Personal Loans for Homeowners Up To 95% LV | Tailored Solutions with Citadel Mortgages

Find the Best Second Mortgage Rates In Canada

Today’s Second Mortgage Rates updated as of September 16, 2025 2:13 pm

For a property located in

Second Mortgage Rates Start From*

4.99%

*Second mortgage rates range from 4.99-16.99 with the average rate being 10.99%. Second mortgages carry lender and brokerage fees that range from 2-10% with the average being 6%. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Unlock Your Home’s Equity with Citadel Mortgages

At Citadel Mortgages, we partner with trusted lenders like Prompt Financial and Fairstone to offer flexible personal loans for homeowners. Whether you need funds for renovations, debt consolidation, or unexpected expenses, our loans allow you to access up to 95% of your home’s value with competitive rates and flexible terms.

What Are Personal Loans for Homeowners?

Personal loans for homeowners leverage your home equity as collateral, allowing you to borrow larger amounts at lower interest rates compared to unsecured loans. These loans are ideal for homeowners looking to access their home equity without selling their property.

Read about how fixed and variable rates compare on the Government of Canada website.

Top Lenders for Homeowner Loans

Prompt Financial

Prompt Financial specializes in providing fast and straightforward loans for Ontario homeowners.

- Loan Amounts: Up to $200,000.

- Approval Time: Same-day or 24 hour approval available.

- LTV Ratio: Up to 80% of home value for secured loans.

- Repayment Terms: Flexible terms ranging up to 10 years.

- Why Choose Prompt Financial?: Prompt Financial is ideal for short-term financial needs with a hassle-free application process and quick funding.

Fairstone

Fairstone provides tailored home equity solutions for Canadians looking to access a higher loan-to-value ratio.

- Loan Amounts: Up to $50,000.

- Second Mortgages Amounts: Up to $125,000.

- Approval Time: Approvals within 24-48 hours.

- LTV Ratio: Borrow up to 95% of your home’s value with a second mortgage.

- Repayment Terms: Flexible terms from 12 to 120 months.

- Why Choose Fairstone?: Fairstone offers personalized loan options with competitive rates and a quick approval process.

Learn more about today’s best mortgage rates in Canada.

How Much Can You Borrow?

The amount you can borrow depends on your home’s appraised value and the existing mortgage balance.

Example:

- Home Value: $500,000

- 95% LTV: $475,000

- Existing Mortgage: $350,000

- Available Loan Amount: $125,000

This allows you to access significant funds while keeping your mortgage intact.

Benefits of Personal Loans for Homeowners

Higher Borrowing Power

- Leverage up to 95% of your home’s value for larger loan amounts.

Flexible Terms

- Choose repayment options that suit your financial situation.

Competitive Rates

- Secured loans offer lower interest rates compared to unsecured loans.

Fast Approval

- Access funds within 24-48 hours for urgent needs.

Multiple Uses

- Use the funds for debt consolidation, home renovations, or emergency expenses.

When considering a second mortgage, it is crucial to compare rates and terms from various private mortgage lenders. Citadel Mortgages helps you make an informed decision that best suits your financial needs.

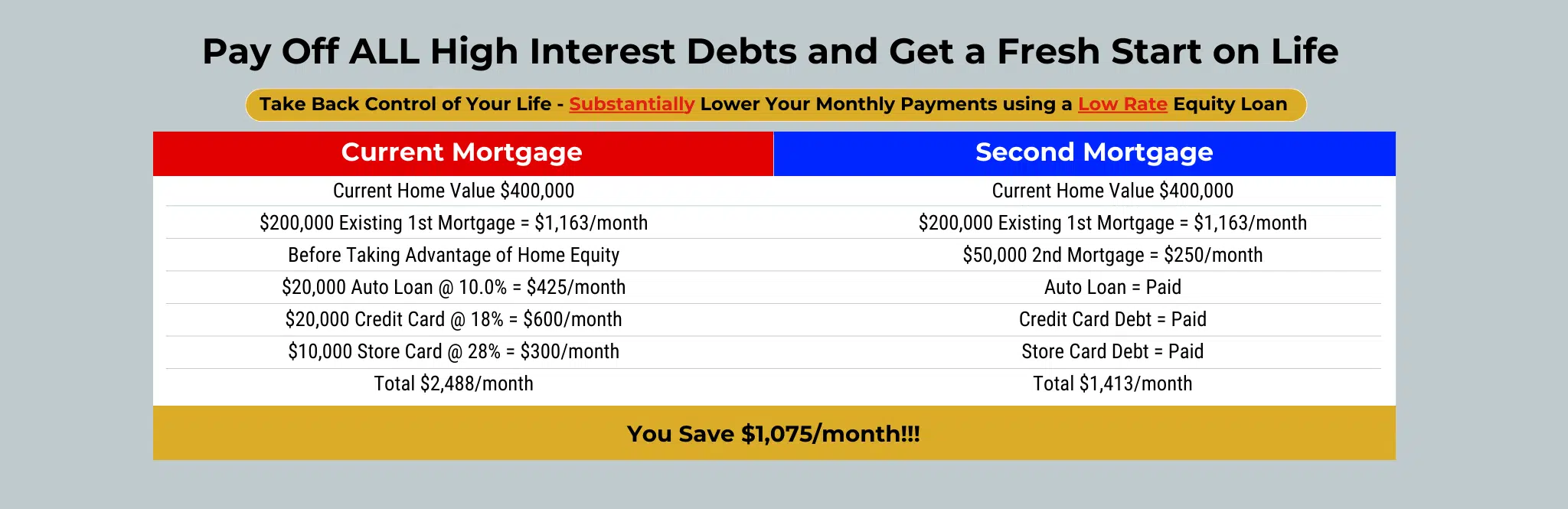

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

Eligibility Requirements Personal Loan For Homeowners:

A Personal Loan for Homeowners can help get you money for whatever you need, and the process is usually as little as 48 Hours. Due to the increased risk for the lenders, because this program sits in the second position, the interest rate is higher than the bank, but there are no high lender or brokerage fees that you would normally see with a traditional second mortgage. In many cases this personal homeowners loan is suitable for most of our clients.

What are the Requirements?

- Must be homeowners

- Must have credit 600 or above

- Must be able to afford the payments

- No Consumer Proposal or Bankruptcy for last 3 years.

- TDS can not be higher then 75%

What you do not have to worry about?

- High Lender fees

- High Brokerage Fees

- No Long application form to complete

- No need to wait weeks to close and get the money you need.

- No Appraisal needed usually, AVM is normally used.

This program has helped our clients receive the funds our clients need in a fast and reliable process, based on the equity in their property. See the difference for yourself and get approved today with our personal loan for homeowners solution program!

Common Uses for Homeowner Loans

- Consolidate Debt

- Renovate Your Home

- Invest In Your Business

- Pay Off A Consumer Proposal

- Pay Mortgage Arrears

- Purchase Investments including Real Estate

- Pay for wedding expenses

- Pay for education

- Cover medical expenses

- Pay CRA tax arrears

- Pay property tax arrears

- Take a family vacation

- Purchase a car

- Get out of high-interest loans

- Invest In RRSP or RESP

- Pay off payday loans

- Pay Off Judgments, Garnishments

- Finance whatever your specific needs may be

No matter your reason for the home equity take out, rest assured this personal homeowner loan could be the perfect solution for you. Quck funding in 48 hours or less.

What are you waiting for? See why many Canadians love to work with Citadel Mortgages, experience the difference yourself and get approved today!

What Documents Do You Need For Your Personal Loan For Homeowners?

These Documents will be required in order to close your personal loan for homeowner needs:

- 2 IDS Front & Back

- Completed Application Form

- Void Check or Pad Form

- Other documents may be necessary, our mortgage agents here at Citadel Mortgages will help you if any additional documents are required for your home equity loan needs

FAQs About Personal Loans for Homeowners

Can I get approved with bad credit?

Yes! Both Prompt Financial and Fairstone offer options for homeowners with less-than-perfect credit.

How long does the approval process take?

Prompt Financial offers same-day approval, while Fairstone typically approves applications within 24-48 hours.

What fees are involved?

Some lenders may charge appraisal or administrative fees, which will be disclosed during the application process.

How much can I borrow?

You can borrow up to 95% from Fairstone and up to 80% from Prompt Financial of your home’s value, minus any existing mortgage balance.

Final Thoughts - Personal Loans for Homeowners

Accessing a personal loan for homeowners is a powerful way to unlock the value of your home. With trusted lenders like Prompt Financial and Fairstone, Citadel Mortgages provides flexible options to meet your financial needs. Whether it’s debt consolidation, renovations, or emergency expenses, our team ensures you get the most value from your home equity.

It’s important to note that a second mortgage represents a significant financial commitment in addition to your existing payments, which can impact your debt-to-income ratios. Second mortgages typically carry higher interest rates compared to your first mortgage, as lenders must account for the increased risk of being in a secondary position. Contact the experts at Citadel Mortgages for personalized advice to determine if a second mortgage is suitable for your situation!

For tailored guidance and competitive rates, get in touch with Citadel Mortgages. Our team will assist you throughout the process and support you in making sound financial decisions.