To get a Home Equity Line of Credit (HELOC) on an investment property, you need to follow these steps:

1. Know Your Finances:

Estimate the equity you have in the investment property by determining the difference between what you owe and the property’s fair market value.

2. Shop Around:

Look for reputable lenders that offer HELOCs on investment properties. Compare at least three lenders to find the best deal, considering factors like the Annual Percentage Rate (APR) and additional fees.

3. Apply:

Prepare for a thorough financial assessment by the lender, including checking your credit score, debt load, cash flow, cash reserves, and other financial details. The lender may also conduct an appraisal of your property.

4. Close:

Closing on a HELOC is typically faster than closing on a traditional mortgage. Some lenders can close in as little as three days, allowing you to access the cash within a week.

It’s important to note that HELOCs on investment properties are considered riskier by lenders compared to those on primary residences, which can result in higher fees and interest rates. However, using a HELOC can be advantageous for accessing cash for various purposes like renovations, repairs, or down payments on other properties.

Requirements for getting a HELOC to invest in a commercial/residential property

The requirements for obtaining a Home Equity Line of Credit (HELOC) on an investment property in Canada typically include:

1. Equity Stake:

Lenders usually require HELOC borrowers to have a minimum of 15-20% home equity stake in the investment property. Borrowers may be allowed to borrow up to 85% of the property’s value.

2. Loan-to-Value Ratio (LTV):

Lenders will want to see a loan-to-value ratio (LTV) of no more than 75% to 80%. This means that outstanding loans on the property, including the mortgage, cannot surpass 75% to 80% of the property’s overall value.

3. Credit Score:

A good credit score is essential for obtaining a HELOC on an investment property. Lenders typically require a minimum credit score of 720 for investment property HELOCs.

4. Debt-to-Income Ratio (DTI):

Borrowers are usually required to have a debt-to-income ratio (DTI) maximum ranging from 43% to 50% for investment property HELOCs.

5. Cash Reserves:

Most lenders will verify that borrowers have significant cash reserves, often at least 18 months’ worth, to cover expenses and repayments.

6. Income Verification:

Lenders may require proof of sufficient income from tenants if the investment property generates rental income.

7. Additional Features:

Some lenders may request additional features such as long-term tenants, multiple appraisal quotes, and other factors that make the property attractive as collateral for HELOC.

Meeting these requirements is crucial for qualifying for a HELOC on an investment property in Canada. It’s important for borrowers to carefully review and understand these criteria before applying for a HELOC to ensure eligibility and increase the chances of approval.

Alternatives to getting a HELOC

According to chip.ca, there are some alternatives to obtaining a Home Equity Line of Credit (HELOC) on an investment property:

1. Cash-Out Refinance:

With a cash-out refinance, you can refinance the loan on your investment property to a higher amount, provided you have enough equity, and receive the difference in cash. This method allows you to access funds based on the increased value of your property.

2. HELOC on Your Primary Residence:

If you are unable to find a lender willing to offer a HELOC on your investment property, you can consider taking out a HELOC on your primary residence. While this option puts your home at risk if you can’t repay the borrowed amount, it provides an alternative source of financing using your primary residence as collateral.

3. Personal Loan:

Depending on your debt situation and creditworthiness, you may be eligible for an unsecured personal loan. Personal loans provide a lump sum of money that you must start repaying immediately. However, interest rates on personal loans can be higher, especially for borrowers with lower credit scores.

4. Small Business Loan:

If you have set up a business entity to manage your investment property, exploring small business loans or lines of credit could be an option. These loans are tailored for business purposes and can provide funding for property-related expenses or investments.

Using HELOC for down payment on an investment property

Using a Home Equity Line of Credit (HELOC) for a down payment on an investment property involves the following steps:

1. Accessing Home Equity:

Calculate the equity in your primary residence by subtracting the outstanding mortgage balance from the property’s current market value. Lenders typically allow you to borrow up to a certain percentage of this equity, often up to 80%.

2. Apply for a HELOC:

Contact your lender or financial institution to apply for a HELOC on your primary residence. The lender will assess your creditworthiness, income, debt-to-income ratio, and other financial factors to determine your eligibility and the approved credit limit.

3. Withdraw Funds:

Once approved, you can access funds from the HELOC by writing checks or transferring money online. Ensure you understand the terms of the HELOC, including interest rates, repayment terms, and any associated fees.

4. Use Funds for Down Payment:

Transfer the funds from the HELOC to your account and use them as a down payment on an investment property. This can help you secure financing for the new property without liquidating other assets or savings.

5. Repayment:

Repay the borrowed amount according to the terms of the HELOC. Keep in mind that failure to make payments can put your primary residence at risk since it serves as collateral for the HELOC.

HELOC on primary residence to fund an investment property

Using a Home Equity Line of Credit (HELOC) on your primary residence to fund an investment property is a common strategy among real estate investors. Here are the key points from the sources:

1. Benefits:

a. Wealth Building:

Investors can borrow against the equity in their primary residence to purchase additional investment properties, thereby expanding their real estate portfolio.

b. Funding Home Improvements:

HELOC funds can be used to finance renovations or improvements on rental properties, like how homeowners use them for their primary residences.

c. Debt Consolidation:

Investors can use a HELOC to pay off high-interest debts related to their investment properties, providing financial flexibility, and potentially reducing overall interest costs.

2. Challenges:

a. Lending Restrictions:

Banks may be less inclined to lend to investment properties due to the higher risk associated with non-primary residences. This can make it challenging for investors to qualify for a HELOC on an investment property.

b. Qualification Criteria:

Lenders assess factors like debt-to-income ratio, credit score, available cash reserves, and other open accounts when considering HELOC applications for investment properties. Meeting these criteria can be a hurdle for some investors.

3. Considerations:

a. Risk Management:

Using a HELOC on your primary residence instead of risking it by putting up your home as collateral for an investment property can reduce the risk of losing your primary residence in case of financial difficulties.

b. Tax Implications:

The Tax Cuts and Jobs Act has changed the tax deductibility rules surrounding HELOCs, including those used for investment properties. It’s advisable to consult with a tax advisor to understand the tax implications of using a HELOC in this manner.

Tax implications of using a HELOC on an investment property

1.Tax Deductibility:

a. Interest Deductions:

The Tax Cuts and Jobs Act has changed the tax deductibility rules surrounding HELOCs, including those used for investment properties. To deduct the interest on a HELOC, the funds must be used for home improvements or repairs related to the investment property.

b. Limitations:

The combined amount of mortgage debt, home equity in use, and other debt cannot exceed a combined $750,000 for those married and filing jointly to qualify for interest deductions

2. Tax Advantages:

a. Expense Deductions:

As a rental property owner, you can write off any expenses incurred related to the rental property, including those financed through HELOC. This can provide tax advantages and help reduce your taxable income.

3. Considerations:

a. Consultation:

Due to the complexity of tax laws and regulations surrounding HELOCs on investment properties, it is advisable to consult with a tax advisor to ensure compliance with tax rules and maximize potential deductions.

b. Usage Tracking:

To benefit from tax deductions, it is crucial to track and document how the HELOC funds are used, ensuring that they are allocated towards qualifying expenses that allow for interest deductions.

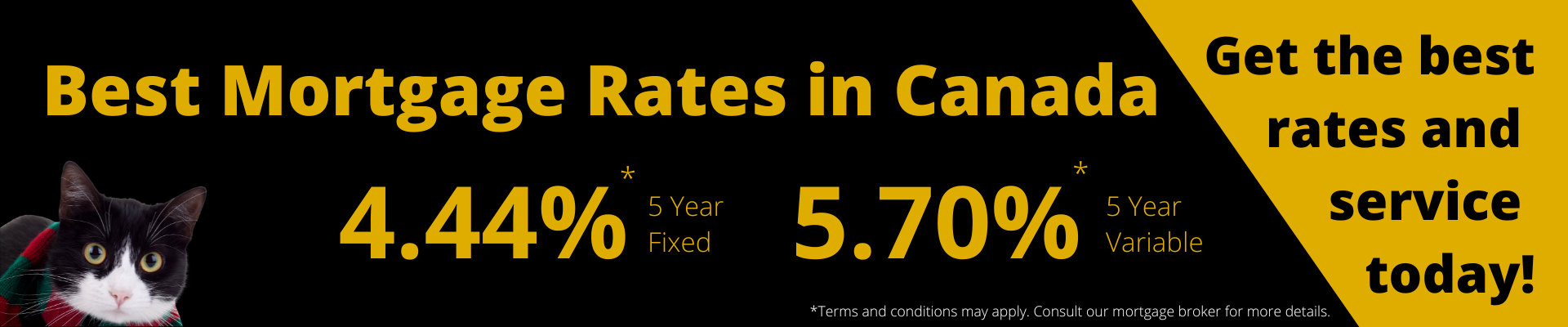

Finding the right lenders for HELOC

To find lenders for investment property loans, investors can explore specialized lenders that focus on collateral-based lending or portfolio lenders such as local community banks that offer in-house financing options. Online mortgage platforms provide information on investment property loans, including down payment requirements and refinancing options. Networking for private funds from friends and family can also be a viable option, requiring trust and a proven track record. Utilizing loan comparison tools available online allows investors to compare different lenders based on interest rates, fees, and loan terms to make informed decisions tailored to their financial needs and investment objectives.

By exploring specialized lenders, online platforms, private funding options, and utilizing comparison tools, investors can effectively find suitable lenders for investment property loans tailored to their financial needs and investment goals. Reach out to Citadel Mortgages for the best HELOC rates.