Private Mortgage Canada

Find the Best Private Mortgage Rates

Today’s Private Mortgage Rates updated as of October 17, 2025 7:39 pm

For a property located in

Private Mortgage Rates Start From*

*Private mortgage rates range from 4.99-16.99 with the average rate being 10.99%. Private mortgages carry lender and brokerage fees that range from 2-10% with the average being 6%. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Private Mortgages in Canada: Your Guide to Private Mortgage Lenders and Alternative Financing

Private mortgages in Canada offer a flexible and fast financing solution for borrowers who may not qualify for traditional bank loans or prefer more tailored options. Whether you’re self-employed, have a lower credit score, or need quick access to funds, private mortgage lenders provide unique opportunities to help you achieve your financial goals.

What is a Private Mortgage?

A private mortgage is a type of loan secured against real estate, provided by private lenders rather than conventional financial institutions. Private mortgage lenders in Canada include individuals, mortgage investment corporations (MICs), and private lending companies. This option is ideal for those seeking flexibility, as private lenders prioritize property value and equity over stringent income and credit requirements.

Our Private Mortgage Rates

1st Private Mortgage Rates

4.99-9.99%

( starts at 4.99% up to 80% ltv of home)

2nd Private Mortgage Rates

8.99-13.99%

(starts at 8.99% up to 80% ltv of home)

Why Choose a Private Mortgage?

Private mortgages in Canada offer borrowers access to funding when traditional channels may be restrictive due to credit, income verification, or time constraints.

- Flexible Approval Criteria: Private mortgage lenders evaluate loans based on the property’s value and equity, making them accessible to borrowers with varied financial backgrounds.

- Quick Approval and Funding: Private mortgages are known for faster approval processes, with funds often available within days, ideal for those needing rapid financing.

- Options for Credit Challenges: Private mortgages cater to those with lower credit scores or previous financial issues, making them a viable alternative for a wider range of borrowers.

- Self-Employed and Non-Traditional Income: With simpler income verification processes, private mortgage lenders are popular among self-employed individuals and those with non-traditional income sources.

Key Benefits of Private Mortgages in Canada

- Fast Approval Process: Private mortgage lenders typically offer quick approval times, often within a few days.

- Flexible Loan Terms and Interest Rates: Private mortgages offer customizable loan terms based on your financial needs and property value.

- No Minimum Credit Score Required: Approval is primarily based on the property’s value and equity rather than the borrower’s credit score.

- High Loan-to-Value (LTV) Ratios: Private mortgages in Canada can offer up to 85% LTV, depending on the lender and property type.

Common Uses for Private Mortgages

- Debt Consolidation: Combine multiple high-interest debts into one manageable payment with a private mortgage.

- Home Renovations and Upgrades: Access funds for home improvement projects that can increase your property’s value.

- Real Estate Investments: Use a private mortgage to purchase investment properties or expand your real estate portfolio.

- Bridge Financing: Private mortgages offer short-term solutions for homeowners transitioning between properties.

- Tax and Property Arrears: A private mortgage can help clear outstanding taxes and prevent potential financial complications.

Types of Private Mortgages

- First Mortgages: A first mortgage from a private lender is the primary lien on the property, with the lender in the first position on the title.

- Second Mortgages: These are used when a primary mortgage already exists. Private lenders issue a second mortgage based on the homeowner’s equity.

- Bridge Loans: Short-term financing for homeowners between buying and selling properties.

- Construction Loans: Private lenders provide construction loans to finance new builds or major renovations, releasing funds in stages.

Private Mortgage Rates in Canada

Private mortgage rates vary widely and depend on factors such as property location, loan amount, and LTV ratio. Interest rates for private mortgages typically range between 6% and 18%, reflecting the added flexibility and reduced credit requirements.

- Property Location and Value: Prime properties and locations often receive more favorable rates.

- Loan-to-Value (LTV) Ratio: Higher LTV ratios can result in higher interest rates, as they increase lender risk.

- Borrower Profile and Loan Amount: Borrowers with higher equity or stable finances may access better terms, and larger loan amounts sometimes qualify for lower rates.

Get a Private Mortgage with Citadel Mortgages

At Citadel Mortgages, we understand that there are times when you need a private mortgage. Our tailored private Mortgage program allows you to access up to 85% of your home equity, even if you have bad credit or low income. . If you have a history of bankruptcy or are currently in a consumer proposal, then you can access up to 80% of your home equity.

Why Choose Our Private Mortgage Program

- No Minimum Credit Score Required: We believe in giving everyone a chance, regardless of their credit history.

- No Job Verification Needed: We understand that steady income is only sometimes available, and we can work around that.

- Low income Accepted: Your income level won’t hinder your approval process.

- Quick Approval: Get approved fast and access your funds in just 3-5 business days.

- Debt Consolidation: We can help consolidate your debts, making it easier for you to manage your finances.

Benefits of a Private Mortgage with Citadel Mortgages

Our private mortgage program offers several advantages:

- Fast Cash Access: Receive cash quickly, helping you cover immediate expenses or investments in as little as 48-72 hours.

- Debt Relief: Pay off all your debts and work towards becoming debt-free while rebuilding your credit.

- Additional Funds: Get extra cash for home improvements, education, or other financial needs.

Who Can Benefit

Even if you have bad credit or low income, Citadel Mortgages can help. Our expert team specializes in fast private mortgages, ensuring that as long as your home has equity, you can get the approval you need.

How to Apply

Applying for a private mortgage with Citadel Mortgages is simple and straightforward. Here’s how:

- Contact Us: Fill out the form to the right, and our team will contact you to discuss your financial needs and eligibility.

- Submit Documentation: Provide necessary documents, including proof of home equity and identification.

- Get Approved: Receive quick approval and access your funds within 3-5 business days.

Contact Us To Get Approved Now

Private Mortgage Lender Requirements in Canada

Private mortgage lenders consider various factors when evaluating applications:

- Property Equity: Private lenders typically require at least 20% equity in the property.

- Property Location and Condition: Higher property values and well-maintained homes attract better rates.

- Clear Exit Strategy: Private lenders favor applicants with a clear repayment plan, such as property sales or traditional refinancing options

What Documents Do You Need For Your Private Mortgage?

These Documents will be required to close your private mortgage:

- Current Mortgage Information Statement -Must be dated the same month as your application form, if you do not have one you can contact your mortgage lender and request one to be sent to you by email.

- Most recent property tax statement -If you do not have this, then you can get the most updated statement from your local city hall.

- Most recent NOA may be requested to show no income tax owing – If income tax owing it will need to be paid out from the new private mortgage upon closing.

- Other documents may be required; our mortgage agents will help you if any additional documents are needed for your private mortgage needs.

- If it’s a private 1st mortgage then you will need the APS from your real estate agent.

Additional Documentation

- Other documents may be needed based on your unique situation. Our experienced mortgage agents at Citadel Mortgages will assist you in identifying and gathering any additional paperwork required to complete your private mortgage application.

What Fees Will You Encounter With a Private Mortgage?

When considering a private mortgage, it’s not just about the money you’ll receive, but also about the fees you’ll encounter. Understanding these costs upfront is a powerful tool that puts you in control, helping you evaluate whether the benefits outweigh the expenses. Here are some standard fees you may encounter:

Common Private Mortgage Fees

Administrative Fees:

Typically range from $150 to $200.

These fees cover the cost of processing your mortgage application.

This is a lender fee

Legal Fees:

Generally fall between $2500 and $3,500.

Legal fees are for the services of a lawyer to handle the mortgage documents and ensure everything is in order.

You pay for both your lawyer and the lender’s lawyer when closing a private mortgage.

Home Appraisal Fees:

Usually between $300 and $600.

Ussaly an appraisal is required to determine the current market value of your home when applying for a private mortgage, which is essential for securing a private first or second mortgage.

Please note if your home value is over 1 Million. Usually, the appraisal fee is higher.

It is important to note that the lender owns the appraisal; you typically do not get a copy.

Title Search Fees:

Range from $250 to $500.

The lawyer conducts a title search to verify that the property has a clear title, ensuring no legal issues could affect the mortgage.

Private Mortgage Lender Fees:

Typically, private lender fees range from 1% to 3% of the loan amount.

Private lenders charge these fees to compensate for the higher risk associated with first and second mortgages.

Sometimes, lender fees can be as high as 10-12%; the typical lender fees are 4-6%.

Mortgage Brokerage Fees

Mortgage brokers typically charge a brokerage fee because lenders do not compensate them for the time spent on your file. This fee is generally equivalent to the lender’s fee and covers the mortgage agent’s efforts in managing and processing your mortgage application.

Why These Fees Matter

Understanding all the fees associated with a private mortgage is essential for making an informed decision about pursuing one. By evaluating the costs and benefits, you can determine if a private mortgage is right for you.

How Private Mortgage Fees Are Handled

Typically, all fees are included in your mortgage amount, so you do not have to pay them out of pocket for second mortgages. However, if there is insufficient equity in your home or if it is a purchase transaction, you will need to pay these fees separately rather than add them to the mortgage.

At Citadel Mortgages, we provide clear information on all potential fees to ensure you are fully informed. Our goal is to inform you and guide you through the complexities of securing a private mortgage, providing the support you need to make the right decisions.

How to Apply for a Private Mortgage with Citadel Mortgages

At Citadel Mortgages, our experts streamline the private mortgage process, offering tailored solutions for your unique needs.

- Consultation: Discuss your financing needs with one of our private mortgage experts and explore possible options.

- Submit Application: Provide key information on your property and finances to begin the approval process.

- Property Assessment: A property evaluation is conducted to determine the market value and assess risk.

- Approval and Funding: Once approved, receive your funds quickly, often within just a few business days.

Private Mortgage Payment Options

Understanding Private Mortgage Payments

Private mortgage payments are typically structured around interest-only payments, with most lenders offering a monthly payment schedule. However, at Citadel Mortgages, we offer flexible payment options to suit your financial needs.

Payment Structures

- Interest-Only Payments: Most private mortgage lenders focus on interest-only payments, keeping your monthly obligations lower.

- Monthly Payment Schedule: The standard payment schedule is monthly, making it easier to manage your finances.

Flexible Payment Options

- Prepaid Interest Payments: We work with private lenders who allow you to prepay the interest for the entire term or a portion of the term. This option can help manage your budget and provide financial flexibility.

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

Private Mortgages and Power of Sale in Canada

For those exploring private mortgages, understanding the concept of a Power of Sale is essential. Power of Sale is a legal process that allows lenders to sell a property when a borrower defaults on their mortgage. This process helps private mortgage lenders recover the funds loaned out, protecting their investment.

What is Power of Sale?

In Canada, Power of Sale is a lender’s right to sell a property without court involvement if the borrower fails to meet mortgage obligations. Private mortgage lenders often rely on this process to mitigate risk, especially when lending to borrowers with lower credit scores or unconventional income sources. Power of Sale is more common in provinces like Ontario, where lenders can initiate the sale without going through a lengthy foreclosure.

How Power of Sale Works in Private Mortgages

- Notice Period: If a borrower defaults, the lender must issue a Notice of Sale. This document provides the borrower with a set time to repay missed payments.

- Redemption Period: This is a window (often 35 days) during which the borrower can bring the account up to date to avoid the sale.

- Sale Process: If the borrower does not settle the debt, the lender can list the property for sale to recover the loan balance, including interest and fees.

Why Power of Sale is Important for Private Mortgage Lenders

Private mortgage lenders view Power of Sale as a vital safeguard, as it ensures they have a legal route to recoup funds. This provision makes private mortgages viable for individuals with complex financial histories, as lenders have a recourse in place should issues arise.

Learn More About Power of Sale

For additional details on Power of Sale, see Government of Canada – Foreclosure and Power of Sale Information. Understanding these rules can empower borrowers to make informed decisions and stay financially prepared.

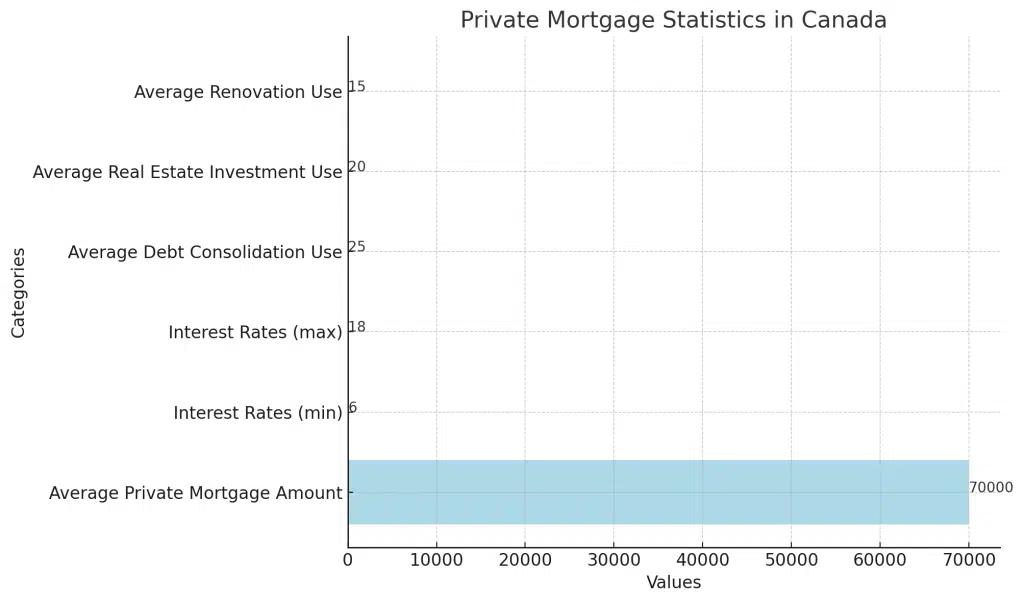

Private Mortgage Statistics in Canada

Private mortgage lending in Canada is a growing sector, with more Canadians turning to private lenders due to increased banking regulations. According to the Canada Mortgage and Housing Corporation (CMHC), private lenders, including mortgage investment corporations (MICs), have expanded their market share in recent years.

- Growth in Private Lending: A significant rise in private mortgages highlights demand for alternative financing due to stricter qualification standards.

- Average Private Mortgage Amount: Typical private mortgage loans in Canada range from $70,000 to $200,000, though amounts vary widely based on property and lender criteria.

- Loan Purposes: Common reasons for seeking private mortgages include debt consolidation, real estate investment, and funding renovations or property purchases.

Here is the chart image displaying private mortgage statistics in Canada.

Frequently Asked Questions (FAQs) About Private Mortgages in Canada

How do private mortgage lenders differ from traditional banks?

Private lenders offer more flexible approval criteria and shorter terms, with faster approvals, while traditional banks generally have lower interest rates but stricter requirements.

Can I get a private mortgage if I have bad credit?

Yes, private mortgage lenders focus on property equity, making these loans accessible to those with lower credit scores.

What are typical private mortgage terms?

Private mortgage terms usually range from 6 months to 3 years, often serving as short-term financing solutions.

Can a private mortgage be refinanced?

Yes, you can refinance a private mortgage, either with another private lender or by switching to a traditional mortgage when you meet eligibility criteria.

Are private mortgage interest rates tax-deductible?

Interest on private mortgages may be tax-deductible if the loan is used for investment purposes. Consult a tax advisor for specific advice.

What is the average term for a private mortgage?

A private mortgage in Canada is usually a 1 year interest only term.

Final Thoughts

Obtaining a private mortgage has its advantages and disadvantages. private mortgages offer the opportunity to access the equity in your home for purposes like consolidating debt, making home improvements, or funding the down payment on a second home.

It’s important to note that a private mortgage represents a significant financial commitment in addition to your existing payments, which can impact your debt-to-income ratios. private mortgages typically carry higher interest rates compared to normal mortgages, as lenders must account for the increased risk. Contact the experts at Citadel Mortgages for personalized advice to determine if a private mortgage is suitable for your situation!

For tailored guidance and competitive rates, get in touch with Citadel Mortgages. Our team will assist you throughout the process and support you in making sound financial decisions.

Why Choose Citadel Mortgages for Private Mortgage Solutions?

- Access to Top Private Lenders: We connect you with trusted private mortgage lenders across Canada, providing a range of options tailored to your needs.

- Competitive Rates and Fast Approvals: Our strong network and expert guidance ensure you receive competitive rates with a quick, streamlined process.

- Personalized Solutions: We specialize in creating custom solutions for borrowers facing credit challenges, those who are self-employed, and clients needing flexible financing options.

- Nationwide Service: Citadel Mortgages provides private mortgage solutions across Canada, helping you achieve your goals no matter where you are located.

Contact Us Today

Explore your options with Citadel Mortgages and secure a private mortgage tailored to your needs. Our team of experts is ready to help you navigate private mortgage lending in Canada.

Use Our Private Mortgage Calculator Today!

Understanding Your Private Mortgage Options

Using a private mortgage calculator can help you determine the potential costs and benefits of taking out a private mortgage. At Citadel Mortgages, we provide a comprehensive second mortgage calculator designed to give you accurate insights into your borrowing potential and monthly payments.

Benefits of Using Our Second Mortgage Calculator

- Accurate Estimates: Get precise calculations on your potential second mortgage amount based on your home’s equity, current mortgage balance, and other financial factors.

- Financial Planning: Understand your monthly payment obligations and how they fit into your overall budget.

- Interest Rate Comparison: Compare different interest rates to see how they affect your monthly payments and total loan cost.

- Loan Scenarios: Explore various loan scenarios to determine the best option for your financial needs.

How to Use the Second Mortgage Calculator

- Enter Your Home’s Current Value: Provide an estimate of your home’s current market value.

- Current Mortgage Balance: Input the remaining balance on your first mortgage.

The second mortgage calculator will then produce an estimate for you, please be sure to contact one of our mortgage brokers at Citadel Mortgages to help you get approved today!