BMO Mortgage Rates Canada

The Bank of Montreal is the fourth largest bank in Canada and was previously known as The Bank of Montreal. It operates in Canada, the USA, Switzerland, Germany, England, India, China, and Singapore. It offers a diversified portfolio of financial services with over 900 branches.

How it Works | How To | Pre-Approval | Feature Comparison | FAQ

BMO Prime Rate

BMO’s prime rate is the base rate for its loans. Higher-risk customers and products get higher interest rates, whereas mortgages with a home as collateral present lower risk and therefore sit below the prime rate. The current prime rate at BMO is 6.7%.

BMO Variable Mortgage Rates

BMO variable-rate mortgages have interest rates that change with their prime rate. However, you always pay the same amount for your mortgage payments. However, the interest rate determines how much of your mortgage payment goes to interest and how much goes to the mortgage’s principal. The lower the prime, the more of your payments go to the principal. Therefore, paying down your principal can take longer when interest rates are high.

BMO Fixed Mortgage Rates

With a fixed-rate mortgage, you always have the same interest rate and mortgage payments for the life of your mortgage.

BMO Mortgage Rates As Per Term

Fixed BMO mortgage rates are as follows:

Variable BMO mortgage rates are as follows:

BMO 5-Year Fixed and Variable Rate History

Here are the 5-year fixed and variable rates over the past few years:

- Year: 2020 Fixed: 2.69% Variable: 2.45%

- Year: 2021 Fixed: 2.34% Variable: 2.45%

- Year: 2022 Fixed: 4.36% Variable: 2.65%

BMO Mortgage Application Checklist

You will need the following information when applying for a BMO mortgage:

- Purchase and Sale Agreement(s), including all schedules and waivers

- MLS Listing with photo

- Property tax estimates, condo fees, and heating costs

- Contact information of your solicitor or notary

- Contact information of your real estate agent

- The individual who the appraiser can contact to coordinate access to the property

- Recent mortgage statement

- Most recent property tax assessment

- Current homeowner insurance policy

- Legal description of your property

- The individual who the appraiser can contact to coordinate access to the property

- Copy of latest pay slip with employer name

- Letter of employment signed by employer

- Most recent T4

- If you are either self-employed or have commission-based income, you’ll need the last two years of tax returns (T1 General) and corresponding Notice of Assessment AND any one of the following:

- Statement of business activities for the respective tax years

- Audited financial statements for the business for the respective tax years

- Financial statements accompanied by a Review Engagement

- Report signed by a practicing accountant

- Notice to Reader financial statements prepared by an accredited professional accountant for the respective tax years

- Most recent years’ tax returns (T1 General) and corresponding Notice of Assessment

- Savings and investment statement(s) with your name from within the last 90 days

- If you are selling an existing property – a copy of the sales agreement

- Gift Letter (if applicable) – a Gift Letter will be provided for you to be signed by the individual providing the funds

- Withdrawal from RRSP through the Home Buyer’s Plan (if applicable)

You should also have the following available:

- Your banking information or a void cheque

- Two pieces of valid personal identification (driver’s license, passport, or government-issued ID)

- If you are consolidating debt, please bring copies of your current statement(s) with balance and account details

BMO Mortgage Features

BMO offers a number of mortgage features that make your mortgage terms a bit more flexible or attractive, including:

Increase Your Mortgage Payments:

Each year, you can increase your monthly mortgage payment by up to 20% or up to 10% for a fixed mortgage. This makes it easy to pay your mortgage off more quickly while paying less interest over time.

Make a Lump Sum Payment:

You can also choose to make a lump sum payment once a year without penalty. With a regular BMO mortgage, you can pay up to 20% of your original mortgage balance or up to 10% for fixed mortgages. Again, over time you reduce how much you pay in interest by reducing your mortgage balance.

Increase Your Payment Frequency:

You can increase your payment frequency to reduce interest as well using one of their more frequent payment options, either bi-weekly or weekly. You reduce your mortgage balance more than you would with monthly payments, so you pay less interest and pay your mortgage off faster.

BMO Mortgage Protection Insurance:

You can opt to include mortgage protection insurance, including mortgage life insurance, critical illness insurance, disability insurance, and job-loss insurance. If any of these unexpected scenarios occur, you are covered, and your mortgage is automatically paid off. Your premiums never increase, but you do end up paying more for your mortgage payments. Ensure you get a final tally of your mortgage payments before opting in.

Property Tax Payments:

In most cases, you will pay BMO a monthly installment to cover your property taxes. The bank then pays them on your behalf. This ensures there are no tax liens on your property should you default on your mortgage. It is actually a good service, as it is one less thing to worry about, and it breaks your property taxes down into easy-to-manage payments.

BMO Mortgages: How It Works

A mortgage is simply a loan the bank provides you to purchase your home. It consists of the principal, which is the balance owed on the price of your home, less the down payment and the interest charged to the principal. As you pay down the mortgage, the amount you pay in interest shrinks along with your balance. Therefore, at the beginning of your mortgage, more goes towards the interest, and over time you eventually are strictly paying for the principal.

Equity

As you pay down your mortgage, you build equity, the amount of your home you own outright. The more equity you have in your home, the more money you get when you sell. As well you are also eligible to access more money via a home equity loan. Equity also builds or reduces based on current market prices.

Amortization & Term

Amortization is how long it takes to pay your entire mortgage balance. This differs from a mortgage term, as the term is how long that particular contract is in place. Your mortgage is renewed at the end of each term. The shorter the amortization, the higher your monthly payments, the quicker you pay the mortgage, and the less you pay in interest.

How to Get a BMO Mortgage

You should first apply for mortgage pre-approval, according to the BMO website. However, they also offer appointments to discuss your options with a mortgage specialist.

How to Get a BMO Mortgage Pre-Approval

A mortgage pre-approval tells you whether you qualify for a BMO mortgage. BMO collects your income and credit history to conduct a check. They then either let you know how much they are willing to lend you or that your preapproval is denied. Preapproval makes it easier to buy a home because you know how much you can afford. It also locks in your interest rates for 130 days while you search for a home. If rates drop, BMO gives you the lower rate, but you are locked into the lower rate if they rise. You can apply for preapproval online if you:

- Are a Canadian resident

- Have reached the age of majority in your province or territory

- Intend to live in the home where you are applying for the mortgage

- Have been employed for at least 2 years

Open vs. Closed Mortgages: Feature Comparison

Here are the differences between open and closed mortgages:

Open

An open mortgage allows you to prepay or re-negotiate your mortgage at any time without having to pay additional fees. As a result, your mortgage is more flexible. You can pay your mortgage down faster, take advantage of lower interest rates, and enjoy more freedom to take advantage of your financial or market conditions. However, you will also pay higher interest rates for an open mortgage than a closed one.

Closed

Closed mortgages maintain the same conditions as those you agree to when you sign the mortgage. If you go outside the permitted payment differences, you are penalized. However, you will also pay lower interest rates.

FAQ

A: Yes, they are. For example, while BMO’s 5-year fixed rate was 5.09%, RBC was 5.69%, TD was 5.44%, Scotiabank was 6.34% and CIBC was 6.49%. It makes sense to shop around to see what other banks are offering.

A: BMO prefers you go through the preapproval process before applying for a mortgage. However, you can also speak to the bank to go through the mortgage application

A: You always have the right to try to negotiate your rate. You can shop around and see what other banks are offering to use that as leverage. However, because BMO tends to be on the lower side, they might not be as willing to budge.

A: You can use the BMO mortgage calculator to see how interest is calculated.

A: It depends on the type of loan. Their prime rate is 6.7% rate, and current posted mortgage rates are as follows:

Fixed BMO mortgage rates are as follows:

- 1-year fixed: 6.04%

- 3-year fixed: 5.59%

- 5-year fixed: 5.54%

Variable BMO mortgage rates are as follows:

- 1-year Variable: NA

- 3-year Variable: NA

- 5-year Variable: 6.50%

A: You can visit their website to find out how to speak to a customer service representative or pop into a branch near you.

FIND A BETTER MORTGAGE RATE

Mortgage Rates British Columbia

Mortgage Rates Saskatchewan

Mortgage Rates Alberta

Mortgage Rates Ontario

Mortgage Rates Nova Scotia

Mortgage Rates New Brunswick

Mortgage Rates Newfoundland

BMO Mortgage Rates

CIBC Mortgage Rates

Scotiabank Mortgage rates

TD Bank Mortgage Rates

RBC Mortgage Rates

Manulife Mortgage Rates

Best Mortgage Bank Rates in Canada

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

5.59%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

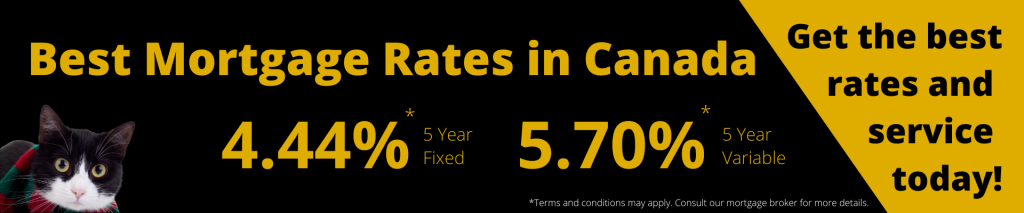

Best Mortgage broker Rates in Canada

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.44%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.89%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.70%

Disclaimer

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.

Let's get started

Find out how much home you can afford

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Start thinking about how much you spend each month, create a budget, and start saving up for your home.

Our Awards