Halal Mortgages in Canada: Sharia-Compliant Financing with Citadel Mortgages

Halal Mortgage Financing in Five Days – No Waitlist

Today’s Halal Mortgage Rates updated as of October 16, 2025 10:06 pm

For a property located in

At Citadel Mortgages, we proudly offer 100% Sharia-compliant halal home financing through our Murabaha-based mortgage product provided by EQRAZ. Designed with faith and transparency in mind, our program adheres strictly to Islamic finance principles, ensuring you can achieve homeownership without compromising your values.

Citadel Mortgages | Your Partner in Finding the Best Mortgage Solutions

Disclosure:

The halal home financing product described on this page is provided by EQRAZ, a trusted provider of Sharia-compliant financial solutions. Citadel Mortgages partners with EQRAZ to offer this ethical financing option to our valued clients.

Our Awards Since 2018

What is a Halal Mortgage?

A Halal mortgage, also known as Sharia-compliant financing, offers an ethical alternative to traditional mortgages by avoiding interest (riba), which is prohibited in Islam. Instead, halal mortgages use Islamic finance structures like Murabaha, Ijara, and Musharaka to ensure compliance with Islamic principles. At Citadel Mortgages, we exclusively offer the Murabaha Financing model, ensuring simplicity, transparency, and adherence to Sharia law.

Types of Halal Mortgages

1. Murabaha (Cost-Plus Financing) – Offered by Citadel Mortgages

The lender purchases the property and sells it to the buyer at a pre-agreed profit margin. The buyer repays in fixed installments over time. This is the sole structure we offer at Citadel Mortgages due to its simplicity and compliance with Islamic principles.

2. Ijara (Lease-to-Own Financing)

In this model, the lender retains ownership of the property while the buyer leases it. Ownership is transferred to the buyer once the lease term ends. (Not offered by Citadel Mortgages)

3. Musharaka (Shared Ownership Financing)

The buyer and lender jointly purchase the property, and the buyer gradually acquires full ownership by buying out the lender’s share over time. (Not offered by Citadel Mortgages)

Key Features of Halal Mortgages with Citadel Mortgages

- Fast Approval and Closing: Finalize your halal mortgage within five business days, with no lengthy waitlists.

- Murabaha Structure: Our financing model allows you to purchase your home without interest (riba), paying a fixed profit margin over time.

- Early Payoff Option: Close your mortgage anytime by repaying the remaining principal and approximately three months of profit as a fee.

- Full Ownership: The title belongs entirely to you from the start, giving you peace of mind that your home is truly yours.

- 100% Halal Funding: All financing is sourced through AAOIFI-compliant Wakala Agreements, ensuring every step of the process aligns with Islamic values.

At Citadel Mortgages, we proudly offer 100% Shariah-compliant Halal home financing through our trusted Murabaha mortgage product, provided in partnership with EQRAZ. This innovative solution adheres to AAOIFI standards, ensuring ethical and transparent financing for our clients.

Our Murabaha mortgage allows you to close your financing agreement anytime by simply repaying the remaining principal along with a fee equivalent to approximately three months of profit. The property title belongs entirely to you from the start, giving you the confidence and peace of mind that your home is truly yours.

The funding for this program is 100% halal, sourced through Shariah-certified, AAOIFI-compliant Wakala Agreements. With a fully funded program, we are issuing mortgages within as little as five business days of application, serving clients across most provinces in Canada. Let us help you achieve your dream of homeownership in a way that aligns with your values.

Halal Mortgage Rates in Canada

Halal mortgage rates in Canada differ from traditional mortgage rates. Instead of interest rates, profit margins are applied. Rates are competitive and reflect market conditions.

- Typical Profit Margin: 5%–6.5% (varies by property value and term).

- Term Options: 1–5 years, renewable.

- Amortization Period: Up to 25 years.

For example, a $500,000 property financed under Murabaha with a 5.5% profit margin over a 25-year term would result in predictable monthly payments, ensuring affordability and compliance.

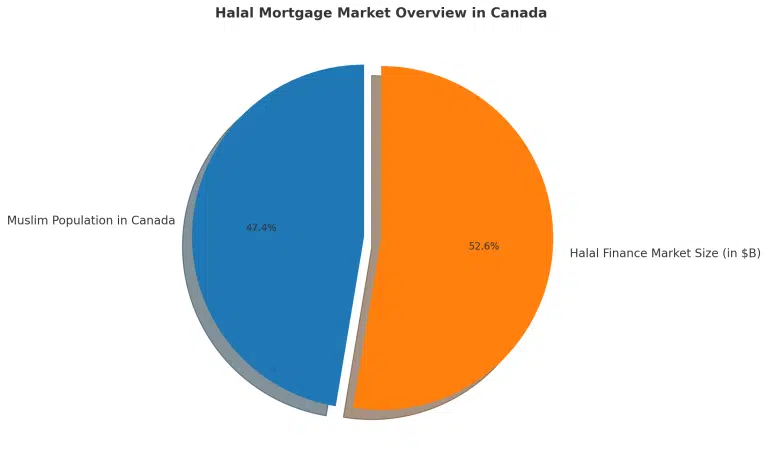

Halal Mortgage Statistics in Canada

- Growing Demand: Canada’s Muslim population has grown to over 1.8 million, driving the need for Sharia-compliant financial products.

- Halal Market Size: The halal financial market in Canada is valued at over $2 billion, with increasing adoption in the real estate sector.

- Demand: Major cities like Toronto, Vancouver, Calgary, and Ottawa have the highest demand for halal mortgages.

- Homeownership Trends: Approximately 65% of Muslim households in Canada own their homes, with many seeking Sharia-compliant financing.

Using a mortgage broker that has access to this type of mortgage financing, is key to ensure you have the best approval.

Approval Process for Halal Mortgages

- Application Submission: Provide basic personal and financial details.

- Property Appraisal: Independent property valuation.

- Documentation: Proof of income, identification, and financial history.

- Approval: Receive conditional approval with a detailed Murabaha agreement.

- Closing: Agreements are finalized, and the property is transferred to the buyer under Murabaha terms.

Terms of Halal Mortgages with Citadel Mortgages

- Maximum Financing Amount: Up to $750,000 (case-by-case approvals up to $1.25M)

- Flexible Terms: 1 to 5 years, renewable

- Amortization Period: Up to 25 years

- No Interest: Structured on profit margins, not interest rates.

Available Across Canada

Our halal mortgage solutions are available in all provinces, providing access to ethical and transparent home financing for Canadian Muslims. Whether you’re purchasing your first home, upgrading, or refinancing, Citadel Mortgages has you covered.

Fees and Costs For HALAL MORTGAGE PROCESS

- Application Fee: $500 (non-refundable).

- Commitment Fee: $5,000 or 2% of the financing amount (whichever is higher).

- Legal Fees: $3,000–$4,000 on average.

- Appraisal Fee: $300–$700.

These fees are transparent and disclosed upfront to ensure clarity.

Example Calculation: How Daily Payments Reduce Costs

A $500,000 property financed through a Halal mortgage with a profit margin of 5% would result in predictable monthly payments. Unlike conventional interest-based mortgages, every payment directly contributes to equity ownership.

Halal Mortgage Qualification Criteria

Eligibility Requirements for Halal Mortgages with Citadel Mortgages

Our Halal mortgage program adheres to Sharia principles, ensuring ethical and compliant financing. Below are the detailed qualification criteria:

Purpose of Financing

- Purchase: Suitable for first-time buyers or repeat purchasers.

- Refinance: Allows homeowners to access equity while maintaining Sharia compliance.

- Transfer/Switch: Transfer an existing conventional mortgage to a Halal financing option.

Key Qualification Criteria

1. Down Payment

- Minimum 20% down payment from personal resources.

- Gifted funds are acceptable if sourced from family.

- Payments must be made through a Canadian bank account. No cash or overseas transfers allowed.

2. Credit Score and History

- Minimum 700 beacon/FICO score.

- Only one major derogatory credit event (e.g., bankruptcy, consumer proposal) allowed, with a valid explanation.

3. Income Requirements

Salaried Income:

- Last two recent pay stubs.

- Last two years of T4 slips.

- Employment letter dated within the past 90 days.

- Bank statements for 90 days confirming deposit of earnings.

Self-Employed Income:

- Two years of T1 Generals with NOA and Statement of Business Activities.

- Last three months of business bank statements.

- Articles of Incorporation and valid business license.

- Additional contracts or invoices to confirm income generation.

Debt Service Ratios

- GDS (Gross Debt Service): Maximum 39%.

- TDS (Total Debt Service): Maximum 44%.

Property Requirements

- Primary owner-occupied residential property.

- Maximum of 4 units, with at least 1 unit owner-occupied.

- Properties must be located in major urban centers with populations:

- Greater than 100,000 in Ontario.

- Greater than 250,000 in other provinces.

Financing Amounts

- Minimum: $100,000.

- Maximum: $750,000 (case-by-case approvals up to $1,250,000).

Amortization and Term

- Up to 300 months (25 years) amortization.

- Terms available up to 60 months (5 years).

Fees and Prepayment Options

- Prepayment: Up to 20% of the original principal allowed annually without penalty.

- Early payout: Greater of 3 months’ profit or Profit Rate Differential (PRD).

Ineligible Properties

- Pre-construction homes.

- Condo hotels, agriculture, and mixed-use properties.

- Properties smaller than:

- 700 sq. ft. for single-family dwellings.

- 500 sq. ft. for condominiums.

FAQs About Halal Mortgages

What is the difference between Murabaha and traditional mortgages?

Murabaha avoids interest by structuring payments as a profit margin on the property price, ensuring compliance with Islamic principles.

Are there penalties for early payments?

You can make additional payments of up to 20% annually without penalties.

What is the maximum financing amount?

Up to $750,000, with case-by-case approvals for amounts up to $1.25M..

Can I refinance with a Halal mortgage?

Yes, refinancing options are available, adhering to the same principles.

How do profit rates compare to interest rates?

Profit rates are competitive and fixed for the term, ensuring predictable payments.

Is there a wait list like other Halal Mortgage Programs?

There is no waitlist for the Halal mortgage program offered through EQRAZ. The approval and closing process is designed to be efficient, with mortgages being finalized within five business days, ensuring fast access to Sharia-compliant home financing.

Final Thoughts - Halal MOrtgages

Citadel Mortgages is committed to providing Sharia-compliant financing tailored to meet the unique needs of the Muslim community in Canada. With transparent terms, no interest, and adherence to Islamic principles, our Halal mortgage program ensures ethical and affordable home financing.

Take the first step toward owning your dream home by contacting us today!