All-in-One Mortgage Solution Canada | Save More with Citadel Mortgages

Find the Best Mortgage Rates in Canada

Today’s Mortgage Rates updated as of October 13, 2025 12:51 pm

For a property located in

5-year fixed*

3.84

5-year Variable*

3.85

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

What is the Citadel All-in-One Mortgage Solution?

The Citadel All-in-One Mortgage Solution, based on the renowned Manulife One program, is a revolutionary way to manage your mortgage and finances under one flexible and powerful solution. This product allows you to consolidate your mortgage, debt, and savings into a single account, giving you greater control over your financial future while saving you time and money.

Whether you’re a first-time homebuyer, refinancing, or renewing your mortgage, understanding current trends and available options helps you make informed financial decisions.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

How the All in One Mortgage Solution Works for You!

As we always hear, your money should never sit around. In fact, your money should always be working for you! What does this mean, though?

For years the banks have taught us we need to keep our debts including our mortgage separate from our savings, income, and investments, but why? Think about if you have a checking account that has a line of credit attached to it and regular savings account at the bank and you go to deposit your money into the bank. Which account will the bank choose to put the money in? (Hint it is never the account with the line of credit.)

The banks have always wanted us to keep our debt high to make interest, but the secret is to have our money work for us, not the bank!

How Does the Citadel All-in-One Mortgage Work?

With the Citadel All-in-One Mortgage, your income and savings are deposited directly into your account, reducing your daily interest charges on your mortgage. This dynamic structure minimizes your interest payments and accelerates your journey to becoming mortgage-free. Here’s how:

Combine Mortgage and Banking

- Your mortgage, savings, and chequing are all in one account.

Daily Simple Interest Calculation

- Interest is calculated daily based on the account’s remaining balance. Every deposit immediately reduces your balance, saving you more in interest compared to traditional mortgages or HELOCs.

Flexible Access to Funds

- Borrow funds when needed without applying for new loans, up to your pre-approved credit limit.

Customizable Payments

- Enjoy flexible payment options that suit your lifestyle and financial goals.

Daily Simple Interest vs. Traditional Mortgage Interest

Daily Simple Interest vs. Traditional Mortgage Interest

One of the most significant benefits of the Citadel All-in-One Mortgage Solution is the use of daily simple interest, which offers substantial savings compared to traditional compound interest methods. Let’s explore this in detail.

How Daily Simple Interest Works

With daily simple interest, the interest you pay is calculated daily on your outstanding balance, not the original loan amount or a monthly average. Every deposit you make directly reduces your balance, which immediately decreases the amount of interest accrued.

Comparison: Citadel All-in-One vs. Traditional Mortgages and HELOCs

| Feature | Citadel All-in-One (Daily Simple Interest) | Traditional Mortgage | HELOC |

|---|---|---|---|

| Interest Calculation | Based on daily balance | Monthly average balance | Daily balance, compounded |

| Impact of Deposits | Immediate reduction of interest | Limited impact | Immediate, but variable rates |

| Flexibility | Full access to available equity | Fixed payments | Flexible, but higher rates |

| Savings Potential | High (deposits immediately reduce interest) | Moderate | Moderate |

Example: Comparing Savings

Let’s break down the impact of daily simple interest using a practical example:

- Scenario:

- Loan Amount: $400,000

- Interest Rate: 5.5%

- Monthly Deposit: $5,000

Traditional Mortgage (Compound Interest)

- Interest is calculated semi-annually on the original loan amount.

- Deposits during the month have no immediate impact on the interest calculation.

- Interest accrued for the month:

- $400,000 × (5.5% ÷ 12) = $1,833.33

Citadel All-in-One Mortgage (Daily Simple Interest)

- Interest is calculated daily on the remaining balance.

- Deposits immediately reduce the balance, lowering the interest accrued.

- After depositing $5,000, the daily balance becomes $395,000:

- Daily interest: $395,000 × (5.5% ÷ 365) = $59.38 per day

- Interest accrued for 30 days: $59.38 × 30 = $1,781.40

Savings:

- Traditional Mortgage: $1,833.33

- Citadel All-in-One Mortgage: $1,781.40

- Monthly Savings: $51.93

- Annual Savings: $623.16

Chart: Savings Comparison

Below is a graphical representation of how daily simple interest offers better savings compared to traditional compound interest methods:

| Loan Type | Interest Accrued per Month | Annual Savings |

|---|---|---|

| Traditional Mortgage | $1,833.33 | – |

| Citadel All-in-One | $1,781.40 | $623.16 |

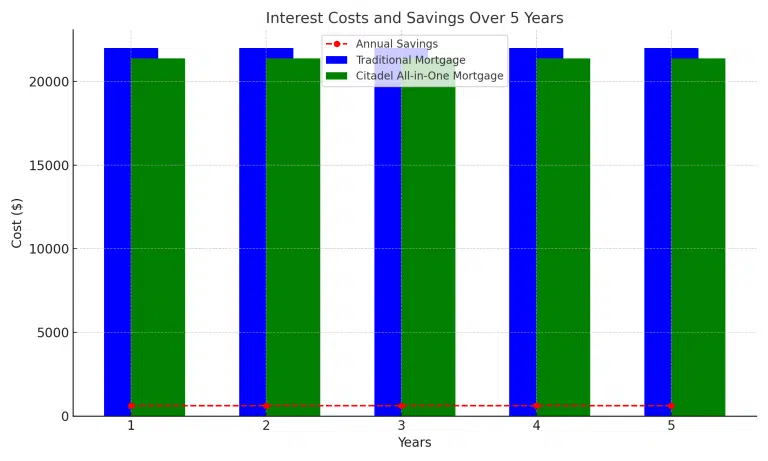

Savings Over Time: 5-Year Comparison

| Year | Traditional Mortgage (Compound Interest) | Citadel All-in-One (Daily Simple Interest) | Total Savings |

|---|---|---|---|

| 1 | $22,000 | $21,376 | $624 |

| 2 | $22,000 | $21,376 | $624 |

| 3 | $22,000 | $21,376 | $624 |

| 4 | $22,000 | $21,376 | $624 |

| 5 | $22,000 | $21,376 | $624 |

| Total | $110,000 | $106,880 | $3,120 |

Why This Matters

For Borrowers:

Immediate Savings:

Every deposit works instantly to reduce your loan balance and interest charges.Better Cash Flow:

Lower interest costs mean more disposable income for other financial goals.Accelerated Mortgage Payoff:

Daily simple interest allows you to become mortgage-free faster than with traditional methods.

Graph: Interest Savings Over Time

Here’s a bar graph comparing interest savings for a $400,000 mortgage over five years between traditional and Citadel All-in-One solutions:

Key Insights

- Traditional mortgages calculate interest less frequently, reducing the opportunity to save.

- Daily simple interest adapts immediately to deposits, leading to long-term financial benefits.

- Combining this with Citadel Mortgages’ integrated tools and expert guidance ensures you maximize savings and financial control.

Compare Mortgage Rates In Canada

Rates and account fees

For a low monthly fee of $16.95 ($9.95 for seniors age 60 and over), you get unlimited:

- Deposits (Canadian funds)

- Automated banking machine (ABM) deposits and withdrawals in Canada, where THE EXCHANGE® Network logo is displayed.1

- Online, mobile and telephone banking services

- Access-card purchases within Canada1

- Pre-authorized payments

- Bill payments

- Funds transfers

- Cheque writing (Canadian funds)

- Mail-in cheques (Canadian funds)

The monthly fee will be waived when there is a positive balance of $5,000 or more across the account at the end of each month.

Borrower subject to credit and underwriting approval. Not all borrowers will be approved for conventional financing or equity financing. Receipt of borrower’s application does not represent an approval for financing or interest rate guarantee. Restrictions may apply, Annual APR is subject to approval and underwriting, APR includes all fees and rate which is calculated on a yearly term. APR varies contact us for current rates or more information on a specific product. OAC*

Benefits of the Citadel All-in-One Mortgage Solution

1. Save Thousands in Interest

- Consolidating debts into a single account reduces the overall interest you pay, as your income offsets the mortgage balance.

2. Flexible Financial Management

- Access your home equity without refinancing. Pay off high-interest debts, invest, or cover unexpected expenses.

3. Faster Mortgage Payoff

- Use savings and income to reduce your mortgage balance faster than with traditional loans.

4. Simplified Banking

- With one account for all your financial needs, tracking expenses and managing money becomes seamless.

5. Emergency Access to Funds

- Secure access to funds when you need them most, without the hassle of reapplying for a loan.

Read about how fixed and variable rates compare on the Government of Canada website.

Eligibility for the Citadel All-in-One Mortgage Solution

To qualify for the Citadel All-in-One Mortgage Solution, you must meet these basic requirements:

Credit Score

- A credit score of 680 or higher is preferred for competitive rates.

Income Verification

- Proof of steady income, such as T4 slips, pay stubs, or Notices of Assessment (NOA).

Property Value

- Your home equity plays a crucial role. Typically, clients need at least 20% equity in their property.

Debt-to-Income Ratio

- A manageable debt-to-income ratio is required to ensure you can handle payments.

Property Type

- Owner-occupied or eligible rental properties in Canada.

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Let us simplify the process and help you secure approval quickly and stress-free!

Documents Needed for Mortgage Approval in Canada

- Government ID: Driver’s license, passport, or permanent resident card.

- Proof of Income: Recent pay stubs, T4 slips, or self-employment income proof.

- Employment Verification: Letter from your employer detailing salary and position.

- Down Payment Proof: Bank statements or proof of savings.

- Credit Report Authorization: Permission for lenders to access your credit history.

Additional Documentation

- Other documents may be needed based on your unique situation. Our experienced mortgage agents at Citadel Mortgages will assist you in identifying and gathering any additional paperwork required to complete your second mortgage application.

Who Can Benefit from the Citadel All-in-One Mortgage Solution?

The Citadel All-in-One Mortgage is perfect for:

Homeowners Seeking Debt Consolidation

- Pay off high-interest loans and credit cards efficiently.

Savvy Investors

- Leverage your home equity to invest in rental properties, education, or other ventures.

Budget-Conscious Families

- Simplify finances and reduce overall interest payments while staying on track with financial goals.

Self-Employed Professionals

- Enjoy flexibility with income fluctuations and access to funds when needed.

How the Citadel All-in-One Mortgage Compares to Traditional Mortgages

| Feature | Citadel All-in-One Mortgage | Traditional Mortgage | HELOC |

|---|---|---|---|

| Account Consolidation | Yes | No | No |

| Daily Interest Calculation | Yes | No | Yes |

| Flexible Payments | Yes | Limited | Yes |

| Access to Home Equity | Immediate | Requires Re-Approval | Immediate |

| Debt Consolidation | Included | Separate Process | Separate Process |

Mortgage Statistics for Canadians

| Metric | Canada Average |

|---|---|

| Average Mortgage Size | $410,000 |

| Average Mortgage Interest Rate | 5.10% – 6.00% |

| Home Equity Utilization | 20% of Canadians use equity |

| Debt Consolidation Usage | 25% of mortgage holders |

Why Choose Citadel Mortgages for the All-in-One Solution?

At Citadel Mortgages, we’re proud to offer this innovative financial solution, helping Canadians achieve their financial goals faster and more efficiently.

What Sets Us Apart?

Personalized Solutions

- We tailor the All-in-One Mortgage to your unique needs and financial situation.

Unparalleled Support

- From application to implementation, our team guides you through every step.

Competitive Rates

- We provide some of the lowest rates in Canada, ensuring you save more over time.

Integrated Financial Services

- As part of Citadel Financial Wealth Group, we offer a suite of financial tools, from savings to insurance, to complement your mortgage.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

FAQs: Citadel All-in-One Mortgage Solution

What is the Citadel All-in-One Mortgage Solution?

The Citadel All-in-One Mortgage Solution is an innovative program that combines your mortgage, chequing, savings, and debt into a single account. This allows you to reduce your mortgage balance daily with every deposit, saving you thousands in interest over time.

How does daily simple interest work?

Daily simple interest is calculated based on your account’s remaining balance each day. Unlike traditional mortgages, where interest is compounded semi-annually, every deposit you make immediately reduces your balance and, therefore, the amount of interest accrued.

How does the Citadel All-in-One compare to traditional mortgages?

The Citadel All-in-One Mortgage offers flexibility, immediate savings through daily interest calculations, and full access to your home equity without requiring refinancing. In contrast, traditional mortgages calculate interest less frequently and often have limited prepayment options.

Who is eligible for the Citadel All-in-One Mortgage Solution?

To qualify, you typically need:

- A credit score of 680 or higher

- Steady income verification (e.g., T4 slips, pay stubs, or NOAs)

- At least 20% home equity

- A manageable debt-to-income ratio

Can I access my home equity with this mortgage?

Yes, the Citadel All-in-One Mortgage gives you instant access to your home equity, allowing you to borrow funds for investments, renovations, debt consolidation, or emergencies without refinancing.

How can this program help me pay off my mortgage faster?

By applying daily simple interest and allowing every deposit to reduce your outstanding balance immediately, the Citadel All-in-One Mortgage minimizes interest costs. This means more of your payments go toward the principal, accelerating your mortgage payoff.

Can self-employed individuals qualify for this program?

Yes, the Citadel All-in-One Mortgage Solution is an excellent option for self-employed individuals. Its flexibility accounts for income fluctuations, and it provides access to funds without the need for requalification.

How is this different from a HELOC?

While similar to a HELOC, the Citadel All-in-One Mortgage offers added benefits:

- Daily simple interest (vs. compounded interest in HELOCs)

- Consolidation of chequing, savings, and mortgage into one account

- Lower overall borrowing costs

Become Mortgage Free Sooner Calculator Today!

The Become Mortgage-Free Sooner Calculator by Citadel Mortgages is a powerful financial tool designed to help Canadians reduce their mortgage costs and pay off their loans faster. By inputting your mortgage details and exploring various strategies, this calculator provides insights into how small adjustments to payments, frequency, or contributions can save you thousands in interest and shorten your mortgage term.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.