Fixed vs.Variable Mortgage Rates in Canada | Get Approved Today

Find the Best Mortgage Rates in Canada

Today’s Mortgage Rates updated as of September 17, 2025 12:44 pm

For a property located in

5-year fixed*

3.84

5-year Variable*

3.99

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Fixed vs Variable Mortgage Rates

Choosing Between Fixed and Variable Mortgages

Fixed vs Variable Mortgage Rates.

One of the most critical decisions Canadian homebuyers face is choosing between a fixed-rate or variable-rate mortgage. Each option has distinct benefits and risks, making it essential to understand how they align with your financial goals and market conditions. This guide breaks down the key differences, advantages, and considerations for each, ensuring you make an informed decision.

What is a Fixed-Rate Mortgage?

A fixed-rate mortgage locks in your interest rate for the entire term, providing consistent monthly payments. This option is ideal for those seeking stability and predictability in their finances.

Key Features of Fixed Mortgages

- Stable Payments: Monthly payments remain unchanged for the duration of the term.

- Higher Initial Rates: Fixed rates are often higher than variable rates at the start.

- Peace of Mind: Protects against potential interest rate increases during the term.

Learn more about fixed-rate mortgages from the Government of Canada.

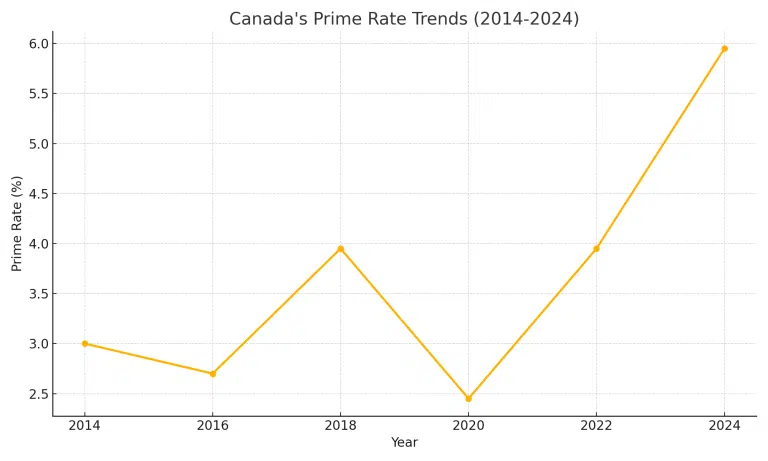

The prime rate is closely linked to the Bank of Canada’s overnight rate, which influences the lending and borrowing rates across financial institutions.

When the Bank of Canada raises or lowers its overnight rate, major banks typically adjust their prime rates accordingly, affecting millions of Canadian borrowers.

Learn more about how the Bank of Canada sets interest rates.

Learn more about today’s best mortgage rates in Canada.

What is a Variable-Rate Mortgage?

A variable-rate mortgage fluctuates based on changes to the lender’s prime rate, which is tied to the Bank of Canada’s overnight rate. While it can offer lower initial rates, payments may increase if rates rise.

Key Features of Variable Mortgages

- Potential Savings: Lower initial rates can reduce your monthly payments.

- Market-Driven Adjustments: Payments or interest portions adjust with rate changes.

- Risk of Increases: Payments can rise if the Bank of Canada raises its benchmark rate.

Fixed vs. Variable: A Comparison

| Feature | Fixed-Rate Mortgage | Variable-Rate Mortgage |

|---|

| Payment Stability | Consistent throughout the term | Fluctuates based on market rates |

| Interest Rate | Higher initially, but stable | Lower initially, with potential to rise |

| Risk Tolerance | Ideal for risk-averse borrowers | Suitable for those comfortable with market changes |

| Market Conditions | Best when rates are expected to rise | Best when rates are expected to decline |

1. Fixed vs. Variable Rate Preferences Over Time

| Year | Fixed Rate Preference (%) | Variable Rate Preference (%) |

|---|---|---|

| 2019 | 65% | 35% |

| 2021 | 62% | 38% |

| 2023 | 72% | 28% |

2. Impact of Rate Changes on Monthly Payments

| Loan Amount | Rate | Monthly Payment (Fixed) | Monthly Payment (Variable) |

|---|---|---|---|

| $300,000 | 5% | $1,745 | $1,645 |

| $300,000 | 6% | $1,925 | $1,825 |

| $300,000 | 7% | $2,106 | $2,006 |

Compare Mortgage Rates In Canada

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

How to Be Approved for the Best Mortgage Rates

Maintain a High Credit Score

- Aim for a score of 680 or higher to qualify for competitive rates.

Lower Your Debt-to-Income Ratio (DTI)

- Keep your total debt payments below 35% of gross income.

Save for a Larger Down Payment

- A 20% down payment reduces your loan-to-value ratio, improving your chances of approval.

Shop Around

- Compare offers from banks, credit unions, and mortgage brokers.

What Influences Fixed and Variable Mortgage Rates in Canada?

Both fixed and variable rates are shaped by key economic factors:

1. Bank of Canada Overnight Rate

- Variable rates directly follow changes in the Bank of Canada’s benchmark rate.

Track overnight rate changes from the Bank of Canada.

2. Bond Market Yields

- Fixed rates are influenced by Canadian government bond yields, which reflect market trends and investor sentiment.

3. Inflation and Economic Growth

- Higher inflation often leads to rate increases as the Bank of Canada aims to control spending.

4. Housing Market Conditions

- Demand for housing and competition among lenders impact rate offerings.

How to Choose Between Fixed and Variable Rates

Consider Your Financial Situation

- Stable Income: Fixed rates provide stability if you rely on consistent budgeting.

- Flexibility: Variable rates may suit those with more disposable income or higher risk tolerance.

Evaluate Market Trends

- Research the Bank of Canada’s rate forecasts and economic indicators to determine whether rates are likely to rise or fall.

Plan for Long-Term Goals

- If you plan to stay in your home for a long time, fixed rates can offer peace of mind. Short-term buyers might benefit from the initial savings of variable rates.

Mortgage Trends in Canada: Fixed vs. Variable Rates

| Year | Fixed Rate Preference (%) | Variable Rate Preference (%) |

|---|---|---|

| 2019 | 65% | 35% |

| 2021 | 62% | 38% |

| 2023 | 72% | 28% |

Lowest Mortgage Rates In Canada

Documents Needed for Mortgage Approval in Canada

- Government ID: Driver’s license, passport, or permanent resident card.

- Proof of Income: Recent pay stubs, T4 slips, or self-employment income proof.

- Employment Verification: Letter from your employer detailing salary and position.

- Down Payment Proof: Bank statements or proof of savings.

- Credit Report Authorization: Permission for lenders to access your credit history.

Additional Documentation

- Other documents may be needed based on your unique situation. Our experienced mortgage agents at Citadel Mortgages will assist you in identifying and gathering any additional paperwork required to complete your second mortgage application.

Get a Mortgage with Citadel Mortgages

Navigate Interest Rate Trends with Confidence: Mortgage Solutions Tailored for You

At Citadel Mortgages, we recognize how important it is to stay informed about changing mortgage interest rates. Whether you’re purchasing your first home, refinancing, or renewing your mortgage, we’re here to guide you through the process with solutions that suit your financial needs, even in fluctuating rate environments.

Why Choose Our Mortgage Solutions?

Flexible Mortgage Options

From fixed to variable rates, we offer tailored solutions that help you secure the most competitive interest rates for your situation.

Expert Guidance on Rate Trends

Our team monitors the Canadian mortgage market to provide insights on current rates, helping you make informed decisions.

Approval Regardless of Credit History

We focus on finding solutions, even if you’ve faced credit challenges or financial setbacks.

Low-Income Friendly Options

Income constraints shouldn’t hold you back. We specialize in making homeownership accessible for Canadians in various financial situations.

Streamlined Application Process

Enjoy a smooth experience with quick approvals and clear communication every step of the way.

Benefits of Working with Citadel Mortgages

Rate Lock Protection

Secure today’s interest rates to avoid surprises if rates increase before your mortgage closes.

Debt Relief Options

Consolidate high-interest debt into a single, lower-interest mortgage payment, saving you money and simplifying your finances.

Customizable Payment Plans

Choose flexible payment terms that fit your budget, whether you prefer the stability of a fixed rate or the potential savings of a variable rate.

Quick Fund Access for Refinancing

Refinance your mortgage to tap into your home’s equity for renovations, debt consolidation, or investment opportunities.

Contact Us To Get Approved Now

Our Featured Rates

Mortgage Statistics in Canada

Mortgage trends offer a snapshot of the current financial landscape:

- Total Residential Mortgage Debt: As of mid-2024, Canadians owe over $2.2 trillion in residential mortgages, marking a 3.5% year-over-year increase.

- Missed Payments: In Q1 2024, missed mortgage payments increased by 22.7%, reflecting financial strain due to rising interest rates.

- Average Home Price: The average home price in Canada is approximately $703,446 as of late 2024.

- Interest Rate Sensitivity: A 0.25% hike in the prime rate increases monthly payments on a $500,000 variable-rate mortgage by roughly $60-$75.

Why Canadians Choose Fixed or Variable Mortgages

Top Reasons for Fixed Mortgages:

- Predictability: Stable payments allow for easier budgeting.

- Market Uncertainty: Avoids the risk of rising rates.

- Long-Term Planning: Ideal for those planning to stay in their home for an extended period.

Top Reasons for Variable Mortgages:

- Lower Initial Rates: Offers short-term savings.

- Flexibility: Potential to lock in at a lower fixed rate if rates drop.

- Market Conditions: Beneficial in a declining rate environment.

FAQs: Fixed vs. Variable Mortgage Rates in Canada

What is a fixed-rate mortgage?

A fixed-rate mortgage locks in your interest rate for the entire term, ensuring consistent monthly payments regardless of market changes.

What is a variable-rate mortgage?

A variable-rate mortgage has an interest rate that fluctuates based on the lender’s prime rate, which is influenced by the Bank of Canada’s overnight rate.

Which is better, fixed or variable rates?

- Fixed rates are ideal for those seeking stability and predictability in payments.

- Variable rates are better for borrowers who can handle potential rate increases and want to benefit from lower initial rates.

How do interest rates affect monthly payments?

A higher interest rate increases monthly payments, while lower rates reduce overall costs.

Should I choose fixed or variable rates?

Fixed rates offer stability, while variable rates provide potential savings if market rates drop.

How do I decide between fixed and variable mortgages?

Consider your financial stability, risk tolerance, and market trends. Fixed rates suit those who prefer stability, while variable rates may work for those comfortable with fluctuations.

Use Our Mortgage Calculator Today!

Understanding Your Mortgage Options

Use our mortgage calculator to gain a clearer picture of what you can expect in terms of monthly payments, interest costs, and amortization schedules. Simply input your loan amount, interest rate, and amortization period to get started. This tool provides estimates to help you make informed decisions as you explore different mortgage options.

Benefits of Using Our Mortgage Calculator

- Accurate Estimates: Get precise calculations on your potential second mortgage amount based on your home’s equity, current mortgage balance, and other financial factors.

- Financial Planning: Understand your monthly payment obligations and how they fit into your overall budget.

- Interest Rate Comparison: Compare different interest rates to see how they affect your monthly payments and total loan cost.

- Loan Scenarios: Explore various loan scenarios to determine the best option for your financial needs.

Final Thoughts: Fixed vs. Variable Mortgages

The decision between fixed and variable mortgages ultimately depends on your financial situation, risk tolerance, and market trends. Staying informed about how these options differ ensures you make the right choice for your long-term goals. For expert advice and access to the best mortgage rates in Canada, contact Citadel Mortgages today.

Why Choose Citadel Mortgages

At Citadel Mortgages, we pride ourselves on offering expert, client-focused mortgage solutions that stand out in the industry. Here’s why you should choose us:

Expertise Across Canada

Our mortgage brokers are licensed and certified across multiple provinces, providing exceptional advice and service tailored to your unique needs. Our mortgage brokers are committed to delivering the highest standards of professionalism and expertise.

Client-Focused Service

Unlike traditional commission-based models, our mortgage agents are evaluated based on client satisfaction and the quality of their advice. This ensures that you receive impartial guidance on the best mortgage options for your situation.

Competitive Rates

Citadel Mortgages offers competitive rates that help you save money over the life of your mortgage. Our team works diligently to find the most favorable terms to suit your financial goals.

Transparent and Seamless Process

We are dedicated to transforming the mortgage industry by offering a transparent, seamless process. Our 100% digital platform ensures that you can manage your mortgage application from start to finish with ease and confidence.

Commitment to Excellence

At Citadel Mortgages, our mission is to provide a positive, empowering, and transparent property financing experience. We simplify the mortgage process to make it as straightforward and stress-free as possible.

Contact Us Today

For personalized advice and the best mortgage rates in Toronto, contact our licensed and knowledgeable mortgage experts at Citadel Mortgages.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.