Scotiabank Mortgage Rates | Competitive Rates with Citadel Mortgages

Find the Best Scotiabank Mortgage Rates in Canada

Today’s Mortgage Rates updated as of October 13, 2025 11:51 am

For a property located in

5-year fixed*

3.84

5-year Variable*

3.85

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Discover Scotiabank Mortgage Rates In Canada

Scotiabank, one of Canada’s leading financial institutions, offers a wide range of mortgage products tailored to fit the unique needs of Canadian homeowners. Whether you’re buying a new home, refinancing, or investing in real estate, Scotiabank provides flexible options and competitive rates.

At Citadel Mortgages, we ensure you access the best Scotiabank mortgage rates while simplifying the process for a seamless experience.

Whether you’re a first-time homebuyer, refinancing, or renewing your mortgage, understanding current trends and available options helps you make informed financial decisions.

This guide focuses on helping you navigate the Canadian mortgage market, offering insights into current rates, strategies for securing the best deal, and regional trends.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

Today’s ScotiaBank Mortgage Rates

Compare ScotiaBanks’s rates to other top lenders to ensure you’re getting the best deal. Contact us to explore all your options.

Learn more about today’s best mortgage rates in Canada.

Prime Rate | Variable Rates | Fixed Rates | Per Term Rates | Rate History | Pre-approval | Checklist | Features | How To | Pros & Cons | FAQ

Scotiabank Prime Rate

Scotiabank’s prime rate aligns with the other Big Six banks. Scotiabank uses the prime rate to guide its decisions on its loan and mortgage rates. As well the prime rate also determines the interest rate for its variable mortgages, which rises and falls with the prime.

Scotiabank Variable Mortgage Rates

The variable mortgage rates are based on Scotiabank’s Prime Rate. The mortgage rate won’t go above the cap rate, which is the highest interest rate the bank will charge you. It’s important to understand the cap rate for variable mortgages. Despite being impacted by fluctuating interest rates, you still pay a fixed payment based on the cap rate. This payment doesn’t change. Instead, the changing interest rates impact how much of your payment goes toward the principal. The lower the interest rate, the more of your payment goes to your principal.

Scotiabank Fixed Mortgage Rates

Scotiabank fixed mortgage rates have a set interest rate and mortgage payment for the full term of your mortgage. So, if you have a 5-year fixed-rate mortgage, you pay the same monthly payment for five years. However, once that term ends, your mortgage is up for renewal. At that time, your interest rates change based on current Scotiabank interest rates, which then impacts your monthly payments.

How Scotiabank Fixed and Variable Rates Compare

| Feature | Fixed Rate Mortgages | Variable Rate Mortgages |

|---|---|---|

| Interest Rate | Fixed throughout the term | Adjusts with market conditions |

| Payment Stability | Predictable | May fluctuate over time |

| Risk Level | Low | Moderate to high |

| Ideal For | Long-term stability seekers | Risk-tolerant individuals |

Read about how fixed and variable rates compare on the Government of Canada website.

Scotia Bank Mortgage Rates as Per Term

Scotiabank 5-Year Fixed and Variable Rate History

Here is a brief history of Scotiabank mortgage rates over the past three years:

- Year: 2020 Fixed: 2.14% Variable: 2.65%

- Year: 2021 Fixed: 2.49% Variable: 1.75%

- Year: 2022 Fixed: 5.84% Variable: 3.90%

Scotiabank Mortgage Pre-Approval

Scotiabank’s eHome app allows you to get an online exclusive rate guarantee and download a letter of pre-approval in a matter of minutes. Pre-approval should be the first step you take when buying a home, as it tells you:

- If you are eligible for a mortgage

- How much the lender will offer you

- The interest rate you’ll lock into for 120 days during your search

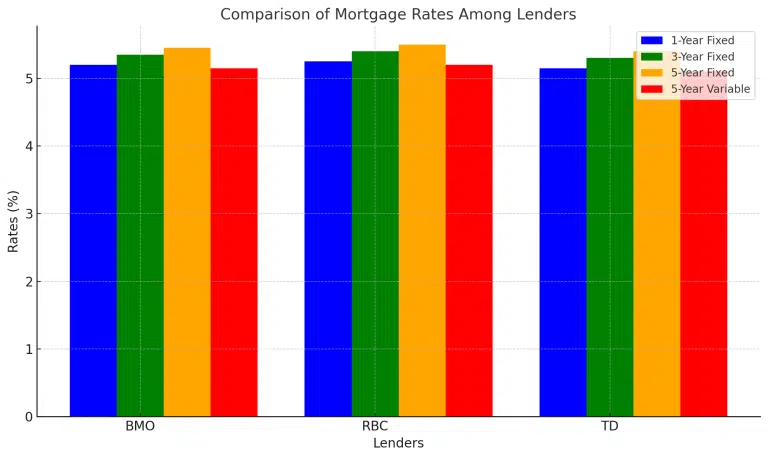

How ScotiaBank Mortgage Rates Compare to Other Lenders

| Lender | 1-Year Fixed | 3-Year Fixed | 5-Year Fixed | 5-Year Variable |

|---|---|---|---|---|

| BMO | 5.20% | 5.35% | 5.45% | 5.15% |

| RBC | 5.25% | 5.40% | 5.50% | 5.20% |

| TD | 5.15% | 5.30% | 5.40% | 5.10% |

This table highlights how ScotiaBank competes with other leading Canadian lenders, offering competitive rates and flexible terms.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

Scotiabank Mortgage Application Checklist

Before applying for a Scotiabank mortgage, you’ll need the following documents:

- Two forms of Government identification

- Proof of income

- Proof of down payment

- Letter of employment from current employer

- Proof of assets

- Debt and savings information

- Agreement of Sale

- Copy of Deed

- Job Letter

- Recent Payment Slip

- Land & Building Tax and Water Rates

Self-employed individuals require one of the following for proof of income:

- Income Tax Returns for the last two years

- Audited Financial Statements for the last two years

- Financial Statements for the last two years prepared by an Accountant on the Bank-Approved Panel

- Any official document issued by the Government indicating the income, such as Notices of Assessment for the past two years

Scotiabank Mortgage Features

Most banks offer similar features focused on helping you pay down your mortgage faster, reducing interest or, in some cases, even missing a payment each year. Scotiabank offers the following mortgage features:

- Scotiabank Match-A-Payment:

This feature allows you to “match” a monthly mortgage payment by doubling how much you pay that month. This is an excellent feature, as when you increase your mortgage payments, you reduce your mortgage principal, so you pay less interest over time. This can save you a pretty sum of money over the years and you also pay down your mortgage faster. - Scotiabank Miss-A-Payment:

This is a very important feature as it gives you a break from paying your monthly mortgage payment. It is a great option if you are facing financial challenges, or you wish to put the money towards something else. However, you can only use this feature if you have doubled a payment at least once in your term. Keep in mind that missing a payment takes you longer to pay off your mortgage, and you also end up paying more interest for the mortgage term. Also, any additional fees added to your mortgage, such as mortgage insurance or property taxes, are still owed for the month. - Scotiabank’s Annual Mortgage Prepayment Privileges:

If you have a closed mortgage that charges a penalty to pay off your mortgage sooner, or you wish to refinance, you are given an annual mortgage prepayment privilege that allows you to pay off 15% of your mortgage principal penalty-free. This helps pay down your mortgage faster. - Monthly Property Tax Payments:

If you are a first-time homebuyer, have a shaky credit history or have certain mortgage terms, you are likely going to have to pay your property taxes along with your mortgage payment each month. However, if you are not required to make these payments, you can still have Scotiabank collect your taxes monthly and make the tax payments for you. It’s not a big deal but does make life easier. - Mortgage Protection Insurance:

All banks offer some sort of mortgage insurance products to their mortgage customers. The premiums add more to your mortgage payments, but you also get coverage for issues such as critical illness, disability, and death. Scotiabank mortgage protection insurance is offered at the time you sign your mortgage, and the premiums applied will never increase. Your premiums are based on your age, and the older you are, the more you will pay. There are no medical assessments, and your premiums are broken down into life and critical illness contributions. Scotiabank also offers a 30-day risk-free period allowing you to cancel within the first 30 days for a full refund. Coverage is calculated per $1000 of your mortgage principal.

Cashback Mortgages

- Receive up to 5% cashback on your loan amount, perfect for covering renovations or closing costs.

Prepayment Options

- Pay up to 15% of your original principal annually without penalties and increase payments by 15% annually.

STEP Program (Scotiabank Total Equity Plan)

- Combine your mortgage with a home equity line of credit (HELOC) for maximum financial flexibility.

How to Get the Best Scotiabank Mortgage Rate

As mentioned above, Scotiabank does not advertise its best mortgage rates. Therefore, you want to ask if they can do better. Keep in mind banks tend to reserve their best rates for clients with an exceptional credit history, but it never hurts to ask. In this case, it’s best to set up an appointment with one of their Home Financing Advisors so that you can speak face-to-face with a representative. They will help you understand what the bank is willing to offer based on your specific financial situation.

The higher your credit score and the better your credit history, the more likely the advisor is to be willing to go to bat for you. Another strategy is to go prepared with research about interest rates so you can lay out all the comparable mortgages being offered by the competition. It never hurts to leverage your knowledge to show them you are willing to walk to get the best rate. Avoid sharing information about smaller lenders, as Big Six banks don’t feel obligated to compete with those lenders.

Scotiabank Pros & Cons

As mentioned above, Scotiabank does not advertise its best mortgage rates. Therefore, you want to ask if they can do better. Keep in mind banks tend

Before you decide on the bank you’d like to do business with, it’s important to consider the pros and cons of their mortgage products. Here are the pros and cons of Scotiabank mortgages:

Pros

- Offers a very user-friendly online banking app, eHome, to make it easier to apply for your mortgage and get pre-approved

- If you are uncertain about mortgage insurance, they offer a 30-day money-back guarantee if you change your mind

- They offer comparable features to the other Big Six banks

Cons

- Mortgage rates tend to be higher compared to the other Big Six banks

- For their miss-a-payment feature, you have to have a doubled payment in the current mortgage term

FAQs About Scotiabank Mortgage Rates

How often do Scotiabank mortgage rates change?

Rates can change based on the Bank of Canada’s interest rate announcements and market conditions.

How do I get a mortgage with Scotiabank?

Scotiabank makes it easy to apply for a mortgage with the following three options to suit your needs:

- Applying online using Scotiabank eHOME mortgages

- Setting up an appointment with a Scotiabank Home Financing Advisor

- Using a Scotia-Approved Broker

Can you negotiate a mortgage rate?

Yes. You can always try to negotiate a better mortgage rate. Because Scotiabank’s interest rates are the highest out there, you might stand a chance of them offering a lower rate if you show them what other banks offer. Also, as mentioned, they tend not to advertise their best rates, so it’s worth asking if they can do better.

Does Scotiabank offer cashback mortgages?

Yes, Scotiabank’s cashback program provides up to 5% cashback, which can be used for renovations, moving costs, or other needs.

Can I switch my current mortgage to Scotiabank?

Yes, Scotiabank offers a seamless mortgage switch program with competitive rates and flexible options.

Factors That Influence ScotiaBank Mortgage Rates

Several factors impact the rates offered by ScotiaBank, including:

1. Economic Conditions

- The Bank of Canada’s overnight rate directly affects variable rates.

- Inflation and market trends can lead to fluctuations in fixed rates.

2. Personal Financial Profile

- A credit score of 680 or higher qualifies for the best rates.

- A low debt-to-income ratio increases your approval chances.

3. Mortgage Type and Term

- Fixed rates offer stability, while variable rates may provide savings when interest rates are low.

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Let us simplify the process and help you secure approval quickly and stress-free!

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

Compare ScotiaBank Mortgage Rates

Final Thoughts - ScotiaBank MOrtgage rates

Scotiabank offers a wide range of mortgage solutions designed to meet the needs of Canadian homeowners. With competitive rates, flexible terms, and innovative programs like STEP, Scotiabank is an excellent choice for your mortgage. Partner with Citadel Mortgages to access the best rates and enjoy a seamless experience tailored to your needs.

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.