Builder Program: Secure Financing for Pre-Construction Homes & Condos

Find the Best Mortgage Rates in Canada

Today’s Mortgage Rates updated as of September 26, 2025 12:34 pm

For a property located in

5-year fixed*

3.84

5-year Variable*

3.99

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

What Is the Builder Program (Appreciated Value)?

The Builder Program is an innovative mortgage solution for buyers of pre-construction homes and condos. This program allows clients to lock in a mortgage approval and interest rate for up to 3 years, ensuring peace of mind and financial security throughout the construction period.

With the Builder Program, you can secure a firm financing commitment today and enjoy the flexibility of financing at the appreciated value of the property at the time of closing.

Whether you’re a first-time homebuyer, refinancing, or renewing your mortgage, understanding current trends and available options helps you make informed financial decisions.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

Key Features of the Builder Program

| Feature | Details |

|---|---|

| 3-Year Approval & Rate Hold | Lock in your mortgage rate and approval for up to 3 years, regardless of market conditions. |

| Appreciated Value Financing | Secure financing based on the increased property value at closing. |

| Firm Approvals | Receive a firm commitment based on property specifications and plans. |

| Upfront Appraisals | Realize the appreciated value with upfront property appraisals. |

| Competitive Cap Rates | Benefit from competitive rates with the option to convert to market rates at closing. |

| Assigned Unit Options | Flexibility to transfer or assign your purchase to another buyer. |

Learn more about today’s best mortgage rates in Canada.

How the Builder Program Works

Get Approved Today

- Secure a mortgage approval valid for up to 3 years.

Lock in a Competitive Rate

- Protect yourself from potential rate increases with a guaranteed rate.

Appraised Value at Closing

- Your loan is adjusted to reflect the appreciated value of the property when construction is complete.

Flexibility with Assigned Units

- If needed, you can assign your purchase to another buyer.

Benefits of the Builder Program

Protection Against Market Volatility

- Lock in today’s rates and approvals, ensuring stability even if market conditions change.

Appreciation Advantage

- Finance based on the increased property value at closing, maximizing borrowing potential.

Flexible Options for Assigned Units

- Refer your unit to other buyers if you decide not to proceed.

Streamlined Process

- Simplified financing based on upfront appraisals and clear guidelines.

Long-Term Peace of Mind

- A 3-year approval period provides ample time to plan and prepare for closing.

Read about how fixed and variable rates compare on the Government of Canada website.

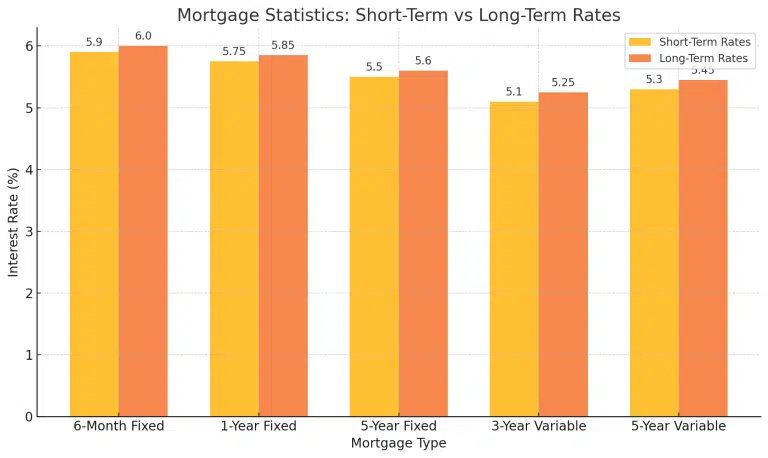

Mortgage Statistics for Short-Term Rates

| Metric | 1-Year Fixed | National Average |

|---|---|---|

| Average Rate (2024) | 5.75% | 5.50% – 6.50% |

| Typical Loan Size | $360,000 | $390,000 |

| Approval Time | 3–5 Business Days | 3–7 Business Days |

Approval Requirements for Builder Program Mortgages

To qualify for the Builder Program, applicants must meet the following criteria:

Standard Mortgage Requirements

- Credit score, income verification, and debt service ratios (GDS/TDS) must meet standard lending guidelines.

Valid Purchase or Assignment Agreement

- The agreement must have a duration of at least one year.

Property Documentation

- Provide detailed property specifications and plans for upfront appraisals.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

Compare Mortgage Rates In Canada

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

Why Choose Citadel Mortgages for the Builder Program?

Expert Guidance

- Our team specializes in pre-construction financing, offering expert advice every step of the way.

Tailored Solutions

- Enjoy flexible financing options designed to meet your unique needs.

Access to Competitive Rates

- Benefit from guaranteed rates that protect you from market fluctuations.

Long-Term Rate Hold

- Lock in today’s rates for up to 3 years, giving you peace of mind until closing.

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Let us simplify the process and help you secure approval quickly and stress-free!

Get a Mortgage with Citadel Mortgages

Navigate Interest Rate Trends with Confidence: Mortgage Solutions Tailored for You

At Citadel Mortgages, we recognize how important it is to stay informed about changing mortgage interest rates. Whether you’re purchasing your first home, refinancing, or renewing your mortgage, we’re here to guide you through the process with solutions that suit your financial needs, even in fluctuating rate environments.

Why Choose Our Mortgage Solutions?

Flexible Mortgage Options

From fixed to variable rates, we offer tailored solutions that help you secure the most competitive interest rates for your situation.

Expert Guidance on Rate Trends

Our team monitors the Canadian mortgage market to provide insights on current rates, helping you make informed decisions.

Approval Regardless of Credit History

We focus on finding solutions, even if you’ve faced credit challenges or financial setbacks.

Low-Income Friendly Options

Income constraints shouldn’t hold you back. We specialize in making homeownership accessible for Canadians in various financial situations.

Streamlined Application Process

Enjoy a smooth experience with quick approvals and clear communication every step of the way.

Benefits of Working with Citadel Mortgages

Rate Lock Protection

Secure today’s interest rates to avoid surprises if rates increase before your mortgage closes.

Debt Relief Options

Consolidate high-interest debt into a single, lower-interest mortgage payment, saving you money and simplifying your finances.

Customizable Payment Plans

Choose flexible payment terms that fit your budget, whether you prefer the stability of a fixed rate or the potential savings of a variable rate.

Quick Fund Access for Refinancing

Refinance your mortgage to tap into your home’s equity for renovations, debt consolidation, or investment opportunities.

Contact Us To Get Approved Now

FAQs About the Builder Program

What happens if property values increase before closing?

With the Builder Program, you can finance based on the appreciated value of your home or condo, maximizing your borrowing potential.

Can I transfer my purchase to another buyer?

Yes, the program allows for assignments, giving you flexibility if your plans change.

How long does the approval last?

The approval and rate hold are valid for up to 3 years, providing stability during the construction period.

What if market rates drop before closing?

You have the option to convert to market rates at the time of closing if they are more competitive.

Final Thoughts - The Builder Program - 3 - Year Rate Hold

The Builder Program is the perfect solution for buyers of pre-construction homes and condos. By locking in today’s rates and approvals for up to 3 years, you can navigate the construction process with confidence and financial security. Whether you’re a first-time buyer or a seasoned investor, Citadel Mortgages is here to guide you every step of the way.

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

Why Choose Citadel Mortgages

At Citadel Mortgages, we pride ourselves on offering expert, client-focused mortgage solutions that stand out in the industry. Here’s why you should choose us:

Expertise Across Canada

Our mortgage brokers are licensed and certified across multiple provinces, providing exceptional advice and service tailored to your unique needs. Our mortgage brokers are committed to delivering the highest standards of professionalism and expertise.

Client-Focused Service

Unlike traditional commission-based models, our mortgage agents are evaluated based on client satisfaction and the quality of their advice. This ensures that you receive impartial guidance on the best mortgage options for your situation.

Competitive Rates

Citadel Mortgages offers competitive rates that help you save money over the life of your mortgage. Our team works diligently to find the most favorable terms to suit your financial goals.

Transparent and Seamless Process

We are dedicated to transforming the mortgage industry by offering a transparent, seamless process. Our 100% digital platform ensures that you can manage your mortgage application from start to finish with ease and confidence.

Commitment to Excellence

At Citadel Mortgages, our mission is to provide a positive, empowering, and transparent property financing experience. We simplify the mortgage process to make it as straightforward and stress-free as possible.

Contact Us Today

For personalized advice and the best mortgage rates in Toronto, contact our licensed and knowledgeable mortgage experts at Citadel Mortgages.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.