First-Time Homebuyer Programs in Canada | Citadel Mortgages

Find the Best Mortgage Rates in Canada

Today’s Mortgage Rates updated as of October 18, 2025 5:47 am

For a property located in

5-year fixed*

3.79

5-year Variable*

3.85

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

First-Time Homebuyer Programs in Canada

Purchasing your first home is a significant milestone, but it can also be financially overwhelming. At Citadel Mortgages, we simplify the process by offering expert advice and access to the best first-time homebuyer programs in Canada. These programs are designed to reduce upfront costs, provide tax benefits, and make homeownership more accessible.

What Are First-Time Homebuyer Programs?

First-time homebuyer programs are government-backed initiatives and financial tools aimed at helping Canadians achieve homeownership. These programs include tax credits, rebates, and shared-equity loans to make purchasing a home more affordable.

This guide focuses on helping you navigate the Canadian mortgage market, offering insights into current rates, strategies for securing the best deal, and regional trends.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

Key Updates for First-Time Homebuyers in Canada

1. Extended Amortization to 30 Years

Effective December 15, first-time homebuyers can access mortgages with a 30-year amortization. This allows for lower monthly payments, making homeownership more manageable, especially in higher-cost markets.

2. Increased Purchase Price Limits

The maximum purchase price for homes eligible under certain first-time homebuyer programs has increased to $1.5 million. This reflects the rising cost of real estate in many regions and provides more flexibility for buyers.

Learn more about today’s best mortgage rates in Canada.

Top First-Time Homebuyer Programs in Canada

1. Home Buyers’ Plan (HBP)

- How It Works: Withdraw up to $35,000 from your RRSP tax-free to use toward your down payment.

- Eligibility:

- Must be a first-time buyer or not have owned a home in the last four years.

- Repayment: Repay the withdrawn amount over 15 years to avoid tax penalties.

Learn more about the Home Buyers’ Plan on the CMHC website.

2. GST/HST New Housing Rebate

- How It Works: Reclaim a portion of the GST/HST paid on new or substantially renovated homes.

- Eligibility:

- Must occupy the property as your primary residence.

For more details, visit the Government of Canada’s New Housing Rebate page.

3. Land Transfer Tax Rebates

- How It Works: Rebates on provincial land transfer taxes, with savings of up to $4,000 in Ontario and other provinces.

- Eligibility:

- Must be a Canadian resident and a first-time homebuyer.

Learn about Land Transfer Tax Rebates on the Ontario government site.

4. First-Time Home Savings Account (FHSA)

- How It Works: Save up to $8,000 annually, with a lifetime maximum of $40,000, tax-free. Contributions are tax-deductible, and withdrawals used for purchasing a home are tax-free.

- Eligibility:

- Must be a Canadian resident and a first-time buyer.

Read more about the FHSA program.

Read about how fixed and variable rates compare on the Government of Canada website.

How Much Can You Save as a First-Time Homebuyer?

| Program | Maximum Benefit |

|---|---|

| Home Buyers’ Plan (HBP) | $35,000 tax-free withdrawal |

| GST/HST New Housing Rebate | Varies by province |

| Land Transfer Tax Rebates | Up to $4,000 |

| First-Time Home Savings Account (FHSA) | $40,000 tax-free savings |

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

Lowest First Time Home Buyer Mortgage Rates In Canada

How to Qualify for First-Time Homebuyer Programs

To benefit from these programs, you’ll need to meet specific requirements:

First-Time Buyer Status

- You must not have owned a home in the past four years.

Income Limits

- Some programs require household incomes below specific thresholds.

Down Payment

- A minimum of 5% for homes priced up to $500,000.

Primary Residence Requirement

- The property must serve as your primary residence.

Creditworthiness

- A credit score of at least 600 is often required.

Mortgage Rates for First-Time Homebuyers

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Let us simplify the process and help you secure approval quickly and stress-free!

Benefits of Monitoring the Target Overnight Rate

Staying updated on the Bank of Canada’s target overnight rate helps homeowners and buyers:

- Plan Financially: Understand how potential rate changes may affect your monthly payments.

- Refinance Strategically: Take advantage of lower rates when refinancing an existing mortgage.

- Lock in Competitive Rates: Secure a fixed rate before anticipated rate increases.

- Avoid Surprises: Prepare for potential increases in borrowing costs.

Bank of Canada Rate Announcements for 2025

The Bank of Canada schedules eight interest rate announcements annually, providing updates on monetary policy.

- Next Announcement: Check the official Bank of Canada Rate Schedule for the next update.

Should You Choose Fixed or Variable Rates in 2025?

With the Bank of Canada targeting inflation control, many Canadians face the dilemma of choosing between fixed and variable mortgage rates.

| Feature | Fixed Rate | Variable Rate |

|---|---|---|

| Payment Stability | Consistent payments for the term | Payments fluctuate with the prime rate |

| Interest Costs | Slightly higher but predictable | Lower initially but may increase |

| Risk Tolerance | Ideal for risk-averse borrowers | Suitable for those comfortable with rate changes |

| Market Outlook | Best if rates are expected to rise | Best if rates are expected to fall |

Citadel Mortgages Making Your Home Buying Simple!

Whether you are a first time home buyer or buying your next home, selecting the right financing for your home is of MAJOR IMPORTANCE. In today’s market, there are many different lenders and products for you to choose from, and on top of that, the lending rules and regulations are constantly changing. Therefore, the task of finding the most suitable rate and terms for your new mortgage can become a challenging task.

With the recent mortgage rule changes, now more then ever it is essential to work with a trusted mortgage agent or mortgage broker to ensure your approval for the best mortgage rate and mortgages terms, regardless of your credit, income or being self-employed or new to Canada.

Citadel Mortgages has the best mortgage solutions to match your needs. See the Difference for Yourself, Get Approved Today!

Documents Needed for Mortgage Approval in Canada

- Government ID: Driver’s license, passport, or permanent resident card.

- Proof of Income: Recent pay stubs, T4 slips, or self-employment income proof.

- Employment Verification: Letter from your employer detailing salary and position.

- Down Payment Proof: Bank statements or proof of savings.

- Credit Report Authorization: Permission for lenders to access your credit history.

Additional Documentation

- Other documents may be needed based on your unique situation. Our experienced mortgage agents at Citadel Mortgages will assist you in identifying and gathering any additional paperwork required to complete your second mortgage application.

FAQs: First-Time Homebuyer Programs

Can I combine multiple programs?

If you haven’t already done so, you should get pre-approved before you start your home hunting. The reason is simple; you will know how much you are approved for so that you save time searching for homes that are within your reach. Additionally, having a pre-approval gives you power in negotiation as both the seller and real estate agents know that you are a serious buyer who can close.

Our Pre-approval for your mortgage is valid for up to 120 days, with some of our pre-approvals valid up to 365 days if you are buying a new condo or home build from a developer. Ask us here at Citadel Mortgages how we can ensure your next mortgage is a smooth transaction!

Are there any benefits for newly constructed homes?

Even if you have 15 to 20% of the property value for a down payment, it may not be enough to qualify for a loan, under the new rules, from a traditional lender such as a bank. As of January 1, 2018, new regulations were put in place, which makes it harder for first-time home-buyers and even experienced home-buyers to secure the loan they need.

What’s the minimum down payment required for first-time buyers?

- You do not meet the regular bank-lending criteria and need to work with an alternate lender

- You are now required to qualify at an above-contract level

- You have 20% down payment or want to refinance your home

How does the stress test work?

The rate will be the greater of the five-year benchmark rate published by the Bank of Canada OR the lender contractual mortgage rate +2.0%. For example:

OLD RULES

- 20% down payment

- 5-year fixed mortgage rates of 3.24%

- 25-year amortization

A family with an annual income of $100,000 can afford a home worth $579,438.09

NEW RULES

- Applying the new “stress-test,” the family must qualify for the mortgage using the greater of 5.14 % and/or 5.24% (calculated as 2% + 3.24%).

- Therefore, with 20% down payment, a 5-year fixed rate of 5.24%, and a 25-year amortization, the family can now afford a home worth $494,045.76

The difference is that under the new rules, the family’s affordability has dropped by $85,392.33. As you can see, the new rules impact the mortgage you qualify for, with a proper mortgage agent form Citadel Mortgages we can help you understand how the rules impact and get you approved today!

Use Our Mortgage Calculator Today!

Understanding Your Mortgage Options

Use our mortgage calculator to gain a clearer picture of what you can expect in terms of monthly payments, interest costs, and amortization schedules. Simply input your loan amount, interest rate, and amortization period to get started. This tool provides estimates to help you make informed decisions as you explore different mortgage options.

Benefits of Using Our Mortgage Calculator

- Accurate Estimates: Get precise calculations on your potential second mortgage amount based on your home’s equity, current mortgage balance, and other financial factors.

- Financial Planning: Understand your monthly payment obligations and how they fit into your overall budget.

- Interest Rate Comparison: Compare different interest rates to see how they affect your monthly payments and total loan cost.

- Loan Scenarios: Explore various loan scenarios to determine the best option for your financial needs.

Final Thoughts - First-Time Homebuyer Programs

With updated programs like the FHSA, increased purchase price limits, and extended amortization, first-time homebuyers in Canada have more opportunities than ever to make homeownership affordable. At Citadel Mortgages, we provide the tools, resources, and expert advice to ensure your first home purchase is a success

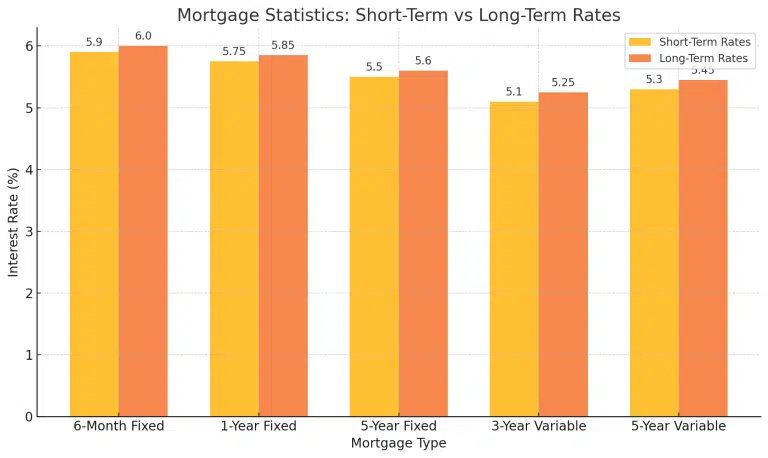

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

Why Choose Citadel Mortgages

At Citadel Mortgages, we pride ourselves on offering expert, client-focused mortgage solutions that stand out in the industry. Here’s why you should choose us:

Expertise Across Canada

Our mortgage brokers are licensed and certified across multiple provinces, providing exceptional advice and service tailored to your unique needs. Our mortgage brokers are committed to delivering the highest standards of professionalism and expertise.

Client-Focused Service

Unlike traditional commission-based models, our mortgage agents are evaluated based on client satisfaction and the quality of their advice. This ensures that you receive impartial guidance on the best mortgage options for your situation.

Competitive Rates

Citadel Mortgages offers competitive rates that help you save money over the life of your mortgage. Our team works diligently to find the most favorable terms to suit your financial goals.

Transparent and Seamless Process

We are dedicated to transforming the mortgage industry by offering a transparent, seamless process. Our 100% digital platform ensures that you can manage your mortgage application from start to finish with ease and confidence.

Commitment to Excellence

At Citadel Mortgages, our mission is to provide a positive, empowering, and transparent property financing experience. We simplify the mortgage process to make it as straightforward and stress-free as possible.

Contact Us Today

For personalized advice and the best mortgage rates in Toronto, contact our licensed and knowledgeable mortgage experts at Citadel Mortgages.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.