Get Prequalified for a Mortgage in 60 Seconds | Citadel Mortgages

Find the Best Mortgage Rates in Canada

Today’s Mortgage Rates updated as of October 7, 2025 1:58 pm

For a property located in

5-year fixed*

3.84

5-year Variable*

3.85

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Fast and Easy Mortgage Prequalification with Citadel Mortgages

At Citadel Mortgages, we understand that time is valuable. That’s why we’ve created a seamless online prequalification process that lets you know your mortgage options in just 60 seconds.

Whether you’re a first-time homebuyer, refinancing, or renewing your mortgage, understanding current trends and available options helps you make informed financial decisions.

This guide focuses on helping you navigate the Canadian mortgage market, offering insights into current rates, strategies for securing the best deal, and regional trends.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

OUR TRUSTED LENDER PARTNERS

What Is Mortgage Prequalification?

Mortgage prequalification is the first step in your home-buying journey. It provides a quick snapshot of how much you may be able to borrow based on your income, credit history, and debt-to-income ratio. While not a formal approval, prequalification gives you a solid starting point to plan your budget and narrow down your home search.

Prequalification vs. Pre-Approval: What’s the Difference?

Prequalification

- What It Is: A quick assessment based on basic financial information you provide, such as income and credit score.

- Purpose: Offers an estimate of how much you may qualify to borrow.

- Credit Check: No hard credit check required.

- Reliability: Useful for initial planning but not a guarantee of approval.

Pre-Approval

- What It Is: A more detailed process where a lender reviews your financial documents and conducts a hard credit check.

- Purpose: Provides a conditional commitment from the lender for a specific loan amount.

- Reliability: Stronger than prequalification but not always underwritten unless explicitly noted.

Read about how fixed and variable rates compare on the Government of Canada website.

Why Pre-Approvals from Big Banks Can Be Misleading

Many large banks issue pre-approvals that are not fully underwritten. While they may look like a green light to proceed with your home purchase, these pre-approvals often lack the depth of a thorough review. Here’s how that can hurt you:

Conditional Approval Risks

- If your financial documents or credit score don’t meet the lender’s final requirements, the pre-approval may be revoked, putting your home purchase at risk.

False Sense of Security

- Many clients assume pre-approval means guaranteed approval, leading to financial planning issues or rejected offers.

Market Risks

- A weak pre-approval may make your offer less competitive in a hot real estate market.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

Mortgage Rates You May Qualify For

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

Why Citadel Mortgages Offers Better Solutions

At Citadel Mortgages, our prequalification and pre-approval processes go beyond surface-level assessments.

Thorough Reviews

- We evaluate your financial situation in-depth, ensuring reliability.

True Underwriting

- Our pre-approvals are fully underwritten by experienced mortgage professionals.

Tailored Guidance

- We work with you to strengthen your financial profile, making you a stronger buyer.

How the 60-Second Prequalification Process Works

How the 60-Second Prequalification Process Works

Fill Out the Form

- Provide basic information, including income, employment, and estimated credit score.

Get Instant Results

- See your potential borrowing power and rate options instantly.

Speak with an Expert

- Connect with a Citadel Mortgages specialist to discuss your options and start your application.

Benefits of Getting Prequalified

1. Understand Your Budget

Prequalification gives you a clear idea of how much you can afford, helping you focus your home search.

2. Strengthen Your Offers

Sellers take your offers more seriously when they know you’re prequalified.

3. Save Time

By starting with prequalification, you can streamline the mortgage approval process.

4. Explore Your Options

Discover fixed, variable, and other mortgage products tailored to your needs.

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Let us simplify the process and help you secure approval quickly and stress-free!

60-Second Prequalification Mortgage Rates In Canada

Documents Needed for Mortgage Approval in Canada

- Government ID: Driver’s license, passport, or permanent resident card.

- Proof of Income: Recent pay stubs, T4 slips, or self-employment income proof.

- Employment Verification: Letter from your employer detailing salary and position.

- Down Payment Proof: Bank statements or proof of savings.

- Credit Report Authorization: Permission for lenders to access your credit history.

Additional Documentation

- Other documents may be needed based on your unique situation. Our experienced mortgage agents at Citadel Mortgages will assist you in identifying and gathering any additional paperwork required to complete your second mortgage application.

Get a Mortgage with Citadel Mortgages

Navigate Interest Rate Trends with Confidence: Mortgage Solutions Tailored for You

At Citadel Mortgages, we recognize how important it is to stay informed about changing mortgage interest rates. Whether you’re purchasing your first home, refinancing, or renewing your mortgage, we’re here to guide you through the process with solutions that suit your financial needs, even in fluctuating rate environments.

Why Choose Our Mortgage Solutions?

Flexible Mortgage Options

From fixed to variable rates, we offer tailored solutions that help you secure the most competitive interest rates for your situation.

Expert Guidance on Rate Trends

Our team monitors the Canadian mortgage market to provide insights on current rates, helping you make informed decisions.

Approval Regardless of Credit History

We focus on finding solutions, even if you’ve faced credit challenges or financial setbacks.

Low-Income Friendly Options

Income constraints shouldn’t hold you back. We specialize in making homeownership accessible for Canadians in various financial situations.

Streamlined Application Process

Enjoy a smooth experience with quick approvals and clear communication every step of the way.

Benefits of Working with Citadel Mortgages

Rate Lock Protection

Secure today’s interest rates to avoid surprises if rates increase before your mortgage closes.

Debt Relief Options

Consolidate high-interest debt into a single, lower-interest mortgage payment, saving you money and simplifying your finances.

Customizable Payment Plans

Choose flexible payment terms that fit your budget, whether you prefer the stability of a fixed rate or the potential savings of a variable rate.

Quick Fund Access for Refinancing

Refinance your mortgage to tap into your home’s equity for renovations, debt consolidation, or investment opportunities.

Contact Us To Get Approved Now

Citadel Mortgages Lowest Mortgage Rates

FAQs About Mortgage Prequalification

Does prequalification guarantee mortgage approval?

No, prequalification provides an estimate of your borrowing power. Formal approval requires a full application and credit check.

Can I prequalify if I have bad credit?

Yes, we work with clients of all credit levels and provide tailored solutions for those with less-than-perfect credit.

Use Our Mortgage Calculator Today!

Understanding Your Mortgage Options

Use our mortgage calculator to gain a clearer picture of what you can expect in terms of monthly payments, interest costs, and amortization schedules. Simply input your loan amount, interest rate, and amortization period to get started. This tool provides estimates to help you make informed decisions as you explore different mortgage options.

Benefits of Using Our Mortgage Calculator

- Accurate Estimates: Get precise calculations on your potential second mortgage amount based on your home’s equity, current mortgage balance, and other financial factors.

- Financial Planning: Understand your monthly payment obligations and how they fit into your overall budget.

- Interest Rate Comparison: Compare different interest rates to see how they affect your monthly payments and total loan cost.

- Loan Scenarios: Explore various loan scenarios to determine the best option for your financial needs.

Final Thoughts - Mortgage Prequalification

Getting prequalified for a mortgage has never been easier. At Citadel Mortgages, we provide a quick, hassle-free way to understand your borrowing power and explore your mortgage options. Plus, our pre-approvals are underwritten for greater reliability, giving you confidence when making offers. Start your journey to homeownership today—get prequalified in just 60 seconds!

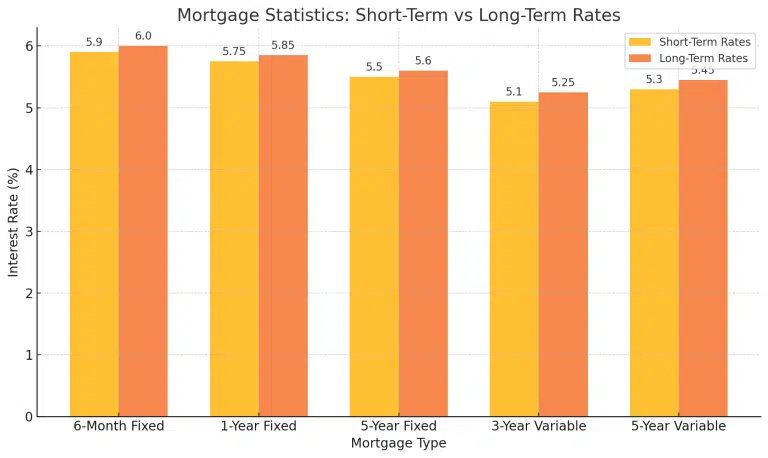

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

Why Choose Citadel Mortgages

At Citadel Mortgages, we pride ourselves on offering expert, client-focused mortgage solutions that stand out in the industry. Here’s why you should choose us:

Expertise Across Canada

Our mortgage brokers are licensed and certified across multiple provinces, providing exceptional advice and service tailored to your unique needs. Our mortgage brokers are committed to delivering the highest standards of professionalism and expertise.

Client-Focused Service

Unlike traditional commission-based models, our mortgage agents are evaluated based on client satisfaction and the quality of their advice. This ensures that you receive impartial guidance on the best mortgage options for your situation.

Competitive Rates

Citadel Mortgages offers competitive rates that help you save money over the life of your mortgage. Our team works diligently to find the most favorable terms to suit your financial goals.

Transparent and Seamless Process

We are dedicated to transforming the mortgage industry by offering a transparent, seamless process. Our 100% digital platform ensures that you can manage your mortgage application from start to finish with ease and confidence.

Commitment to Excellence

At Citadel Mortgages, our mission is to provide a positive, empowering, and transparent property financing experience. We simplify the mortgage process to make it as straightforward and stress-free as possible.

Contact Us Today

For personalized advice and the best mortgage rates in Toronto, contact our licensed and knowledgeable mortgage experts at Citadel Mortgages.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.