Professional Mortgage Programs in Canada | Tailored Solutions for Every Career

Find the Best Mortgage Rates in Canada

Today’s Mortgage Rates updated as of September 15, 2025 7:43 pm

For a property located in

5-year fixed*

3.89

5-year Variable*

3.99

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Exclusive Mortgage and HELOC Offers for Professionals

At Citadel Mortgages, we understand the unique financial needs of professionals across various industries. Whether you’re a doctor, nurse, engineer, or teacher, we offer tailored mortgage and line-of-credit programs designed to provide competitive rates and flexible options to help you achieve your financial goals.

Whether you’re a first-time homebuyer, refinancing, or renewing your mortgage, understanding current trends and available options helps you make informed financial decisions.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

Mortgage Programs by Profession

Healthcare Professionals

Eligible Professions: Doctors, Chiropractors, Dentists, Optometrists, Pharmacists, Podiatrists, Veterinarians

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime – 0.25%

- Unsecured Personal Line of Credit: Prime – 0.25%

- Free personal bank account and World Elite Mastercard.

2. Health Sciences Specialists and Students

Eligible Professions: Audiologists, Kinesiologists, Medical Technologists, Midwives, Occupational Therapists, Physiotherapists, Psychologists, and more.

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime + 0.50%

- Unsecured Personal Line of Credit: Prime + 0.75%

- Free personal bank account and World Elite Mastercard.

3. Nurses and Nurse Practitioners

Eligible Professions: Registered Nurses, Licensed Practical Nurses, Nurse Practitioners, and students in these fields.

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime + 0.50%

- Unsecured Personal Line of Credit: Prime + 0.75%

- Free personal bank account and World Elite Mastercard.

4. Business Professionals

Eligible Professions: Lawyers, Accountants (CPA), Notaries, Actuaries, Architects, CFA holders.

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime + 0.25%

- Unsecured Personal Line of Credit: Prime + 0.25%

- Free personal bank account and World Elite Mastercard.

5. Engineers and Engineering Students

Eligible Professions: Engineers, Engineering Graduates, and Students.

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime + 0.25%

- Unsecured Personal Line of Credit: Prime + 0.25%

- Free personal bank account and World Elite Mastercard.

6. Teachers

Eligible Professions: Primary, Secondary, CEGEP, University, Vocational Training Teachers, and Full-Time Lecturers.

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime + 0.50%

- Unsecured Personal Line of Credit: Prime + 0.75%

- Free personal bank account and World Elite Mastercard.

7. IT Professionals

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime + 0.25%

- Unsecured Personal Line of Credit: Prime + 0.25%

- Free personal bank account and World Elite Mastercard.

8. Farmers

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime + 0.35%

- Unsecured Personal Line of Credit: Prime + 0.50%

- Free personal bank account and World Elite Mastercard.

9. Public and Municipal Officials

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime + 0.50%

- Unsecured Personal Line of Credit: Prime + 0.75%

- Free personal bank account and World Elite Mastercard.

10. Administrative Professionals

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime + 0.50%

- Unsecured Personal Line of Credit: Prime + 0.35%

- Free personal bank account and World Elite Mastercard.

- Mastercard.

11. Any Other Professionals

Offers:

- Home Equity Line of Credit/All-In-One Mortgage: Prime + 0.50%

- Unsecured Personal Line of Credit: Prime + 0.35%

- Free personal bank account and World Elite Mastercard.

Learn more about today’s best mortgage rates in Canada.

Benefits of Profession-Specific Mortgages

- Competitive Interest Rates: Save thousands with exclusive rates lower than standard offerings.

- Flexible Terms: Adjust repayment options to fit your income and career stage.

- Tailored Solutions: Programs designed specifically for the needs of each profession.

- Streamlined Approval: Simplified processes with faster approvals for professionals.

- Value-Added Perks: Free bank accounts, premium credit cards, and other exclusive benefits.

Read about how fixed and variable rates compare on the Government of Canada website.

Approval Requirements

Proof of Profession or Enrollment

- Employment verification, professional certification, or proof of enrollment for students.

Credit and Income Verification

- Meet minimum credit score requirements and provide income documentation (T4, NOAs, etc.).

Down Payment

- Minimum down payment of 5% for insured mortgages or 20% for conventional loans.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

Compare Mortgage Rates In Canada

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

Get a Mortgage with Citadel Mortgages

Navigate Interest Rate Trends with Confidence: Mortgage Solutions Tailored for You

At Citadel Mortgages, we recognize how important it is to stay informed about changing mortgage interest rates. Whether you’re purchasing your first home, refinancing, or renewing your mortgage, we’re here to guide you through the process with solutions that suit your financial needs, even in fluctuating rate environments.

Why Choose Our Mortgage Solutions?

Flexible Mortgage Options

From fixed to variable rates, we offer tailored solutions that help you secure the most competitive interest rates for your situation.

Expert Guidance on Rate Trends

Our team monitors the Canadian mortgage market to provide insights on current rates, helping you make informed decisions.

Approval Regardless of Credit History

We focus on finding solutions, even if you’ve faced credit challenges or financial setbacks.

Low-Income Friendly Options

Income constraints shouldn’t hold you back. We specialize in making homeownership accessible for Canadians in various financial situations.

Streamlined Application Process

Enjoy a smooth experience with quick approvals and clear communication every step of the way.

Benefits of Working with Citadel Mortgages

Rate Lock Protection

Secure today’s interest rates to avoid surprises if rates increase before your mortgage closes.

Debt Relief Options

Consolidate high-interest debt into a single, lower-interest mortgage payment, saving you money and simplifying your finances.

Customizable Payment Plans

Choose flexible payment terms that fit your budget, whether you prefer the stability of a fixed rate or the potential savings of a variable rate.

Quick Fund Access for Refinancing

Refinance your mortgage to tap into your home’s equity for renovations, debt consolidation, or investment opportunities.

Contact Us To Get Approved Now

FAQs About Professional Mortgages

Can students apply for these programs?

Yes, many of our programs are available to students pursuing eligible professional degrees.

Are these rates available across Canada?

Yes, our programs are designed to serve professionals nationwide.

Can I refinance an existing mortgage under this program?

Yes, refinancing options are available for eligible professionals.

Are there fees for the unsecured personal line of credit?

No, the unsecured personal line of credit includes no application or annual fees.

Final Thoughts - Professional Mortgage Programs in Canada

At Citadel Mortgages, we’re committed to providing exceptional mortgage solutions tailored to the needs of professionals across Canada. With competitive rates, flexible terms, and exclusive perks, our programs are designed to help you achieve your financial and homeownership goals with ease.

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Let us simplify the process and help you secure approval quickly and stress-free!

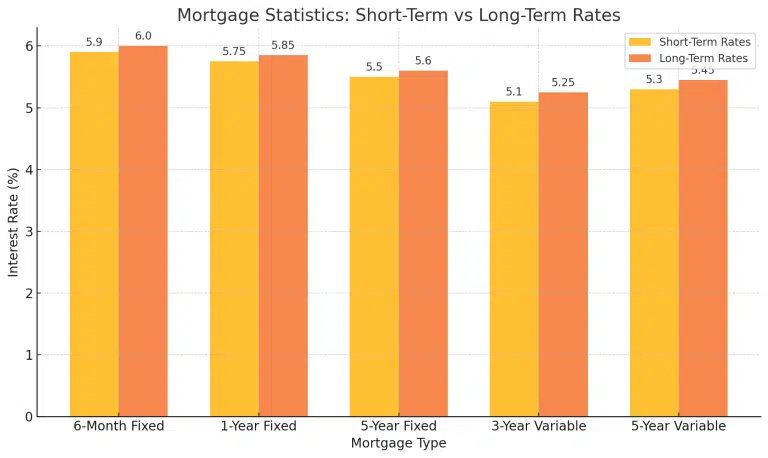

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

Why Choose Citadel Mortgages

At Citadel Mortgages, we pride ourselves on offering expert, client-focused mortgage solutions that stand out in the industry. Here’s why you should choose us:

Expertise Across Canada

Our mortgage brokers are licensed and certified across multiple provinces, providing exceptional advice and service tailored to your unique needs. Our mortgage brokers are committed to delivering the highest standards of professionalism and expertise.

Client-Focused Service

Unlike traditional commission-based models, our mortgage agents are evaluated based on client satisfaction and the quality of their advice. This ensures that you receive impartial guidance on the best mortgage options for your situation.

Competitive Rates

Citadel Mortgages offers competitive rates that help you save money over the life of your mortgage. Our team works diligently to find the most favorable terms to suit your financial goals.

Transparent and Seamless Process

We are dedicated to transforming the mortgage industry by offering a transparent, seamless process. Our 100% digital platform ensures that you can manage your mortgage application from start to finish with ease and confidence.

Commitment to Excellence

At Citadel Mortgages, our mission is to provide a positive, empowering, and transparent property financing experience. We simplify the mortgage process to make it as straightforward and stress-free as possible.

Contact Us Today

For personalized advice and the best mortgage rates in Toronto, contact our licensed and knowledgeable mortgage experts at Citadel Mortgages.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.