Reverse Mortgages Equitable Bank | Access Your Home Equity Tax-Free

Find the Best Reverse Mortgage Rates in Canada

Today’s Reverse Mortgage Rates updated as of October 8, 2025 1:05 pm

For a property located in

*Rates can change at anytime. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Reverse Mortgages Equitable Bank : Unlock Your Home’s Equity Today

Equitable Bank offers Canadian homeowners aged 55+ a secure and flexible way to access their home equity through reverse mortgages. Whether you’re looking to supplement your retirement income, fund home renovations, or consolidate debt, an Equitable Bank Reverse Mortgage provides financial freedom without requiring monthly mortgage payments.

Why Choose Equitable Bank for Your Reverse Mortgage?

Equitable Bank is one of Canada’s leading reverse mortgage providers, known for its competitive rates and customer-centric approach. Here’s what sets them apart:

Flexible Loan Options

Choose between fixed and variable interest rates to suit your financial needs.No Negative Equity Guarantee

You’ll never owe more than your home’s fair market value when it’s sold, giving you peace of mind.Customized Payouts

Receive your funds as a lump sum, in scheduled payments, or a mix of both.Maintain Homeownership

Stay in your home while accessing its equity.Expert Support

Equitable Bank’s team provides personalized support to guide you through every step of the reverse mortgage process.

For more details on how reverse mortgages work, visit the Financial Consumer Agency of Canada (FCAC).

Current Reverse Mortgage Rates at Equitable Bank

As of 2025, Equitable Bank offers some of the most competitive reverse mortgage rates in Canada:

- Fixed Rates: 7.25% – 9.10%

- Variable Rates: 6.90% – 8.75%

For the latest rate updates, visit Equitable Bank Reverse Mortgage Rates.

EQUITABLE BANK REVERSE MORTGAGE RATES

Get An Estimate

See How Much You Can Borrow Today!

Who Can Benefit from an Equitable Bank Reverse Mortgage?

Who Can Benefit from an Equitable Bank Reverse Mortgage?

This financial solution is ideal for Canadian seniors who:

- Are 55 years or older and want to access up to 55% of their home’s value.

- Need a reliable, tax-free income source to support their retirement lifestyle.

- Are looking to renovate their home or cover healthcare costs.

- Want to help family members financially without liquidating other investments.

How Much Can You Borrow?

The amount you can borrow depends on several factors, including:

- Your Age

- Your Home’s Value

- Location

Use our Reverse Mortgage Calculator to get an estimate of your borrowing potential.

Reverse Mortgage Fees at Equitable Bank

Here’s a breakdown of typical fees associated with an Equitable Bank Reverse Mortgage:

- Appraisal Fee: $350 – $600

- Legal Fees: $1,500

- Administrative Fee: $995

- Prepayment Penalty: Applicable if the loan is repaid early.

Get An Estimate

See How Much You Can Borrow Today!

Reverse Mortgage Statistics

Understanding the market trends and usage patterns for reverse mortgages can help you make informed decisions. Here are key statistics:

Key Statistics

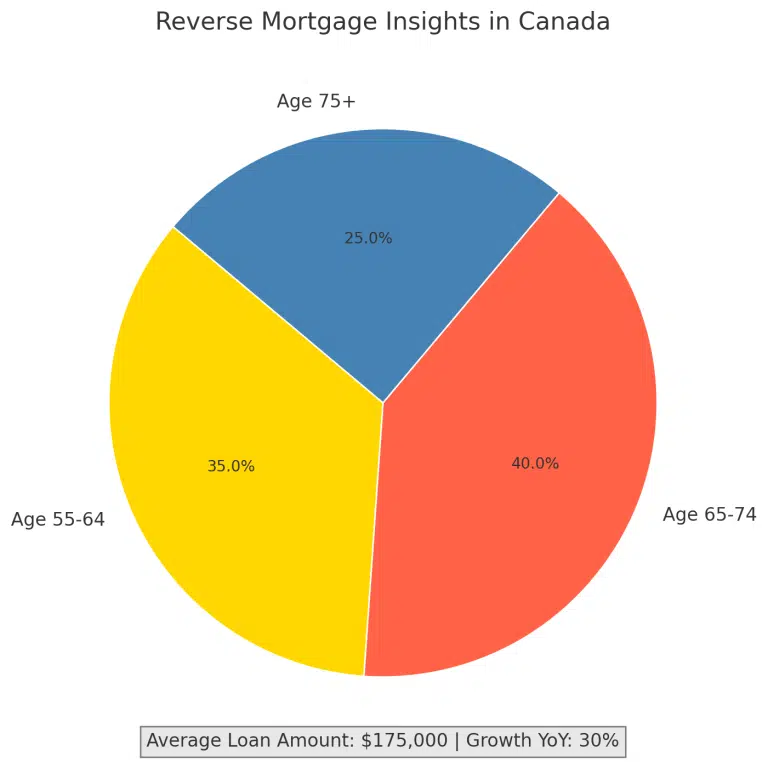

- Average Loan Amount: $175,000

- Year-Over-Year Growth: 30%

- Homeowner Eligibility: 90% of homeowners with sufficient equity qualify.

- Usage Breakdown:

- Debt Consolidation: 25%

- Home Renovations: 23%

- Retirement Income: 30%

- General Spending: 22%

Age Distribution of Reverse Mortgage Holders

- Age 55-64: 35%

- Age 65-74: 40%

- Age 75+: 25%

FAQs About Equitable Bank Reverse Mortgages

Are reverse mortgages safe?

Yes, reverse mortgages in Canada are regulated by federal and provincial laws. Lenders like HomeEquity Bank and Equitable Bank offer government-backed solutions with no negative equity guarantees.

How does repayment work with a reverse mortgage?

The loan is typically repaid when you sell your home, move into long-term care, or pass away. You or your estate won’t owe more than the home’s fair market value at the time of sale.

Why get a reverse mortgage?

Here are some examples of how clients commonly use it:

- eliminate debt payments

- help a child or grandchild with a down payment on a home

- purchase a new home (right-sizing instead of having to downsize the home)

- increase cash flow to improve lifestyle (e.g., vacation, new car)

- pay healthcare costs

- pay for an unexpected expense (e.g. home repairs)

Can I apply if my spouse is under 55?

No, both you and your spouse must be at least 55 years old to qualify for a reverse mortgage in Canada.

Can I lose my home with a reverse mortgage?

No, as long as you meet your obligations, such as keeping your property taxes and insurance up to date, you can stay in your home for life.

What happens if the loan exceeds the home’s value?

Canadian reverse mortgages come with a no negative equity guarantee, meaning you’ll never owe more than the value of your home.

How is the reverse mortgage repaid?

The loan is typically repaid when you sell your home, move into long-term care, or pass away.

Are there penalties for early repayment?

Yes, prepayment penalties may apply. However, Equitable Bank offers flexible repayment options to minimize costs.

Get An Estimate

See How Much You Can Borrow Today!

Why Choose Citadel Mortgages for Your Equitable Bank Reverse Mortgage?

At Citadel Mortgages, we’re committed to finding the best reverse mortgage solutions for your unique needs. Partnering with Equitable Bank allows us to offer:

- Expert Advice: We’ll guide you through the process, ensuring you fully understand your options.

- Competitive Rates: Access some of the lowest rates on the market.

- Personalized Solutions: Tailored reverse mortgage plans designed to meet your goals.

Reverse Mortgage Calculator Equitable Bank

Understanding your reverse mortgage potential is easier with our Reverse Mortgage Calculator. This tool provides an instant estimate of how much equity you can access based on:

- Your Age

- Home Value

- Location

- Loan-to-Value Ratio (LTV)

How to Use the Reverse Mortgage Calculator:

- Enter Your Home’s Current Market Value.

- Input Your Age and Your Spouse’s Age (if applicable).

- Receive an Estimate of the Amount You Can Borrow.

Try the Citadel Mortgages Reverse Mortgage Calculator today to explore your options!

Final Thoughts on reverse mortgages Equitable Bank

An Equitable Bank Reverse Mortgage offers Canadian homeowners a secure, flexible way to unlock their home equity. Whether you’re planning for retirement, managing debt, or funding home improvements, this financial tool provides the freedom to live comfortably without monthly payments.

Contact Citadel Mortgages today to explore how an Equitable Bank Reverse Mortgage can work for you.

See Reverse Mortgages By City

See Reverse Mortgages By Bank

Get An Estimate

See How Much You Can Borrow Today!