortgage can work for you.

See Reverse Mortgages By City

See Reverse Mortgages By Bank

Get An Estimate

See How Much You Can Borrow Today!