CIBC Mortgage Rates in Canada | Compare & Save with Citadel Mortgages

Find the Best CIBC Bank Mortgage Rates in Canada

Today’s Mortgage Rates updated as of October 13, 2025 10:42 am

For a property located in

5-year fixed*

3.84

5-year Variable*

3.85

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Discover Competitive CIBC Mortgage Rates in Canada

CIBC (Canadian Imperial Bank of Commerce) is one of the country’s leading lenders, offering competitive mortgage rates for fixed, variable, and cashback options. At Citadel Mortgages, we work to match you with the best mortgage solution from CIBC or other top lenders, ensuring you save money and achieve your financial goals.

Whether you’re a first-time homebuyer, refinancing, or renewing your mortgage, understanding current trends and available options helps you make informed financial decisions.

This guide focuses on helping you navigate the Canadian mortgage market, offering insights into current rates, strategies for securing the best deal, and regional trends.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

Today’s CIBC Mortgage Rates

Compare CIBC mortgage rates to other top lenders to ensure you’re getting the best deal. Contact us to explore all your options.

Learn more about today’s best mortgage rates in Canada.

Prime Rate | Variable Rate | Fixed Rate | Per Term | Rate History | Checklist | Features | How it Works | How To | History | FAQ

CIBC Prime Rate

CIBC’s Prime Rate provides the basis for their various loans and mortgages. Prime rates change when the Bank of Canada raises or lowers its overnight rate. The CIBC bases their mortgages on the prime rate, but because your home is collateral for the loan, the rate tends to be lower than the prime. However, we should point out that CIBC mortgage rates are closer to the prime than other leading Canadian banks.

CIBC Variable Mortgage Rates

If you have a variable-rate mortgage, your interest rate changes based on the specified financial index in your mortgage. This is often the CIBC Prime Rate. Your mortgage agreement explains how changing interest rates impact your payments. Often, your regular payments stay the same. However, when interest rates decrease, more of your payment covers the principal, while more goes towards interest if they increase.

CIBC Fixed Mortgage Rates

If you have a fixed-rate mortgage, your interest rate and monthly payments stay the same for the full term of the mortgage agreement. However, once the term ends, the latest interest rates apply, changing how much you pay each month.

Read about how fixed and variable rates compare on the Government of Canada website.

CIBC Mortgage Rates as Per Term

CIBC 5-Year Fixed and Variable Rate History

Here is a brief history of the past fixed and variable rates for CIBC:

- Year: 2020 Fixed: 2.97% Variable: 2.45%

- Year: 2021 Fixed: 2.37% Variable: 1.54%

- Year: 2022 Fixed: 4.42% Variable: 3.24%

Why Choose CIBC for Your Mortgage?

1. Competitive Rates

CIBC offers some of the best fixed and variable rates, helping you secure lower monthly payments.

2. Flexible Prepayment Options

Pay up to 20% of your mortgage balance annually without penalties, reducing your interest costs.

3. Rate Lock for Pre-Approvals

Lock in your rate for up to 120 days, protecting you from rate increases while you shop for your home.

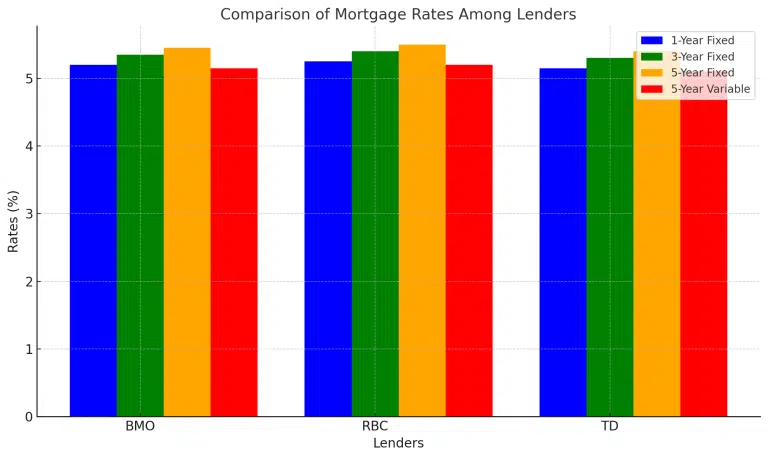

How CIBC Mortgage Rates Compare to Other Lenders

| Lender | 1-Year Fixed | 3-Year Fixed | 5-Year Fixed | 5-Year Variable |

|---|---|---|---|---|

| CIBC | 5.20% | 5.35% | 5.50% | 5.10% |

| RBC | 5.25% | 5.40% | 5.45% | 5.15% |

| TD | 5.15% | 5.30% | 5.40% | 5.05% |

By working with Citadel Mortgages, you can compare rates from CIBC and other lenders to ensure you get the best deal.

This table highlights how BMO competes with other leading Canadian lenders, offering competitive rates and flexible terms.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

CIBC Mortgage Application Checklist

When applying for a CIBC mortgage, they require the following documents:

- Confirmation of your down payment

- Current employment and amount of income

- Savings or investments statement from the last 90 days

- Copy of recent pay slips

- Evidence of recent pay deposited electronically

- T1 General and associated Notice of Assessment (NOA)

- A copy of the sale agreement in the case of a recent sale

- Withdrawal from RRSP through the Home Buyer’s Plan, if applicable

- Gift Letter, if applicable

- Previous employment (if required)

- Additional income sources (if any)

- A list of current assets and liabilities

- A copy of the real estate listing

- Bank account and transit number for payments

- A copy of the accepted purchase and sale agreement

- Your CIBC Pre-Approved Mortgage Certificate, if applicable

- The property’s full address, including legal description and postal code

- Property tax estimates, condo fees, and heating costs (usually available on the real estate listing)

- Well and septic certificates when purchasing a rural property

- Your real estate lawyer’s name, address, postal code, telephone, and fax number

CIBC Mortgage Features

CIBC is often criticized for not offering any payment breaks for its clients like other leading banks in Canada. And this really is a big deal. Most banks offer an annual missed payment option each year. However, they do provide the following other features:

- CIBC Mortgage Prepayment Allowance:

You can prepay up to 20% of your original mortgage balance each year without penalty. This is always worth taking advantage of as it allows you to pay down your mortgage more quickly while reducing how much interest you pay over the life of your mortgage. CIBC offers the highest prepayment you’ll find Canadian banks provide, which is a plus. - CIBC Increase Your Mortgage Payment:

You can double your CIBC monthly mortgage payment, which goes towards your principal, reducing how much you pay in interest in the long term. You also pay your mortgage faster. - CIBC Increase Your Payment Frequency:

You can choose weekly or bi-weekly payments instead of monthly payments. This reduces interest by paying down your principal faster. - CIBC Property Tax Payments:

Most mortgages require you to pay your property taxes to your bank on top of your mortgage payments. Some types of mortgages don’t have this requirement, but CIBC will collect your taxes as a free service if you like. This makes life easier as you pay in small amounts over the year and don’t have to remember to make payments on your own. - CIBC Mortgage Protection Insurance:

It’s worth considering CIBC mortgage protection to cover your mortgage payments in the event of death, disability, or long-term illness. The only thing is that it does increase your monthly mortgage payments. On the plus side, your premiums are set for the life of your mortgage. Unfortunately, CIBC also has a maximum coverage limit of $750,000, which doesn’t provide a total mortgage payoff if the balance owed is on a higher-priced home. Be sure to review the premiums and payout so you understand how much it will cost you each month and how much of your mortgage will be paid should the unthinkable happen.

CIBC Mortgages: How It Works

Mortgages are loans used specifically to purchase a home. As you pay down the loan, you build equity in your home. The equity is realized when you either sell your home or want to access cash via a home equity loan. Equity is the difference between what you owe on your mortgage and the value of your home.

Your mortgage has a “term” that determines how long the interest rates and conditions are in effect. This is usually five years but can be as short as a year or as long as 10. Each term comes with an interest rate, payment amount, and timeline, which are renegotiated and renewed when the period ends. Interest rates are based on CIBC’s current rates, which will impact how much your payments are each month.

The term is different from amortization. Amortization is the time it takes you to pay off your entire mortgage and all the interest the bank applies. It usually takes about 25 years to pay down a mortgage when you aren’t making any prepayments.

If you fail to make your payments over several months, the bank can “foreclose” on your mortgage and take your home to regain the money owed on the house.

Factors That Influence CIBC Mortgage Rates

Several factors impact the rates offered by CIBC, including:

1. Economic Conditions

- The Bank of Canada’s overnight rate directly affects variable rates.

- Inflation and market trends can lead to fluctuations in fixed rates.

2. Personal Financial Profile

- A credit score of 680 or higher qualifies for the best rates.

- A low debt-to-income ratio increases your approval chances.

3. Mortgage Type and Term

- Fixed rates offer stability, while variable rates may provide savings when interest rates are low.

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Let us simplify the process and help you secure approval quickly and stress-free!

How to Get a CIBC Mortgage Pre-Approval

You can start the CIBC mortgage pre-approval process online. Complete their online application form, and someone will contact you. Pre-approval tells you whether you qualify for a CIBC mortgage or not. If you are eligible, CIBC tells you how much they will lend you. Pre-approval also provides a locked-in interest rate until you either find your home or for 120 days, whichever comes first. Should interest rates decrease, you will be given the lowest rate.

CIBC’s History

CIBC is the result of Canada’s largest bank merger in history. It consisted of the Canadian Bank of Commerce, established in 1867, and the Imperial Bank of Canada, established in 1875. The merger took place on June 1, 1961. Later, CIBC entered into asset management with a stake in TAL Investment Counsel. However, the Canadian government blocked their plans to merge with TD bank in 1998.

This was followed by another failure when they attempted to merge with Manulife Financial in 2002. Talks fell apart when both parties realized they would not likely get approval from the government. Despite these mergers falling through, they did expand with the acquisition of Wood Gundy and Merrill Lynch Canada. Since 2010 CIBC has continued to expand with the acquisitions of multiple wealth management firms and has its sights set on expansion in the U.S.

FAQs: CIBC Mortgage Rates

Are CIBC rates lower than other banks?

No, CIBC tends to have much higher rates. For example, their five-year fixed rate was 6.49%, BMO was 5.09%, TD was 5.44%, and RBC was 5.69%.

How do I get a mortgage with CIBC?

You can apply online, via phone, or by appointment at your local branch or mobile bank advisor.

Can you negotiate a mortgage rate?

Considering CIBC is amongst the highest interest rates in Canada, it is worth trying to negotiate a better rate. You can reference similar mortgage products and features at other banks for leverage. Be sure to point out that they do not offer any break on payments.

How do I contact CIBC about mortgage payments?

Most mortgage-related questions are answered at their central number: 1-888-264-6843.

Can you skip a mortgage payment with CIBC?

No, CIBC is the only big bank not offering a mortgage feature to pause your monthly mortgage payment. With its higher interest rates, it is not the best bank to consider, especially for first-time buyers.

What credit score is needed for a CIBC mortgage?

In most cases, CIBC needs a credit score of at least 600 to qualify for a mortgage, but they often want your score to be even higher. This is particularly true if you are self-employed or have non-traditional sources of income such as commission, freelance work or owning your own business.

Can I switch my mortgage to CIBC?

Yes, CIBC offers mortgage transfer options with potential cashback incentives for eligible borrowers.

Can I switch my mortgage to CIBC?

Yes, CIBC offers mortgage transfer options with potential cashback incentives for eligible borrowers.

How do I lock in a CIBC mortgage rate?

You can lock in your rate for up to 120 days by getting pre-approved through CIBC or Citadel Mortgages.

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

Compare CIBC Mortgage Rates

Final Thoughts - CIBC MOrtgage rates

Choosing the right mortgage rate can significantly impact your financial future. At Citadel Mortgages, we help you compare CIBC mortgage rates with other top lenders to ensure you make the best decision. Contact us today to start saving and achieving your homeownership goals.

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.