TD Bank Mortgage Rates

As one of Canada’s largest and oldest banks, TD Bank is part of the big six banks in the country. It is a “tier 1 bank” with operations across Canada and the East Coast of the United States, with a strong global presence. It is the 12th largest bank in the world, providing a diversified portfolio of financial services, including mortgages. With over 1200 branches and secure online application options, it is easy to shop for mortgages with TD Bank.

Prime Rate | Per Term Rates | Per Province Rates | Features | FAQ | Pros & Cons | History

TD Bank Prime Rate

Prime rates change when the Bank of Canada raises or lowers its overnight rate. When it comes to mortgages, there is a separate mortgage rate that tends to be lower than the prime rate. TD Bank’s prime rate is 6.70%, the highest it’s been since 2001.

5-Year History of TD Prime Rate

To get a feel for changes to the TD prime rate over the years, here is the 5-year history:

- January 26, 2023: 6.700%

- December 8, 2022: 6.450%

- October 27, 2022: 5.950%

- September 8, 2022: 5.450%

- July 14, 2022: 4.700%

- June 2, 2022: 3.700%

- April 14, 2022: 3.200%

- March 03, 2022: 2.700%

- March 30, 2020: 2.450%

- March 17, 2020: 2.950%

- March 5, 2020: 3.450%

- October 25, 2018: 3.950%

- July 12, 2018: 3.700%

- January 18, 2018: 3.450%

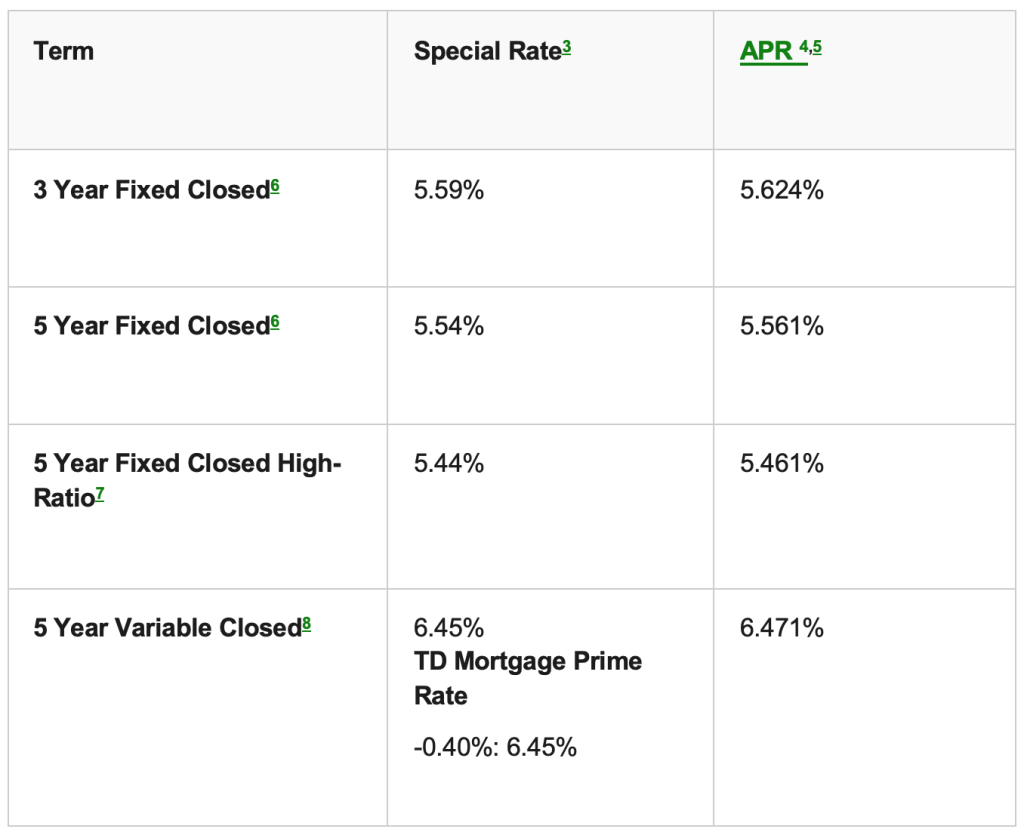

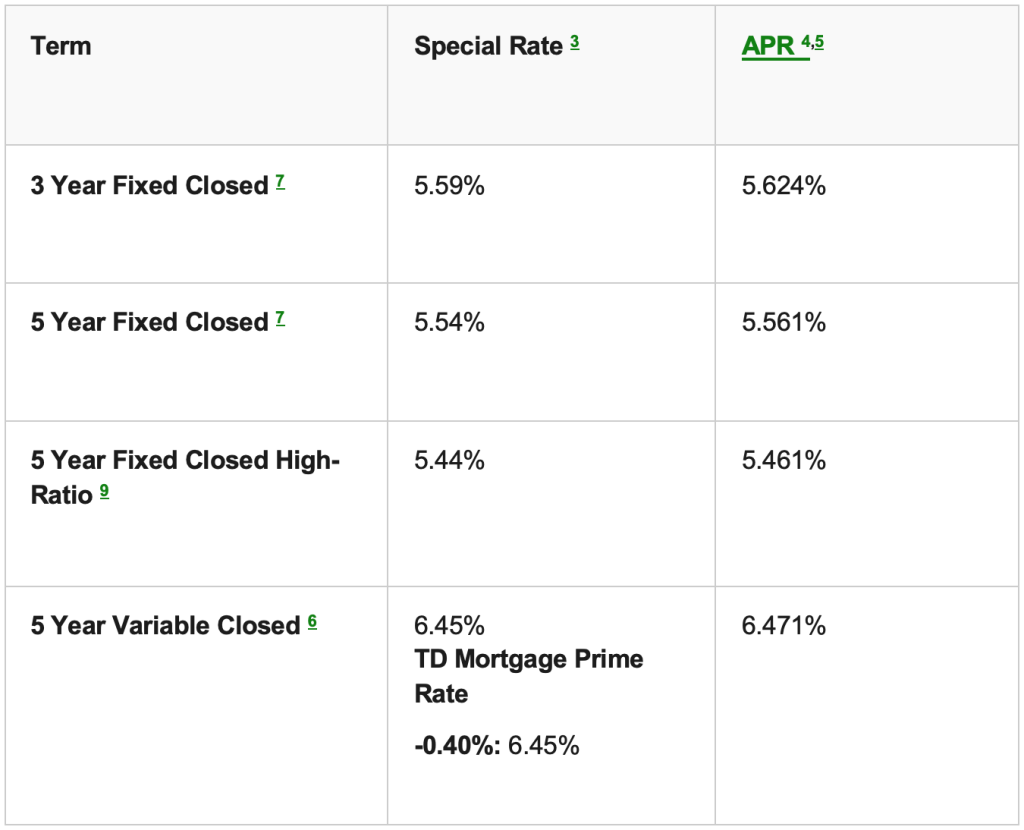

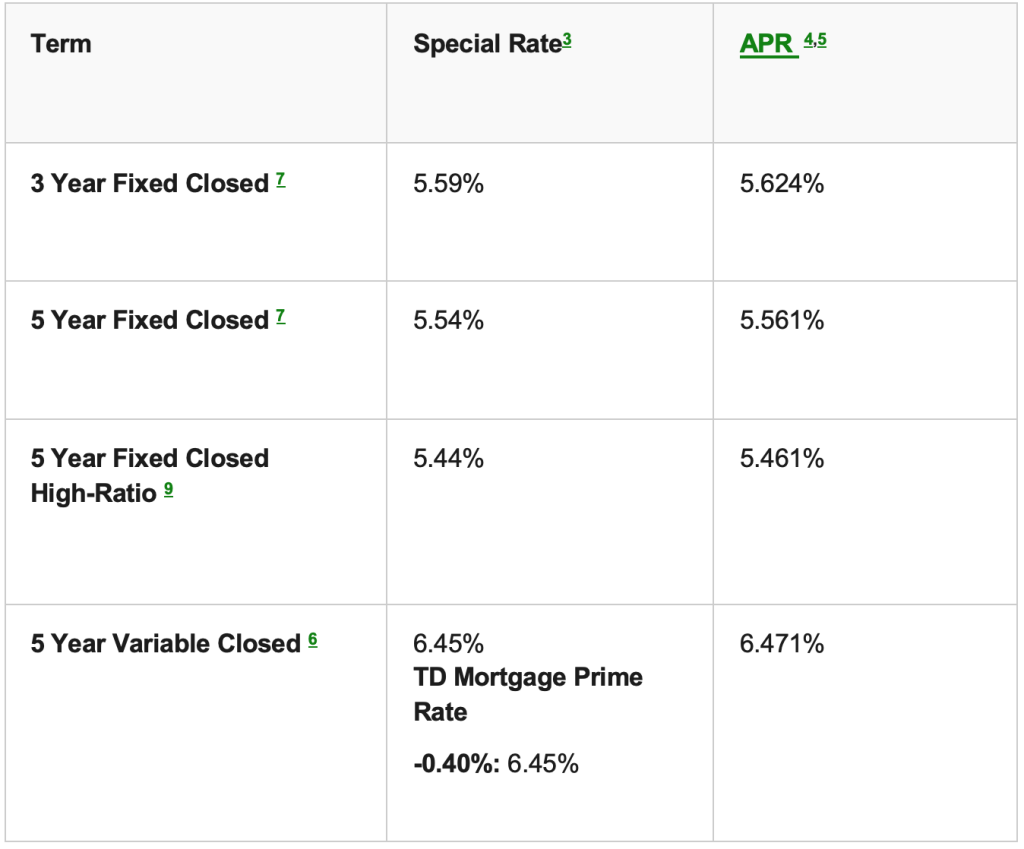

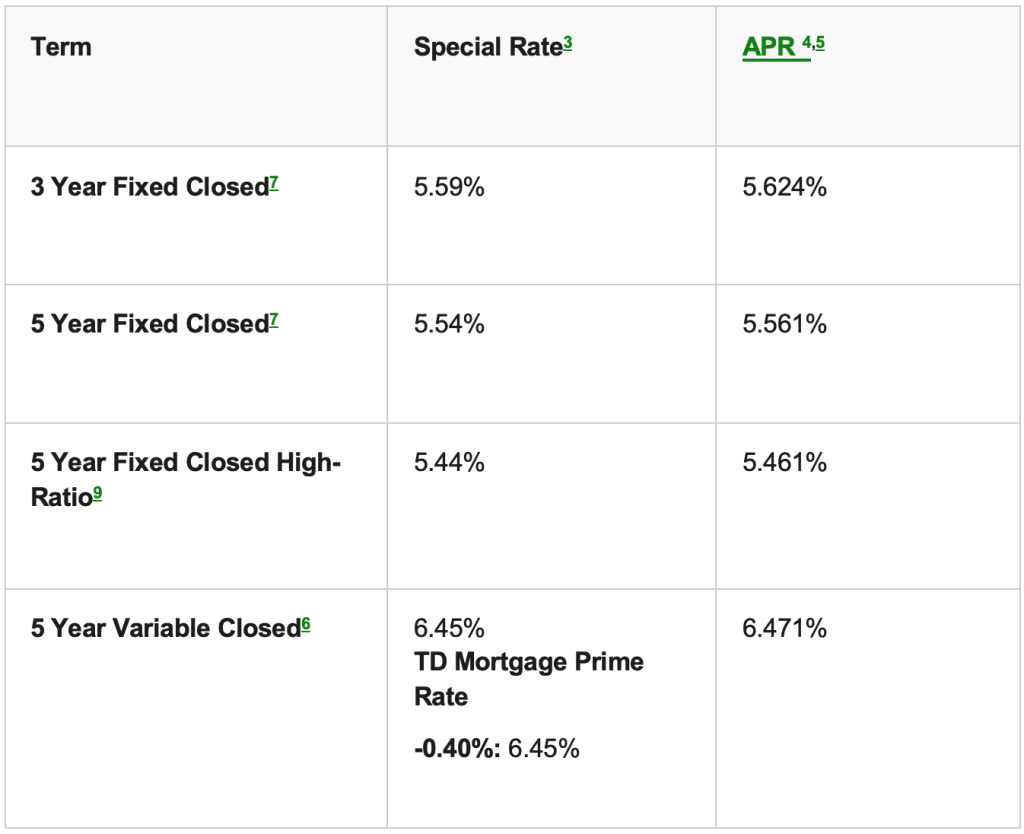

TD Bank Mortgage Rates as Per Term

TD Bank Mortgage Rates as per Province

Ontario

QUEBEC

British Columbia

Alberta

TD Mortgage Features

TD offers the following mortgage features:

Increase Your Mortgage Payment:

Each year you can make an extra payment for your month of choice. This is an important feature, as it allows you to pay down your mortgage more quickly when you have a little extra cash available. Many mortgages apply a penalty when you wish to make additional payments, which makes this a feature to use as a point of comparison. The payment can be up to the full amount of your usual monthly payment.

Annual Mortgage Prepayment:

Another way TD helps you pay down your mortgage more quickly is their annual mortgage prepayment. This allows you to contribute up to 15% of your original mortgage principal as a lump sum each year on closed mortgages. When you take advantage of this option, you reduce interest paid over the life of your mortgage and become mortgage-free sooner.

Payment Pause:

Over the full amortization period of your mortgage, TD allows you to skip four payments, with a limit of one per year. This means you can’t save them all up and then skip all four at once. These skipped payments are not considered a default held against you and instead act more like a deferral or grace period without a negative impact on your payment history. The payment pause is based on your payment frequency, either a single skipped payment for the month, two skipped payments for bi-weekly, and four skipped payments for weekly. However, when you skip a payment, it’s important to remember it slows down how long it takes to pay off your mortgage. It also costs you more in interest. This is especially true if you take full advantage of the four payment pauses you are allowed to take over the life of your mortgage. This is because TD applies the interest not paid on your skipped payments to your principal balance. It is best to save your paused payments for a rainy day.

Payment Vacation:

In hand with your payment pause option, TD also offers a payment “vacation” for up to four months. This is based on the prepaid amount of your mortgage. It is ideal for scenarios where you need time off work and aren’t earning money, whether it is because you are sick, having a baby, or returning to school. As with the payment pause, be sure this is worth it, because those four months of interest accrue and are applied to your mortgage principal. Also, it will take you at least four months longer to pay off your mortgage, in hand with the time it takes to pay off the extra interest. Although it does make your mortgage a bit more flexible, make sure you understand the pros and cons.

Monthly Property Tax Payments:

Most mortgages require you to pay your property tax along with your mortgage payments. If your mortgage does not, TD offers the option for you to pay towards your property taxes and the money collected they then pay for you when they are due. There really isn’t a big benefit to this, but it’s there if you want it.

Mortgage Protection Insurance:

At the time you sign your mortgage, you can opt-in for mortgage protection insurance. The premiums do not increase over the life of your mortgage, and your insurance offers coverage for various scenarios, such as the death of the policyholder or a critical illness that keeps you from making payments. Mortgage life insurance is always a good idea, as it pays off your mortgage, so the burden of the payments doesn’t fall onto the shoulders of family members. Just keep in mind the premiums add up over time and impact your mortgage payments.

TD Mortgage Application Checklist

To apply for a TD mortgage, you’ll need the following:

- A list of your current and previous addresses

- Current and previous employment information

- Proof of income such as a pay stub or bank deposits

- Recent bills

- Credit card statements

- The estimated value of your home

- A list of your monthly expenses

FAQ

A: TD Bank mortgage rates tend to sit in the mid-range of interest rates compared to other providers. For example, while TD’s five-year fixed rate was 5.44%, Bank of Nova Scotia was 6.43% and RBC was at 5.69%. On the lower end, BMO and CIBC were just above 5%, while HSBC was at 4.89%. So, it pays to shop around.

A: TD Mortgage online applications make it easy to apply for a mortgage. You’ll need the following information to complete the process:

- Proof of your status as either a Canadian citizen or approval as a permanent resident

- Your property closing date, down payment source, and what mortgage option suits your needs

- Confirm this home is intended as your primary residence

- The full address of the property you’d like to purchase, the MLS Realtor Listing and the Purchase and Sale Agreement

- At least one document confirming your employment status and income

- A list of your assets and liabilities

- Proof you are the age of majority

A TD Mortgage Specialist will contact you within 24 hours to review your application and discuss the next steps of the application process. Of course, you can also set up an appointment at your local TD Bank to complete the process in person. However, it is always best to seek pre-approval first to know how much they are willing to lend you before you start your house hunt. Their online process offers an immediate response, and they hold your interest rate for 120 days upon pre-approval.

A: Although Canadian lenders post their mortgage rates, you can try to negotiate a better rate. Mortgage lenders are highly competitive, and depending on current market conditions, your employee status, and your credit score, they might be willing to give you a bit of a break.

A: The terms of your mortgage agreement determine prepayment charges as follows:

- Open mortgage: An open mortgage allows you to pay off your entire mortgage at any time without penalties.

- Closed mortgage: There are charges for a closed mortgage based on whether you have a variable or fixed mortgage. Variable interest rates usually charge three months of interest, while fixed interest rates aren’t as cut and dry. It is based on the greater of three months’ interest or the Interest Rate Differential (IRD) amount.

A: As a new Canadian without an established credit history, you can still qualify for a TD mortgage if you are or have applied to become a permanent resident and have been in Canada for five years or less.

Find a better mortgage rate

Mortgage Rates British Columbia

Mortgage Rates Saskatchewan

Mortgage Rates Alberta

Mortgage Rates Ontario

Mortgage Rates Nova Scotia

Mortgage Rates New Brunswick

Mortgage Rates Newfoundland

BMO Mortgage Rates

CIBC Mortgage Rates

Scotiabank Mortgage rates

TD Bank Mortgage Rates

RBC Mortgage Rates

Manulife Mortgage Rates

Pros & Cons of TD Bank

Pros

- Their interest rates are mid-range, so not as high as other options

- Their payment vacations and pauses come in handy when life throws a wrench into your finances

- They are rated #1 for online banking apps

- Immediate response for online mortgage pre-approval

Cons

- There are lower interest rates available at other lenders offering similar features

- As a big-six bank, they have stricter lending criteria to qualify

TD Bank’s Background/History

The TD Bank started off as the Bank of Toronto in 1855, founded by a group of millers and merchants. In 1871 the first branch of the Dominion Bank opened, and the two banks merged in 1955, forming Toronto Dominion Bank. In 2000, TD acquired Canada Trust and then entered the U.S. retail banking arena when it acquired Banknorth in 2005.

Best Mortgage Bank Rates in Canada

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

5.59%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

Best Mortgage broker Rates in Canada

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.29%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.79%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.40%

Disclaimer

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.

Let's get started

Find out how much home you can afford

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Start thinking about how much you spend each month, create a budget, and start saving up for your home.

Our Awards