TD Bank Mortgage Rates | Explore Competitive Options with Citadel Mortgages

Find the Best TD Bank Mortgage Rates in Canada

Today’s Mortgage Rates updated as of October 16, 2025 9:46 pm

For a property located in

5-year fixed*

3.79

5-year Variable*

3.85

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

TD Bank Mortgage Rates in Canada

TD Bank is one of Canada’s largest financial institutions, offering a range of competitive mortgage products to meet the needs of homeowners, refinancers, and investors. At Citadel Mortgages, we help you access the best TD Bank mortgage rates, ensuring a seamless experience while securing the perfect mortgage for your needs.

Whether you’re a first-time homebuyer, refinancing, or renewing your mortgage, understanding current trends and available options helps you make informed financial decisions.

This guide focuses on helping you navigate the Canadian mortgage market, offering insights into current rates, strategies for securing the best deal, and regional trends.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

Current TD Bank Mortgage Rates

Compare TD mortgage rates to other top lenders to ensure you’re getting the best deal. Contact us to explore all your options.

Learn more about today’s best mortgage rates in Canada.

TD Bank Prime Rate

Prime rates change when the Bank of Canada raises or lowers its overnight rate. When it comes to mortgages, there is a separate mortgage rate that tends to be lower than the prime rate. TD Bank’s prime rate is the highest it’s been since 2001.

5-Year History of TD Prime Rate

To get a feel for changes to the TD prime rate over the years, here is the 5-year history:

- January 26, 2023: 6.700%

- December 8, 2022: 6.450%

- October 27, 2022: 5.950%

- September 8, 2022: 5.450%

- July 14, 2022: 4.700%

- June 2, 2022: 3.700%

- April 14, 2022: 3.200%

- March 03, 2022: 2.700%

- March 30, 2020: 2.450%

- March 17, 2020: 2.950%

- March 5, 2020: 3.450%

- October 25, 2018: 3.950%

- July 12, 2018: 3.700%

- January 18, 2018: 3.450%

Read about how fixed and variable rates compare on the Government of Canada website.

TD Mortgage Rates As Per Term

TD Mortgage Features

TD offers the following mortgage features:

Increase Your Mortgage Payment:

Each year you can make an extra payment for your month of choice. This is an important feature, as it allows you to pay down your mortgage more quickly when you have a little extra cash available. Many mortgages apply a penalty when you wish to make additional payments, which makes this a feature to use as a point of comparison. The payment can be up to the full amount of your usual monthly payment.

Annual Mortgage Prepayment:

Another way TD helps you pay down your mortgage more quickly is their annual mortgage prepayment. This allows you to contribute up to 15% of your original mortgage principal as a lump sum each year on closed mortgages. When you take advantage of this option, you reduce interest paid over the life of your mortgage and become mortgage-free sooner.

Payment Pause:

Over the full amortization period of your mortgage, TD allows you to skip four payments, with a limit of one per year. This means you can’t save them all up and then skip all four at once. These skipped payments are not considered a default held against you and instead act more like a deferral or grace period without a negative impact on your payment history. The payment pause is based on your payment frequency, either a single skipped payment for the month, two skipped payments for bi-weekly, and four skipped payments for weekly. However, when you skip a payment, it’s important to remember it slows down how long it takes to pay off your mortgage. It also costs you more in interest. This is especially true if you take full advantage of the four payment pauses you are allowed to take over the life of your mortgage. This is because TD applies the interest not paid on your skipped payments to your principal balance. It is best to save your paused payments for a rainy day.

Payment Vacation:

In hand with your payment pause option, TD also offers a payment “vacation” for up to four months. This is based on the prepaid amount of your mortgage. It is ideal for scenarios where you need time off work and aren’t earning money, whether it is because you are sick, having a baby, or returning to school. As with the payment pause, be sure this is worth it, because those four months of interest accrue and are applied to your mortgage principal. Also, it will take you at least four months longer to pay off your mortgage, in hand with the time it takes to pay off the extra interest. Although it does make your mortgage a bit more flexible, make sure you understand the pros and cons.

Monthly Property Tax Payments:

Most mortgages require you to pay your property tax along with your mortgage payments. If your mortgage does not, TD offers the option for you to pay towards your property taxes and the money collected they then pay for you when they are due. There really isn’t a big benefit to this, but it’s there if you want it.

Mortgage Protection Insurance:

At the time you sign your mortgage, you can opt-in for mortgage protection insurance. The premiums do not increase over the life of your mortgage, and your insurance offers coverage for various scenarios, such as the death of the policyholder or a critical illness that keeps you from making payments. Mortgage life insurance is always a good idea, as it pays off your mortgage, so the burden of the payments doesn’t fall onto the shoulders of family members. Just keep in mind the premiums add up over time and impact your mortgage payments.

Why Choose TD Bank for Your Mortgage?

Competitive Fixed and Variable Rates

- Access market-leading rates that fit your financial goals.

Flexible Payment Options

- Choose from weekly, bi-weekly, or monthly payment plans to match your budget.

Generous Prepayment Privileges

- Pay up to 15% of the original principal annually or increase your regular payments by up to 15%.

Portability Options

- Transfer your mortgage to a new property without penalties.

Specialized Mortgage Programs

- Explore cashback mortgages, insured high-ratio mortgages, and more.

TD Mortgage Application Checklist

To apply for a TD mortgage, you’ll need the following:

- A list of your current and previous addresses

- Current and previous employment information

- Proof of income such as a pay stub or bank deposits

- Recent bills

- Credit card statements

- The estimated value of your home

- A list of your monthly expenses

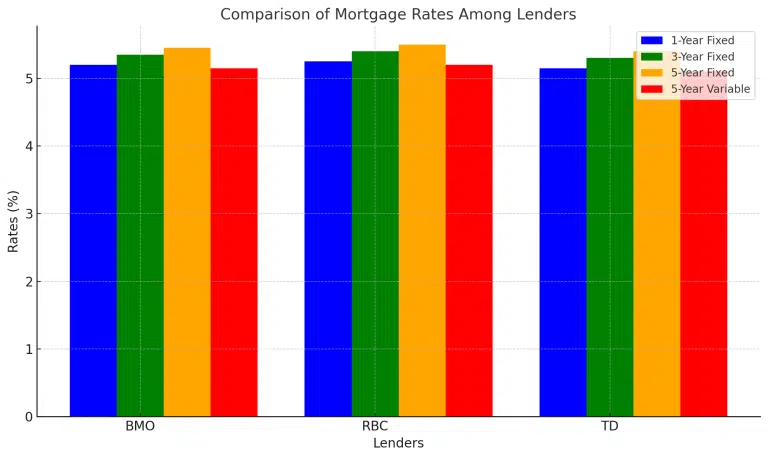

How TD Mortgage Rates Compare to Other Lenders

| Lender | 1-Year Fixed | 3-Year Fixed | 5-Year Fixed | 5-Year Variable |

|---|---|---|---|---|

| BMO | 5.20% | 5.35% | 5.45% | 5.15% |

| RBC | 5.25% | 5.40% | 5.50% | 5.20% |

| TD | 5.15% | 5.30% | 5.40% | 5.10% |

This table highlights how TD bank competes with other leading Canadian lenders, offering competitive rates and flexible terms.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

How TD Bank Fixed and Variable Rates Compare

| Feature | Fixed Rates | Variable Rates |

|---|---|---|

| Interest Rate Stability | Fixed throughout the term | Fluctuates with market rates |

| Payment Consistency | Predictable payments | Payments may vary |

| Risk Level | Low | Moderate to high |

| Ideal For | Long-term planners | Risk-tolerant borrowers |

TD Bank Mortgage Programs

Cashback Mortgages

- Get cashback upon closing to cover moving expenses, renovations, or other costs.

Home Equity Line of Credit (HELOC)

- Access flexible financing using your home equity as collateral.

Explore HELOC Options

- Access flexible financing using your home equity as collateral.

First-Time Homebuyer Mortgages

- Benefit from tailored options for first-time buyers, including competitive rates and incentives.

Explore First-Time Buyer Programs

- Benefit from tailored options for first-time buyers, including competitive rates and incentives.

Refinancing Options

- Refinance your mortgage to reduce rates or access home equity.

Learn About Refinancing

- Refinance your mortgage to reduce rates or access home equity.

Who Qualifies for TD Bank Mortgage Rates?

To qualify for TD Bank’s best mortgage rates, you’ll need:

Good Credit Score

- A score of 680 or higher is typically required for the most competitive rates.

Stable Income

- Provide proof of steady income, such as pay stubs, T4 slips, or tax returns.

Sufficient Down Payment

- A minimum of 5% for insured mortgages or 20% for uninsured mortgages.

Acceptable Debt-to-Income Ratio

- Your total monthly debts should not exceed 42% of your gross income.

FAQs About TD Bank Mortgage Rates

Are TD Bank rates lower than other banks?

TD Bank mortgage rates tend to sit in the mid-range of interest rates compared to other providers. For example, while TD’s five-year fixed rate was 5.44%, Bank of Nova Scotia was 6.43% and RBC was at 5.69%. On the lower end, BMO and CIBC were just above 5%, while HSBC was at 4.89%. So, it pays to shop around.

How do I get a mortgage with TD Bank?

TD Mortgage online applications make it easy to apply for a mortgage. You’ll need the following information to complete the process:

- Proof of your status as either a Canadian citizen or approval as a permanent resident

- Your property closing date, down payment source, and what mortgage option suits your needs

- Confirm this home is intended as your primary residence

- The full address of the property you’d like to purchase, the MLS Realtor Listing and the Purchase and Sale Agreement

- At least one document confirming your employment status and income

- A list of your assets and liabilities

- Proof you are the age of majority

A TD Mortgage Specialist will contact you within 24 hours to review your application and discuss the next steps of the application process. Of course, you can also set up an appointment at your local TD Bank to complete the process in person. However, it is always best to seek pre-approval first to know how much they are willing to lend you before you start your house hunt. Their online process offers an immediate response, and they hold your interest rate for 120 days upon pre-approval.

Can you negotiate a mortgage rate?

Although Canadian lenders post their mortgage rates, you can try to negotiate a better rate. Mortgage lenders are highly competitive, and depending on current market conditions, your employee status, and your credit score, they might be willing to give you a bit of a break.

What is the penalty for breaking a mortgage with TD

The terms of your mortgage agreement determine prepayment charges as follows:

- Open mortgage: An open mortgage allows you to pay off your entire mortgage at any time without penalties.

- Closed mortgage: There are charges for a closed mortgage based on whether you have a variable or fixed mortgage. Variable interest rates usually charge three months of interest, while fixed interest rates aren’t as cut and dry. It is based on the greater of three months’ interest or the Interest Rate Differential (IRD) amount.

I am new to Canada. How can I get a TD mortgage?

As a new Canadian without an established credit history, you can still qualify for a TD mortgage if you are or have applied to become a permanent resident and have been in Canada for five years or less.

Pros & Cons of TD Bank

Pros

- Their interest rates are mid-range, so not as high as other options

- Their payment vacations and pauses come in handy when life throws a wrench into your finances

- They are rated #1 for online banking apps

- Immediate response for online mortgage pre-approval

Cons

- There are lower interest rates available at other lenders offering similar features

- As a big-six bank, they have stricter lending criteria to qualify

TD Bank’s History

The TD Bank started off as the Bank of Toronto in 1855, founded by a group of millers and merchants. In 1871 the first branch of the Dominion Bank opened, and the two banks merged in 1955, forming Toronto Dominion Bank. In 2000, TD acquired Canada Trust and then entered the U.S. retail banking arena when it acquired Banknorth in 2005.

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

Compare TD Bank Mortgage Rates

Disclaimer

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.

Final Thoughts - TD MOrtgage rates

TD Bank offers some of the most competitive mortgage products in Canada, with flexible terms and exclusive features like cashback mortgages and HELOCs.

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.