Find the best 6 month fixed mortgage rates

Featured On

Best 6 month fixed mortgage rates

Relieve the Burden of High Interest Rates with Rate Remedy

Are you feeling the pinch of high mortgage rates? Don’t suffer in silence. Introducing Rate Remedy, an exclusive limited-time mortgage solution brought to you by Citadel Smart Home Plan powered by Marathon Mortgage, With Rate Remedy, we offer you 6 months of lower payments to alleviate the financial strain but it will also enhance your home buying power, allowing you to compete effectively in the housing market. Experience the benefits of Rate Remedy as you transition into your new mortgage with confidence.

6 Month Fixed Rate

(High Ratio)

Rate Type 6-Month-Fixed

Mortgage TypeClosed

Prepayment 20%

4.19%

Discover the Advantages of Rate Remedy: Your Path to Financial & Housing Relief

Experience a range of reported beneficial side effects with Rate Remedy, the mortgage solution designed to bring you long-lasting relief. Take a look at the positive changes you can expect:

Continuous Support:

Enjoy the benefits of Rate Remedy 24/7 for a full 6 months, starting from the date of funding. This extended period ensures sustained relief and peace of mind as you navigate your mortgage journey and best in market renewal rates at the end of the term.

Improved Buying power:

Experience a significant decrease in anxiety as Rate Remedy provides you with more purchasing power to help ensure you get the home your trying to buy.

Heightened Relaxation:

Adjusting to lower payments can be a seamless and stress-free experience with Rate Remedy. Feel more relaxed as you settle into your new mortgage terms, allowing you to get comfortable with managing your budget by adding your mortgage to it

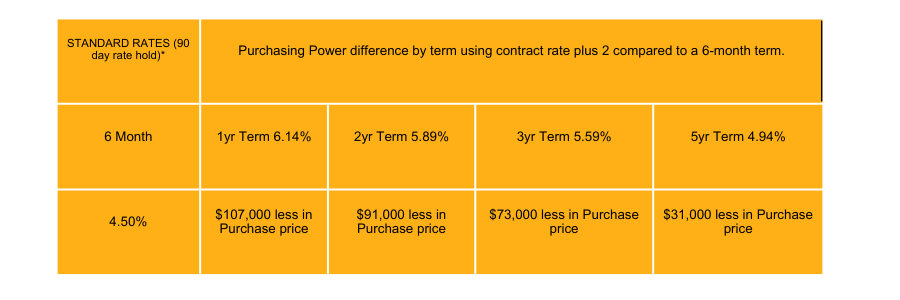

How much more buying power does rate remedy 6 month fixed term offer?

Rate Remedy may be the ideal solution if:

– You’re in the process of buying a new home in Canada

– Your mortgage is a high ratio, meaning buying with less than a 20% down payment.

– You’re seeking a short-term option with a low rate.

– Your home value is below $1M or less

– Your mortgage amortization is 25 years or less.

– You desire a full-featured mortgage, even with your lower rate.

Rate Remedy: Alleviating New Home Symptoms and Renewal Benefits

Experience the relief from new home symptoms with Rate Remedy. These symptoms may manifest as additional budget pain caused by closing costs, including lawyer fees, utilities, and property taxes. Our exclusive Rate Remedy mortgage solution is designed to provide you with the relief you need to combat these symptoms effectively.

Renewal Benefits of Rate Remedy

At the end of your term, you have the freedom to renew into any 3-year term or longer with our Citadel Smart Home Plan, without any penalties. One of the significant advantages of Rate Remedy is that you don’t have to requalify, meaning it protects you against the stress test when renewing. However, please note that if you choose to renew into a regular product at current rates, the interest rate may be slightly higher than the competitive rate offered by the 6-month Rate Remedy product.

Important Considerations for Refinancing

Should you decide to refinance your mortgage with another institution, it’s essential to be aware that you will be subjected to the stress test. Furthermore, due to the substantial discount provided by the Rate Remedy mortgage product, a 1% administration fee will be applicable.

Choose Rate Remedy for a mortgage solution that not only provides relief from new home symptoms but also offers valuable renewal benefits. Speak to one of our experts at Citadel Mortgages to learn more about how Rate Remedy can suit your specific needs. You can also apply online, and one of our brokers will contact you promptly during business hours.

compare mortgage rates

BMO 5-year Fixed Mortgage Rate

Rate Type5-Year-Fixed

Mortgage TypeClosed

Prepayment 20%

5.64%

HSBC 3-year Fixed Mortgage Rate

Rate Type3-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

6.09%

CIBC 5-year Variable Mortgage Rate

Rate Type5-Year-Variable

Mortgage TypeClosed

Prepayment 20%

6.70%

5 Year Fixed Rate

(High Ratio)

Rate Type 5-Year-Fixed

Mortgage TypeClosed

Prepayment 15%

4.29%

3 Year Variable Rate

(High Ratio)

Rate Type 3-Year-Variable

Mortgage TypeClosed

Prepayment 20%

5.79%

5 Year Variable Rate

(High Ratio)

Rate Type 5-Year-Variable

Mortgage TypeClosed

Prepayment 15%

5.40%

6-month fixed mortgage rates: rATE REMEDY FAQ

Mortgages offer a range of options when it comes to term lengths, including the shortest term of 6 months. It’s important to understand that the term of your mortgage refers to the period during which you are committed to a specific lender. Opting for a shorter mortgage term provides the advantage of flexibility, allowing you to easily switch lenders or adjust your mortgage features within a relatively brief timeframe. In contrast, longer mortgage terms involve a more extended commitment.

A 6-month fixed-rate mortgage term can come with either open or closed rates, giving you flexibility in choosing the type of interest rate that suits your needs. Additionally, this type of mortgage term often includes a conversion option, allowing you to explore different options and make changes to your mortgage as circumstances evolve. Whether you prefer the stability of a closed rate or the flexibility of an open rate, a 6-month fixed-rate mortgage term offers you the opportunity to tailor your mortgage to your specific requirements.

6-month fixed mortgage rates offer two options: closed rates and open rates. A closed rate means that you are not allowed to make extra payments or pay off your mortgage before the term ends without incurring prepayment penalties. However, it’s worth noting that many 6-month closed mortgages also come with a conversion option, which we will discuss further.

On the contrary, an open term provides you with the flexibility to make additional payments or pay off your mortgage in full at any time without facing penalties. This freedom comes at a cost, though, as open mortgages typically have higher interest rates compared to closed mortgages. While the flexibility of an open term is advantageous, it’s essential to consider the higher associated costs.

In summary, a 6-month fixed mortgage term allows you to choose between a closed rate, which offers stability but limits prepayment options, and an open rate, which provides more flexibility but comes with higher interest rates. It’s important to assess your financial situation and goals to determine which option aligns best with your needs.

Mortgage Rates British Columbia

Mortgage Rates Saskatchewan

Mortgage Rates Alberta

Mortgage Rates Ontario

Mortgage Rates Nova Scotia

Mortgage Rates New Brunswick

Mortgage Rates Newfoundland

BMO Mortgage Rates

CIBC Mortgage Rates

Scotiabank Mortgage rates

TD Bank Mortgage Rates

RBC Mortgage Rates

Manulife Mortgage Rates

Let's get started

Find out how much home you can afford

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Start thinking about how much you spend each month, create a budget, and start saving up for your home.

Our Awards

DISCLAIMER

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.