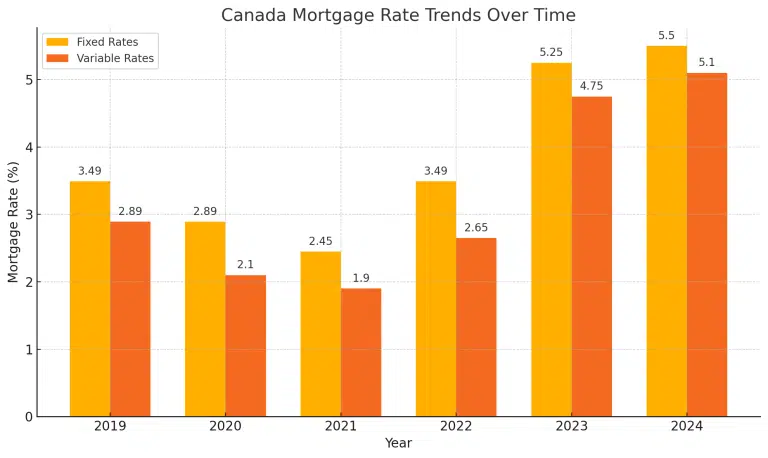

Canada Mortgage Rate Trends Over Time

| Year | Average Fixed Rate (%) | Average Variable Rate (%) |

|---|---|---|

| 2019 | 3.49% | 2.89% |

| 2021 | 2.89% | 2.00% |

| 2023 | 5.25% | 4.75% |

| 2024 | 5.50% – 6.25% | 5.10% – 5.75% |

Key Insight: Rates have risen significantly since 2021 due to inflation control measures by the Bank of Canada.