In exploring the possibility of buying a house in cash in Canada, it’s essential to understand the various aspects that come into play. Here’s a breakdown of the key points to consider:

Payment Options:

In Canada, when it comes to purchasing a home, you have two primary options: paying with cash or taking out a mortgage. Opting for a cash payment can streamline the process in many ways, but it’s vital to weigh this against the benefits a mortgage might offer in terms of finance.

Private Sales and Legalities:

Buying from a Private Owner:

It’s entirely feasible to buy a house from a private owner using cash. This method of transaction is recognized and can be executed with the proper legal framework in place to ensure a smooth transfer of ownership.

Documentation and Reporting:

Regardless of the payment method used, all transactions must be meticulously documented and reported. This ensures that the process is transparent and legally sound. When dealing with large sums of money, such as those involved in home purchases, it’s crucial to adhere to Canadian financial regulations, including declaring any amount over $10,000 when bringing money into the country.

Role of Professionals:

Legal Assistance:

Engaging a competent lawyer is highly recommended to navigate the complexities of the transaction. They will ensure that the property is transferred correctly, registered, and free of any liens or complications. This legal oversight is invaluable in securing your investment.

Proof of Funds:

In cash transactions, sellers will typically require proof of funds. This is often provided in the form of a signed letter from a bank or an investment advisor, confirming the buyer’s financial capability to complete the purchase without the need for mortgage financing.

Understanding the nuances of buying a house with cash versus opting for a mortgage is crucial for anyone considering this route. While cash offers can expedite the sales process and are attractive to sellers for their simplicity and speed, they also require significant upfront capital and may tie up funds that cancan be leveraged or invested elsewhere. Additionally, it’s worth considering the potential tax implications and benefits that might be forfeited when not taking out a mortgage. As with any significant financial decision, weighing the pros and cons in the context of your personal financial situation is key.

Buying a house with cash in Ontario

When considering buying a house in cash in Ontario, it’s crucial to understand the financial implications and required steps to ensure a smooth transaction. Here’s a breakdown of the key costs and considerations:

Upfront Costs:

Down Payment:

For a $500,000 condo, expect a down payment of approximately $30,000.

Check out this video for more information.

Sales Tax on CMHC Insurance:

On an $18,000 CMHC insurance for a $500,000 condo, the sales tax would be around $1,400.

Home Inspection Fees:

Typically range from $400 to $500.

Land Transfer Tax:

For a $500,000 condo, this would be about $3,500. However, first-time homebuyers are eligible for a rebate.

Lawyer Fees:

Including Title Insurance, disbursements, and other costs might total around $3,160.

Adjustments:

Necessary to cover the seller’s prepaid expenses, such as property taxes or condo fees.

Total Cash to Close:

For a $500,000 condo, the total cash required to close would be approximately $38,000.

Non-Resident Considerations:

Non-Resident Speculation Tax (NRST):

A 25% tax for non-citizens, corporations, and trusts acquiring property in Ontario.

Down Payment for Non-Residents:

Typically, a 35% down payment is required.

Closing Costs for Non-Residents:

Includes Non-Resident Speculation Tax, Ontario Land Transfer Tax, and Toronto Land Transfer Tax.

Benefits and Tips for Cash Buyers:

Quicker Closings:

Buying with cash can result in quicker closings, usually within two weeks.

Lower Closing Costs:

Cash buyers may benefit from lower closing costs since they don’t have to pay lender-related fees.

Attractiveness to Sellers:

The simplicity and speed of cash transactions can make cash buyers more attractive to sellers.

Financial Security:

However, tying up funds in a single asset could jeopardize financial security.

Missed Opportunities:

Cash buyers will miss out on mortgage tax deductions and assistance programs offered by provincial and federal governments.

Tips:

Include not rushing the homebuying process and try hiring a real estate lawyer, conducting a home inspection, hiring an appraiser, and buying a homeowners insurance policy.

Understanding these aspects of buying a house with cash in Ontario not only prepares you for the financial commitment but also highlights the advantages and potential drawbacks of such a decision.

Understanding the Cash Purchase Process of a House in Canada

Understanding the cash purchase process of a house in Canada involves several critical steps. Here’s a breakdown to guide you through:

Initial Steps and Negotiations:

- Begin by negotiating the purchase price with the seller, ensuring both parties agree on the terms.

Verify your ability to pay by obtaining proof of funds https://citadelmortgages.ca/faq-mortgage-questions/ from your bank. This demonstrates to the seller that you have the financial capability to complete the purchase without mortgage financing.

Legal and Financial Preparations:

- Conduct a title search to ensure the property is free of liens or complications, safeguarding your investment.

- Engage a real estate lawyer to handle the paperwork, deed transfer, and registration, ensuring all legal aspects of the transaction are correctly managed.

- Consult a financial advisor and tax professional to understand the implications of a cash purchase, including how it affects your taxes and financial planning

Closing the Deal:

- If not working with a lender, hire a settlement agent to facilitate the transaction, ensuring a smooth process.

- Be prepared to obtain a cashier’s check for the transaction, as paying with actual cash (boxes of bills) could raise questions about the source of the funds.

- Account for additional expenses such as insurance, maintenance, and renovation costs, which are part of homeownership beyond the purchase price.

- It’s important to note that while paying in cash can expedite the purchasing process, it’s crucial to ensure all legal and financial aspects are handled correctly to avoid any complications. Additionally, be mindful that the source of the cash must be declared when bringing large amounts into Canada, ensuring compliance with financial regulations.

Pros of Buying a House With Cash

When considering the pros of buying a house in cash, it’s essential to weigh the benefits this approach brings to the table. Here’s a breakdown of the key advantages:

Financial Savings and Simplicity:

No Mortgage Payments, Interest, or Other Fees:

According to the NBC, by paying in cash, you sidestep the need for monthly mortgage payments and avoid the accumulation of interest over time, leading to significant long-term savings.

Lower Closing Costs:

The absence of mortgage insurance and the need for a mortgage approval process can considerably reduce the closing costs associated with home purchases.

Simplified Closing Process:

Without the complexities of mortgage financing, the closing process becomes more straightforward, often resulting in a quicker transaction.

Enhanced Negotiating Power and Market Position:

Stronger Negotiating Power:

The ability to pay in cash gives you a leverage point in negotiations, potentially allowing for a lower purchase price or more favorable terms.

Attractiveness to Sellers:

Cash buyers are often preferred by sellers due to the assurance of a smooth and swift closing process without the risks associated with financing fall-throughs.

Immediate and Long-Term Benefits:

Immediate Ownership and Equity:

Cash buyers gain 100% equity in their home from the outset, providing a solid foundation for financial security and the flexibility to leverage home equity in the future.

Psychological Peace of Mind:

The absence of monthly mortgage payments can offer a sense of financial freedom and stability, removing a common source of stress for homeowners.

Risk Mitigation:

Buying a house in cash can protect you from the volatility of the real estate market, as you’re less exposed to the risk of losing your home due to an inability to meet mortgage payments during economic downturns.

Incorporating these advantages into your decision-making process can illuminate the potential benefits of buying a house in cash. However, it’s crucial to balance these pros with the cons and consider your overall financial strategy to ensure that this approach aligns with your long-term goals and circumstances.

Cons of Buying A House With Cash

When exploring the option of buying a house in cash, it’s crucial to consider not just the benefits but also the potential drawbacks. Understanding these can help you make a more informed decision. Here are some of the cons associated with a cash purchase:

Financial Flexibility and Liquidity Concerns

Tying Up Money:

A significant amount of your funds will be tied up in one asset, potentially limiting your ability to invest in other opportunities or handle emergencies.

Liquidity Constraints:

The immediate reduction in liquidity could make it challenging to access funds quickly for other investments or needs.

Refinancing Penalties:

Should you decide to mortgage your home after purchasing it with cash, you might face higher interest rates, considered as refinancing.

Missed Financial Advantages:

Loss of Mortgage Tax Deductions:

You’ll miss out on the potential tax benefits associated with mortgage interest payments if you opt for a cash purchase.

Lower Percentage Gains:

The percentage gain on the value of your home may be lower for cash purchases compared to those with a mortgage, due to the large initial investment.

Foregone Financial Leverage:

Without a mortgage, you miss the opportunity to leverage your investment, potentially limiting the growth of your wealth over time.

Risks and Opportunity Costs:

High-Stakes Risk:

Investing a large sum in real estate can be risky, as it is not a liquid asset and may take time to sell if needed.

Possible Opportunity Cost:

By allocating a significant portion of your resources to a single investment, you might miss out on other opportunities that could offer higher returns.

Impact on Credit Score:

Not having a mortgage could affect your credit score, as regular mortgage payments contribute positively to credit history.

Considering these factors is essential in understanding the full spectrum of implications that come with buying a house in cash. While the allure of immediate ownership and the absence of mortgage payments are appealing, the potential limitations on liquidity, financial flexibility, and the missed opportunities for leveraging your investment should not be overlooked.

Using Cash for Home Purchases without associating with a realtor

Opting to buy a house in cash without associating with a realtor can be a unique path with its own set of challenges and rewards. If you’re considering this route, understanding the process and what to expect is crucial for a successful transaction. Here’s a breakdown of key points and steps involved:

Research and Preparation:

Conduct Extensive Market Research:

Without a realtor, you’ll need to dive deep into local market trends, pricing, and available properties on your own.

Understand Legal Requirements:

Familiarize yourself with the legalities of home buying in your area, including necessary documentation and reporting.

Schedule a Home Inspection:

Ensure the property’s condition is thoroughly assessed by a professional to avoid unforeseen issues.

Negotiation and Paperwork:

Handle Negotiations Directly:

Be prepared for direct negotiations with the seller, which can be more challenging without a realtor’s market knowledge and expertise.

Manage All Paperwork:

From offer letters to closing documents, you’ll be responsible for ensuring all paperwork is correctly handled.

Closing the Deal:

Review and Sign Representation Agreements:

Ensure you understand all terms before signing any agreements.

Review Counteroffers and Confirm Acceptance:

Carefully consider any counteroffers and confirm acceptance once you’re satisfied with the terms.

Navigate the Conditional Period:

Address any conditions, such as financing or home inspection results, before finalizing the purchase

Closing on the Home

Coordinate with a lawyer and the seller to finalize the sale and transfer ownership.

While the journey of purchasing a home with cash without a realtor involves more personal involvement and can be riskier, it also offers potential savings on realtor commissions and a more direct negotiation process. In Ontario, for instance, the standard real estate agent commission is 5%, a cost you can avoid by navigating the process independently. However, it’s essential to weigh these potential savings against the risks and additional effort required.

Understanding Cash Purchases in the Canadian Real Estate Market

In understanding cash purchases in the Canadian real estate market, several key factors highlight the current trends and future projections that are crucial for anyone considering this route for home buying. Here’s a detailed look:

Market Dynamics and Growth Projections:

- The Canadian real estate market is on an upward trajectory, with the Residential Real Estate Transactions market segment expected to grow significantly in the coming years. According to Statista Market Insights, a compound annual growth rate (CAGR) of 6.33% from 2024 to 2028 is anticipated, indicating robust market health and investor confidence.

- By 2028, the market volume is estimated to reach a staggering US$63.35bn, underscoring the increasing value and demand within the Canadian housing landscape.

- This surge in demand is primarily driven by low interest rates and a marked increase in migration to the country, factors that collectively bolster the real estate sector.

Interest Rates and Market Performance:

- The beginning of 2024 is expected to see a slow start in sales due to high interest rates, which often deter buyers. However, anticipated rate cuts in the second half of the year are likely to boost home sales, with existing home sales projected to reach 484k units, marking a 9.2% increase from the previous year, according to Better Dwelling.

- Despite the rise in sales, home prices are expected to experience a slight decline in 2024, with a 1-point decrease, followed by a 3-point increase in 2025. This fluctuation emphasizes the critical role interest rates play in the Canadian real estate market.

Investor Activity and Market Influences:

- The share of home purchases by investors has seen a notable increase since 2015, now accounting for over one-fifth of all home purchases in Canada. This rise indicates a growing interest in real estate as a lucrative investment avenue–.

- Major cities like Toronto exhibit the highest share of investor activity, with 21% of home purchases attributed to investors. This demographic shift underscores the varying market dynamics across different regions within Canada–.

- Factors such as rapid population growth, stronger than expected wage growth, and pent-up demand are other significant influences that will impact the market, alongside the challenge of affordability, which remains a pressing issue.

Understanding these facets of the Canadian real estate market provides a comprehensive backdrop for considering a cash purchase. While mortgage debt is often viewed as ‘good debt’ due to the appreciating value of the home and relatively lower interest rates, the increasing trend of cash purchases, as seen with 15% of buyers in Montreal in 2015, suggests a growing preference for immediate ownership free from the obligations of a mortgage. This shift is reflective of broader market trends and individual financial strategies, making it imperative for potential buyers to stay informed and weigh their options carefully in the context of these evolving dynamics.

Tax Issues Associated with Home Purchases with Cash

Navigating through the tax implications of buying a house in cash can be complex, but understanding these aspects is crucial for making informed decisions. Here’s a breakdown of key tax issues and potential benefits associated with cash home purchases in Canada:

Capital Gains and Compliance:

- Non-residents selling property in Canada face a Capital Gains Tax of 25% of the gross selling price. However, obtaining a Certificate of Compliance from the CRA can reduce or even eliminate withholding taxes, making it a critical step for non-residents.

- For Canadian residents, capital gains on the sale of a property are 50% taxable. The taxable amount can be reduced by deducting expenses related to the sale, such as renovations and legal fees, from the capital gain. Furthermore, the Principal Residence Exemption may allow the property to be exempt from capital gains tax if it was your principal residence.

Tax Credits and Rebates:

- Home Buyers’ Amount: According to the CRA, A non-refundable tax credit of up to $750 is available for first-time home buyers, easing the initial financial burden.

- GST/HST New Housing Rebate: Offers a rebate on some of the GST/HST paid on newly built homes, which can be significant for cash buyers investing in new constructions.

- Home Accessibility Tax Credits: For renovations that make a home more accessible, expenses are claimable, providing financial relief to those making necessary home modifications.

Annual Obligations and Opportunities:

Property Taxes: An annual obligation, the amount varies based on your municipality and the value of your property. It’s essential to factor this into your budgeting.

Income Taxes on Rental Properties: If your cash-purchased property is used as a rental, income taxes will apply, necessitating proper financial planning and consideration of potential tax strategies to minimize or avoid capital gains tax on rental properties.

By understanding these tax implications and leveraging available credits and rebates, you can optimize your financial outcomes when buying a house in cash. Always consult with a tax professional to navigate these complexities and ensure compliance with Canadian tax laws.

The Financial Implications and Planning

Embarking on the journey of buying a house in cash involves meticulous financial planning and understanding the implications of such a significant investment. Here’s a guide to navigate through the financial landscape:

Initial Financial Considerations

Down Payment:

- For homes valued at $500,000 or less, a minimum down payment of 5% is required. For portions of the home price above $500,000, a 10% down payment is necessary.

- Non-residents eyeing property in Canada need to prepare for a heftier initial financial commitment, generally needing a 35% down payment.

- Additionally, a deposit, typically around 5% of the purchase price, is expected within 24 hours of offer acceptance for non-residents.

Building Credit:

- A strong credit history is pivotal. Achieve this by consistently paying bills on time and responsibly using credit cards. Regularly monitoring and ensuring the accuracy of your credit report is also advisable.

Strategic Financial Planning

Savings and Investment:

- Consider the First-Time Home Buyer Savings Account (FHSA), allowing up to $40,000 in savings over time with an $8,000 annual limit. Contributions are tax-deductible, and investment gains are not taxed, making it a savvy way to accumulate your down payment.

- Utilize the federal Home Buyers’ Plan to leverage RRSP funds for your down payment, enhancing your financial readiness without immediate tax implications.

Understanding Mortgage Options:

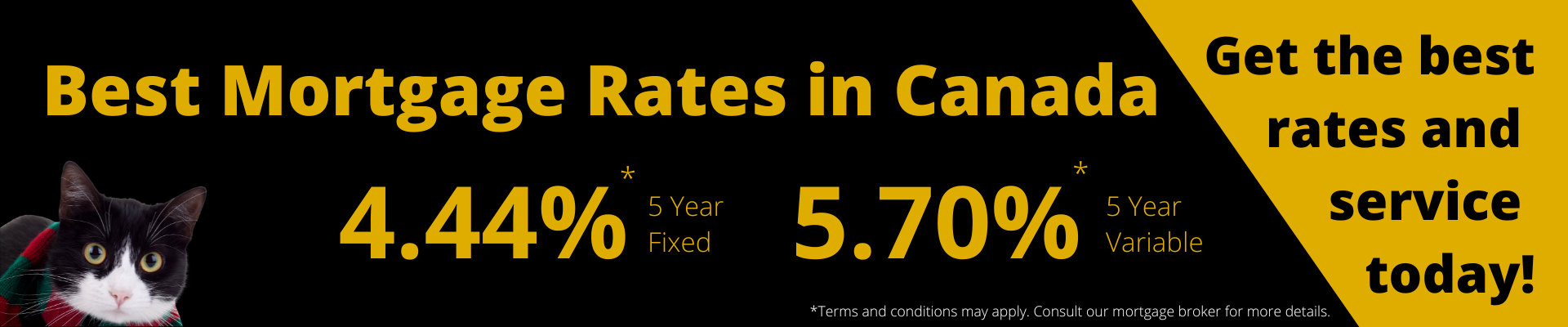

- Familiarize yourself with mortgage types, such as the difference between variable and fixed-rate mortgages. Knowing these distinctions can aid in making an informed decision that aligns with your financial goals and risk tolerance.

- If considering a mortgage, remember that a down payment of 20% or more eliminates the need for mortgage insurance fees, offering long-term savings.

Additional Costs and Long-term Planning

Beyond the Purchase Price:

- Legal fees, typically amounting to between 2% and 3% of the home’s value, are crucial to budget.

- Plan for property tax, maintenance, and potential repairs. These ongoing costs are an integral part of homeownership.

- Evaluate your financial situation, future goals, and risk tolerance. If the numbers don’t add up or the financial commitment feels overwhelming, it might be prudent to wait.

Incorporating these financial strategies and considerations can significantly influence your home-buying journey, ensuring you’re well-prepared for the investment. Engaging with a mortgage broker experienced in assisting non-residents and understanding the nuances of the Canadian real estate market can also provide valuable insights and support

How to Prepare for a Cash Purchase

Preparing for a cash purchase in the real estate market requires a well-thought-out strategy, especially in the context of the Canadian market’s current dynamics. Here are some key steps and considerations to guide you through the process:

Financial Considerations and Market Trends

Assess Market Conditions:

According to Flynn Real Estate Inc., the new housing price index in Canada has seen a decline, indicating a potential buyer’s market. This, coupled with the decrease in building costs, suggests that house prices may continue to trend down. It’s crucial to monitor these trends as they can significantly impact the timing and cost-effectiveness of your cash purchase.

Building Costs:

With the cost to build a house coming down from its peak, this may lead to a decrease in house prices. This factor is particularly important if you’re considering buying land and building a house, as lower construction costs can result in substantial savings.

Strategic Financial Planning

Leverage Financial Flexibility:

While the allure of a cash purchase is strong, considering financing options can offer a strategic advantage. Financing can provide leverage, allowing you to maintain liquidity and flexibility for other investments or emergency funds. This is particularly relevant in a market where the cost dynamics are shifting.

Build and Maintain Your Credit Score:

Even if you’re buying in cash, maintaining a strong credit score is beneficial for future financial transactions. Consider using credit responsibly to build or maintain your score, ensuring you remain an attractive candidate for lenders should you choose to finance or refinance in the future.

By keeping these considerations in mind and staying informed about market trends, you can navigate the complexities of a cash purchase with confidence. Remember, every financial decision should align with your long-term goals and investment strategy, ensuring that you maximize the benefits while minimizing potential drawbacks.

FAQs

A: Yes, you can purchase a home with cash instead of obtaining a mortgage. In the current real estate market, paying in cash can provide an advantage over other buyers. However, it’s crucial to understand the specific details of the cash-buying process, which can be more complex than it appears.

A: If you’re paying for a house in cash, you might be able to get a discount of approximately 5 to 10% off the asking price, provided that the asking price is consistent with the home’s appraised value. This discount reflects the benefits to the seller of a cash transaction.

A: Buying a property with cash has several benefits. You will avoid paying interest on a mortgage and can save on closing costs that are typically associated with taking out a loan. Cash purchases can also give buyers a competitive edge, as sellers may prefer the certainty of a cash deal over one that requires financing approval.

A: Sellers often prefer cash offers because they usually mean a quicker and more secure closing process. Cash deals eliminate the uncertainty that comes with buyers who need to secure financing, which can fall through and delay or derail the sale.