Cashback Mortgage Rates in Canada | Maximize Your Savings with Citadel Mortgages

Find the Best Mortgage Rates in Canada

Today’s Mortgage Rates updated as of October 16, 2025 9:54 pm

For a property located in

5-year fixed*

3.79

5-year Variable*

3.85

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

What Are Cashback Mortgage Rates?

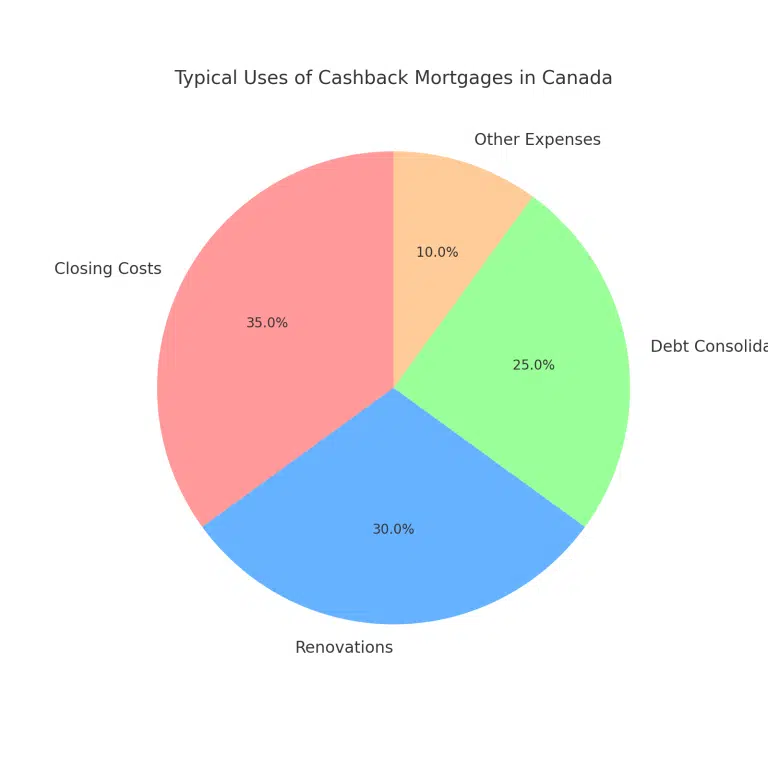

A cashback mortgage provides homeowners with a lump sum of cash at the time of their mortgage approval. This upfront amount, typically a percentage of your total mortgage value, can be used for expenses like closing costs, renovations, debt consolidation, or financial investments. While cashback mortgages often have slightly higher interest rates than traditional mortgages, they provide a unique financial advantage for homeowners needing immediate funds.

Best High Ratio Cash Back Mortgage Rates in Canada

Best Low Ratio Cash Back Mortgage Rates in Canada

How Cashback Mortgages Work

A cashback mortgage is structured to offer a percentage of your mortgage amount as cash upfront. For example:

- Mortgage Amount: $400,000

- Cashback Percentage: 3%

- Cashback Amount: $12,000

While cashback mortgages generally have higher interest rates, they provide a financial buffer, especially for first-time buyers or those planning renovations.

Learn more about today’s best mortgage rates in Canada.

Benefits of Cashback Mortgages

1. Immediate Access to Funds

- Use the cashback for closing costs, furnishing your new home, or other financial goals.

2. Flexible Financial Planning

- Helps manage large upfront expenses like legal fees, moving costs, or repairs.

3. Combine with Competitive Rates

- Access tailored rates from lenders to maximize savings while benefiting from cashback.

Read about how fixed and variable rates compare on the Government of Canada website.

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

Who Should Consider a Cashback Mortgage?

Ideal for:

- First-Time Buyers

- Offset the costs of purchasing a home.

- Home Renovators

- Finance upgrades without dipping into savings.

- Debt Consolidators

- Use cashback to pay off high-interest debts.

Today's High Ratio Cashback Mortgage Rates in Canada

Today's Low Ratio Cashback Mortgage Rates in Canada

How to Qualify for a Cashback Mortgage

To qualify, lenders typically consider:

- Credit Score: Minimum 680 for competitive rates.

- Down Payment: At least 5% of the purchase price.

- Income Stability: Proof of steady income through T4s or NOAs.

- Debt-to-Income Ratio: Less than 42%.

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Let us simplify the process and help you secure approval quickly and stress-free!

Comparison: Cashback Mortgages vs. Traditional Mortgages

| Feature | Cashback Mortgage | Traditional Mortgage |

|---|---|---|

| Cash Upfront | Yes, % of mortgage | No |

| Interest Rates | Slightly higher | Lower |

| Best For | Large upfront expenses | Long-term savings |

| Flexibility | High | Moderate |

Get a Mortgage with Citadel Mortgages

Navigate Interest Rate Trends with Confidence: Mortgage Solutions Tailored for You

At Citadel Mortgages, we recognize how important it is to stay informed about changing mortgage interest rates. Whether you’re purchasing your first home, refinancing, or renewing your mortgage, we’re here to guide you through the process with solutions that suit your financial needs, even in fluctuating rate environments.

Why Choose Our Mortgage Solutions?

Flexible Mortgage Options

From fixed to variable rates, we offer tailored solutions that help you secure the most competitive interest rates for your situation.

Expert Guidance on Rate Trends

Our team monitors the Canadian mortgage market to provide insights on current rates, helping you make informed decisions.

Approval Regardless of Credit History

We focus on finding solutions, even if you’ve faced credit challenges or financial setbacks.

Low-Income Friendly Options

Income constraints shouldn’t hold you back. We specialize in making homeownership accessible for Canadians in various financial situations.

Streamlined Application Process

Enjoy a smooth experience with quick approvals and clear communication every step of the way.

Benefits of Working with Citadel Mortgages

Rate Lock Protection

Secure today’s interest rates to avoid surprises if rates increase before your mortgage closes.

Debt Relief Options

Consolidate high-interest debt into a single, lower-interest mortgage payment, saving you money and simplifying your finances.

Customizable Payment Plans

Choose flexible payment terms that fit your budget, whether you prefer the stability of a fixed rate or the potential savings of a variable rate.

Quick Fund Access for Refinancing

Refinance your mortgage to tap into your home’s equity for renovations, debt consolidation, or investment opportunities.

Contact Us To Get Approved Now

Cashback Mortgage Statistics in Canada

| Metric | Value |

|---|---|

| Average Cashback Percentage | 3%-5% of mortgage amount |

| Typical Cashback Use | Closing costs, renovations |

| Average Cashback Amount | $12,000 |

| Popular Terms | 5-Year Fixed |

FAQs About Cashback Mortgage Rates

What are cashback mortgages used for?

They are often used to cover closing costs, pay off debt, or fund renovations.

Do cashback mortgages have higher interest rates?

Yes, cashback mortgages typically have slightly higher interest rates to offset the upfront cash provided.

Can I pay off a cashback mortgage early?

Yes, but early repayment may result in a penalty, depending on your lender’s terms.

Documents Needed for Mortgage Approval in Canada

- Government ID: Driver’s license, passport, or permanent resident card.

- Proof of Income: Recent pay stubs, T4 slips, or self-employment income proof.

- Employment Verification: Letter from your employer detailing salary and position.

- Down Payment Proof: Bank statements or proof of savings.

- Credit Report Authorization: Permission for lenders to access your credit history.

Additional Documentation

- Other documents may be needed based on your unique situation. Our experienced mortgage agents at Citadel Mortgages will assist you in identifying and gathering any additional paperwork required to complete your second mortgage application.

Final Thoughts - Cashback Mortgage Rates

A cashback mortgage can be a valuable financial tool when managed strategically. By securing competitive rates and leveraging cashback wisely, you can achieve your homeownership goals with ease. Contact Citadel Mortgages today to explore your options and get started.

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

Why Choose Citadel Mortgages

At Citadel Mortgages, we pride ourselves on offering expert, client-focused mortgage solutions that stand out in the industry. Here’s why you should choose us:

Expertise Across Canada

Our mortgage brokers are licensed and certified across multiple provinces, providing exceptional advice and service tailored to your unique needs. Our mortgage brokers are committed to delivering the highest standards of professionalism and expertise.

Client-Focused Service

Unlike traditional commission-based models, our mortgage agents are evaluated based on client satisfaction and the quality of their advice. This ensures that you receive impartial guidance on the best mortgage options for your situation.

Competitive Rates

Citadel Mortgages offers competitive rates that help you save money over the life of your mortgage. Our team works diligently to find the most favorable terms to suit your financial goals.

Transparent and Seamless Process

We are dedicated to transforming the mortgage industry by offering a transparent, seamless process. Our 100% digital platform ensures that you can manage your mortgage application from start to finish with ease and confidence.

Commitment to Excellence

At Citadel Mortgages, our mission is to provide a positive, empowering, and transparent property financing experience. We simplify the mortgage process to make it as straightforward and stress-free as possible.

Contact Us Today

For personalized advice and the best mortgage rates in Toronto, contact our licensed and knowledgeable mortgage experts at Citadel Mortgages.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.