Reverse Mortgages Bloom | Flexible Home Equity Solutions with Citadel Mortgage

Find the Best Bloom Reverse Mortgage Rates in Canada

Today’s Reverse Mortgage Rates updated as of October 3, 2025 6:57 pm

For a property located in

*Rates can change at anytime. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Bloom Reverse Mortgage: A Modern Approach to Home Equity Solutions

Bloom Financial offers an innovative reverse mortgage solution designed for Canadian homeowners aged 55+. With Bloom, you can unlock up to 55% of your home equity while enjoying a transparent, straightforward process. Whether you need to supplement retirement income, pay for renovations, or consolidate debt, Bloom provides financial freedom without the hassle of monthly payments with a reverse mortgage.

Why Choose Bloom Financial?

Bloom Financial is one of Canada’s leading reverse mortgage providers, known for its competitive rates and customer-centric approach. Here’s what sets them apart:

Modern, Transparent Process

Bloom simplifies reverse mortgages with an easy-to-understand approach.Competitive Rates

Enjoy some of the lowest rates in the market, ensuring you get the most out of your home equity.Flexible Fund Options

Choose between a lump sum, scheduled payments, or a mix to meet your needs.No Negative Equity Guarantee

Like other top providers, Bloom ensures you’ll never owe more than your home’s value when sold.Dedicated Customer Support

Bloom offers personalized service to guide you through every step.

For more details on how reverse mortgages work, visit the Financial Consumer Agency of Canada (FCAC).

Current Reverse Mortgage Rates at Bloom Financial

As of 2025, Bloom reverse mortgage offers some of the most competitive reverse mortgage rates in Canada:

- Fixed Rates: 7.25% – 9.10%

- Variable Rates: 6.90% – 8.75%

For the latest rate updates, visit Bloom Reverse Mortgage Rates.

BLOOM REVERSE MORTGAGE RATES

Get An Estimate

See How Much You Can Borrow Today!

Eligibility for Bloom Reverse Mortgage

- Age: 55 or older

- Primary Residence: Your home must be your primary residence

- Home Equity: Meet Bloom’s criteria for property valuation and location

Use the Bloom Reverse Mortgage Calculator to get a personalized estimate.

Reverse Mortgage Fees at Bloom Financial

Here’s a breakdown of typical fees associated with an Bloom Reverse Mortgage:

- Appraisal Fee: $300 – $500

- Legal Fees: $1,000 – $1,500

- Administrative Fee: $1,495

- Prepayment Penalties: Reduced compared to competitors

Common Uses for Bloom Reverse Mortgage Funds

- Debt Consolidation

- Home Renovations

- Healthcare Expenses

- Supplementing Retirement Income

- Financial Assistance for Family

Get An Estimate

See How Much You Can Borrow Today!

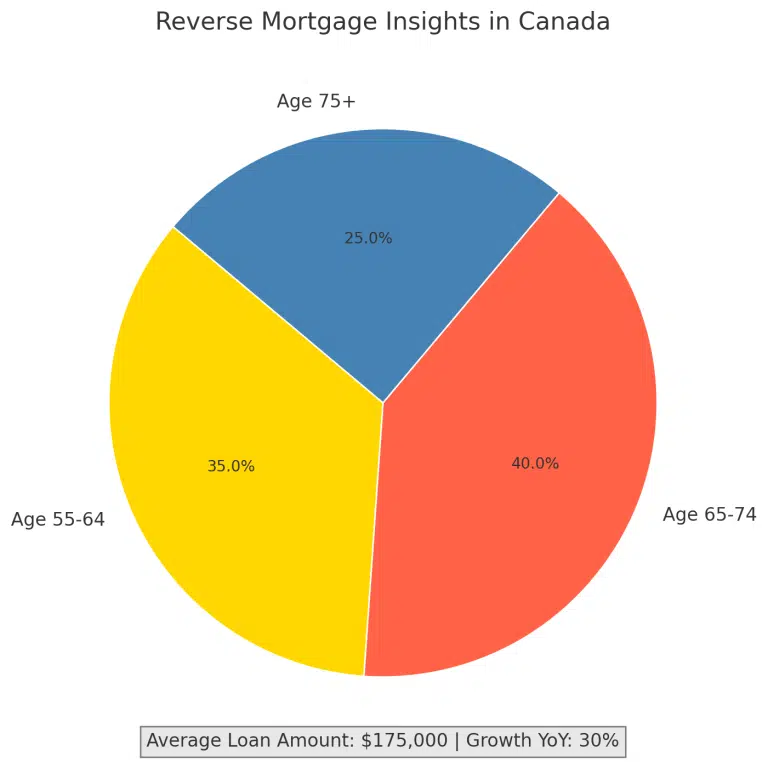

Reverse Mortgage Statistics

Understanding the market trends and usage patterns for reverse mortgages can help you make informed decisions. Here are key statistics:

Key Statistics

- Average Loan Amount: $175,000

- Year-Over-Year Growth: 30%

- Homeowner Eligibility: 90% of homeowners with sufficient equity qualify.

- Usage Breakdown:

- Debt Consolidation: 25%

- Home Renovations: 23%

- Retirement Income: 30%

- General Spending: 22%

Age Distribution of Reverse Mortgage Holders

- Age 55-64: 35%

- Age 65-74: 40%

- Age 75+: 25%

FAQs About Bloom Reverse Mortgages

Are Bloom reverse mortgages safe?

Yes, Bloom reverse mortgages in Canada are regulated by federal and provincial laws. Lenders like HomeEquity Bank and Equitable Bank offer government-backed solutions with no negative equity guarantees.

How does repayment work with a reverse mortgage?

The loan is typically repaid when you sell your home, move into long-term care, or pass away. You or your estate won’t owe more than the home’s fair market value at the time of sale.

Why get a reverse mortgage?

Here are some examples of how clients commonly use it:

- eliminate debt payments

- help a child or grandchild with a down payment on a home

- purchase a new home (right-sizing instead of having to downsize the home)

- increase cash flow to improve lifestyle (e.g., vacation, new car)

- pay healthcare costs

- pay for an unexpected expense (e.g. home repairs)

Can I apply if my spouse is under 55?

No, both you and your spouse must be at least 55 years old to qualify for a reverse mortgage in Canada.

Can I lose my home with a reverse mortgage?

No, as long as you meet your obligations, such as keeping your property taxes and insurance up to date, you can stay in your home for life.

What happens if the loan exceeds the home’s value?

Canadian reverse mortgages come with a no negative equity guarantee, meaning you’ll never owe more than the value of your home.

How is the reverse mortgage repaid?

The loan is typically repaid when you sell your home, move into long-term care, or pass away.

Are there penalties for early repayment?

Yes, prepayment penalties may apply. However, Equitable Bank offers flexible repayment options to minimize costs.

Get An Estimate

See How Much You Can Borrow Today!

Why Choose Citadel Mortgages for Your Bloom Reverse Mortgage?

At Citadel Mortgages, we’re committed to finding the best reverse mortgage solutions for your unique needs. Partnering with Bloom Financial allows us to offer:

- Expert Advice: We’ll guide you through the process, ensuring you fully understand your options.

- Competitive Rates: Access some of the lowest rates on the market.

- Personalized Solutions: Tailored reverse mortgage plans designed to meet your goals.

Bloom Reverse Mortgage Calculator

Understanding your reverse mortgage potential is easier with our Reverse Mortgage Calculator. This tool provides an instant estimate of how much equity you can access based on:

- Your Age

- Home Value

- Location

- Loan-to-Value Ratio (LTV)

How to Use the Reverse Mortgage Calculator:

- Enter Your Home’s Current Market Value.

- Input Your Age and Your Spouse’s Age (if applicable).

- Receive an Estimate of the Amount You Can Borrow.

Try the Citadel Mortgages Reverse Mortgage Calculator today to explore your options!

Final Thoughts on reverse mortgages Bloom

An Bloom Reverse Mortgage offers Canadian homeowners a secure, flexible way to unlock their home equity. Whether you’re planning for retirement, managing debt, or funding home improvements, this financial tool provides the freedom to live comfortably without monthly payments.

Contact Citadel Mortgages today to explore how an Bloom Reverse Mortgage can work for you.

See Reverse Mortgages By City

See Reverse Mortgages By Bank

Get An Estimate

See How Much You Can Borrow Today!