National Bank Mortgage Rates | Compare and Save with Citadel Mortgages

Find the Best National Bank Mortgage Rates in Canada

Today’s Mortgage Rates updated as of October 7, 2025 1:53 pm

For a property located in

5-year fixed*

3.84

5-year Variable*

3.85

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

National Bank Mortgage Rates in Canada

National Bank is one of Canada’s leading financial institutions, offering a variety of competitive mortgage options tailored to suit your needs. At Citadel Mortgages, we help you access the best National Bank mortgage rates, saving you time and money while ensuring a seamless process.

Whether you’re a first-time homebuyer, refinancing, or renewing your mortgage, understanding current trends and available options helps you make informed financial decisions.

This guide focuses on helping you navigate the Canadian mortgage market, offering insights into current rates, strategies for securing the best deal, and regional trends.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

Current National Bank Mortgage Rates

Compare National Bank mortgage rates to other top lenders to ensure you’re getting the best deal. Contact us to explore all your options.

Learn more about today’s best mortgage rates in Canada.

Why Choose National Bank for Your Mortgage?

Competitive Rates

- Access some of the most attractive fixed and variable rates in Canada.

Flexible Payment Options

- Choose from weekly, bi-weekly, or monthly payment schedules.

Generous Prepayment Privileges

- Pay up to 10% of the original principal annually and increase your regular payments by up to 100%.

Mortgage Portability

- Move your mortgage to a new home without penalties.

Tailored Solutions

- Specialized programs for first-time homebuyers, investors, and those refinancing.

Read about how fixed and variable rates compare on the Government of Canada website.

National Bank Rates As Per Term

National Bank Mortgage Programs

Cashback Mortgages

- Receive cashback at closing to cover renovations, moving costs, or other expenses.

HELOC (Home Equity Line of Credit)

- Flexible borrowing against your home equity, perfect for ongoing projects or financial needs.

Explore HELOC Options

- Flexible borrowing against your home equity, perfect for ongoing projects or financial needs.

First-Time Homebuyer Mortgages

- Benefit from competitive rates and government incentives designed to help you purchase your first home.

Learn About First-Time Buyer Programs

- Benefit from competitive rates and government incentives designed to help you purchase your first home.

Refinancing Options

- Lower your interest rate, access your equity, or consolidate debt with National Bank’s refinancing solutions.

Discover Refinancing Benefits

- Lower your interest rate, access your equity, or consolidate debt with National Bank’s refinancing solutions.

National Bank Mortgage Application Checklist

To apply for a National Bank mortgage, you’ll need the following:

- A list of your current and previous addresses

- Current and previous employment information

- Proof of income such as a pay stub or bank deposits

- Recent bills

- Credit card statements

- The estimated value of your home

- A list of your monthly expenses

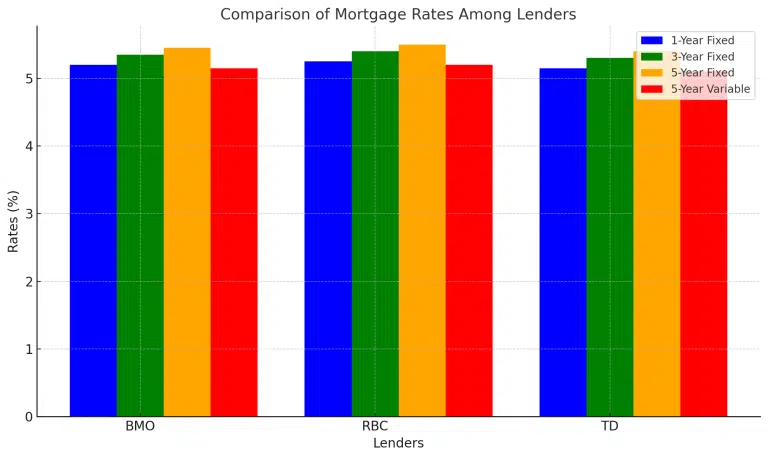

How National Bank Mortgage Rates Compare to Other Lenders

| Lender | 1-Year Fixed | 3-Year Fixed | 5-Year Fixed | 5-Year Variable |

|---|---|---|---|---|

| BMO | 5.20% | 5.35% | 5.45% | 5.15% |

| RBC | 5.25% | 5.40% | 5.50% | 5.20% |

| TD | 5.15% | 5.30% | 5.40% | 5.10% |

This table highlights how National bank competes with other leading Canadian lenders, offering competitive rates and flexible terms.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

How National Bank Fixed and Variable Rates Compare

| Feature | Fixed Rates | Variable Rates |

|---|---|---|

| Interest Rate Stability | Fixed throughout the term | Fluctuates with market rates |

| Payment Consistency | Predictable payments | Payments may vary |

| Risk Level | Low | Moderate to high |

| Ideal For | Long-term planners | Risk-tolerant borrowers |

Who Qualifies for National Bank Mortgage Rates?

To secure National Bank’s most competitive rates, you’ll need:

Good Credit Score

- A credit score of 680 or higher is recommended.

Stable Income

- Provide documentation such as pay stubs, T4 slips, or tax returns.

Down Payment

- A minimum of 5% for insured mortgages or 20% for uninsured mortgages.

Debt-to-Income Ratio

- Ensure your total monthly debts don’t exceed 42% of your gross income.

Start Your Prequalification Today

Benefits of Choosing National Bank Mortgages with Citadel Mortgages

Access to Exclusive Rates

- We leverage our partnerships to secure the best rates for our clients.

Customized Mortgage Solutions

- We match your financial goals with the ideal mortgage product.

Fast Approvals

- Get prequalified quickly with a streamlined process.

Expert Guidance

- Our team walks you through every step of the mortgage process, ensuring a stress-free experience.

FAQs About National Bank Mortgage Rates

Does National Bank offer cashback mortgages?

Yes, cashback mortgages are available and can help cover immediate expenses like renovations or legal fees.

How quickly can I switch my mortgage to National Bank?

The process typically takes 2-4 weeks, depending on your documentation and lender approval.

Can you negotiate a mortgage rate?

Although Canadian lenders post their mortgage rates, you can try to negotiate a better rate. Mortgage lenders are highly competitive, and depending on current market conditions, your employee status, and your credit score, they might be willing to give you a bit of a break.

What is the penalty for breaking a mortgage with National Bank

The terms of your mortgage agreement determine prepayment charges as follows:

- Open mortgage: An open mortgage allows you to pay off your entire mortgage at any time without penalties.

- Closed mortgage: There are charges for a closed mortgage based on whether you have a variable or fixed mortgage. Variable interest rates usually charge three months of interest, while fixed interest rates aren’t as cut and dry. It is based on the greater of three months’ interest or the Interest Rate Differential (IRD) amount.

I am new to Canada. How can I get a National Bank mortgage?

As a new Canadian without an established credit history, you can still qualify for a TD mortgage if you are or have applied to become a permanent resident and have been in Canada for five years or less.

Pros and Cons of Choosing National Bank

Pros

Competitive Rates

- Offers attractive fixed and variable mortgage rates to suit diverse financial needs.

Innovative Programs

- Unique mortgage products like cashback options and the All-in-One Home Equity Plan.

Generous Prepayment Options

- Pay up to 10% of the original principal annually and double your monthly payments.

Strong Customer Service

- Recognized for personalized service and flexible mortgage solutions.

Wide Accessibility

- A trusted name with branches and advisors across Canada.

Cons

Higher Closing Costs

- Appraisal and legal fees may not be covered by the lender in some cases.

Limited Promotions Outside Quebec

- Some exclusive offers are more accessible to Quebec residents.

Eligibility Requirements

- Stricter qualification criteria for the lowest rates, including a 680+ credit score.

History of National Bank

Founded in 1859, National Bank of Canada (Banque Nationale du Canada) has grown to become one of the country’s largest financial institutions, with a strong presence across Quebec and Canada. National Bank is well-known for its focus on customer service, financial innovation, and a commitment to helping Canadians achieve their financial goals.

Key Milestones

- 1859: Established in Montreal as Banque Nationale.

- 1979: Merged with Provincial Bank of Canada to form National Bank of Canada.

- Present: Recognized as a leader in digital banking and mortgage solutions.

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

Compare National Bank Mortgage Rates

Disclaimer

Citadel Mortgages operates an information-based website that displays mortgage rates from its partners. While the company strives to provide the best possible rates, it cannot guarantee their accuracy at all times. Therefore, Citadel Mortgages accepts no liability for the precision of the information presented and is not accountable for any damages resulting from its use. Terms and conditions apply, and it is necessary to speak with a mortgage broker for further details. Please note that the rates displayed in this article are for article use only.

Final Thoughts - NATIONAL BANK MORTGAGE RATES

National Bank has a rich history of delivering innovative financial products and personalized customer service

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.