Canada Mortgage Interest Rate Forecast 2025 | Stats, Trends & Expert Insights

Find the Best Mortgage Rates in Canada

Today’s Mortgage Rates updated as of October 15, 2025 12:21 pm

For a property located in

5-year fixed*

3.84

5-year Variable*

3.85

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Introduction to Mortgage Interest Rates in Canada

Mortgage interest rates are a cornerstone of the Canadian housing market. For both homebuyers and those looking to refinance, understanding current trends and projections is vital. This guide provides insights into interest rate trends, historical data, expert predictions, and essential strategies to secure the best rates.

Learn more about how the Bank of Canada sets interest rates.

Lean more about today’s best mortgage rates in Canada.

What Are Mortgage Interest Rates?

Mortgage interest rates are the cost borrowers pay to lenders for the funds required to purchase or refinance a home. These rates vary depending on economic conditions, lending policies, and the type of mortgage chosen.

Types of Mortgage Rates in Canada

- Fixed Rates:

- Consistent payments over the term.

- Preferred by those seeking stability and predictability.

- Variable Rates:

- Fluctuate based on the Bank of Canada’s benchmark interest rate.

- Offer lower initial rates but carry the risk of increases over time.

Read about how fixed and variable rates compare on the Government of Canada website.

Mortgage Stats for Canadian Homebuyers and Refinancers

Understanding the data behind Canada’s mortgage market can help buyers and refinancers make better decisions. Below are key statistics related to mortgage activity in Canada.

Key Stats 2025

- Account for 50% of home purchases in major Canadian cities.

- Average mortgage size: $460,000.

Refinancing Activity:

- Refinancers represent 35% of all mortgage applications.

- Average equity withdrawn during refinancing: $80,000.

Mortgage Terms:

- 5-Year Fixed Rate: Preferred by 72% of Canadians.

- Variable Rate Mortgages: Chosen by 28% of homeowners, down from 38% in 2021.

Average Interest Rates:

- Fixed: 5.50% – 6.25%.

- Variable: 5.10% – 5.75%.

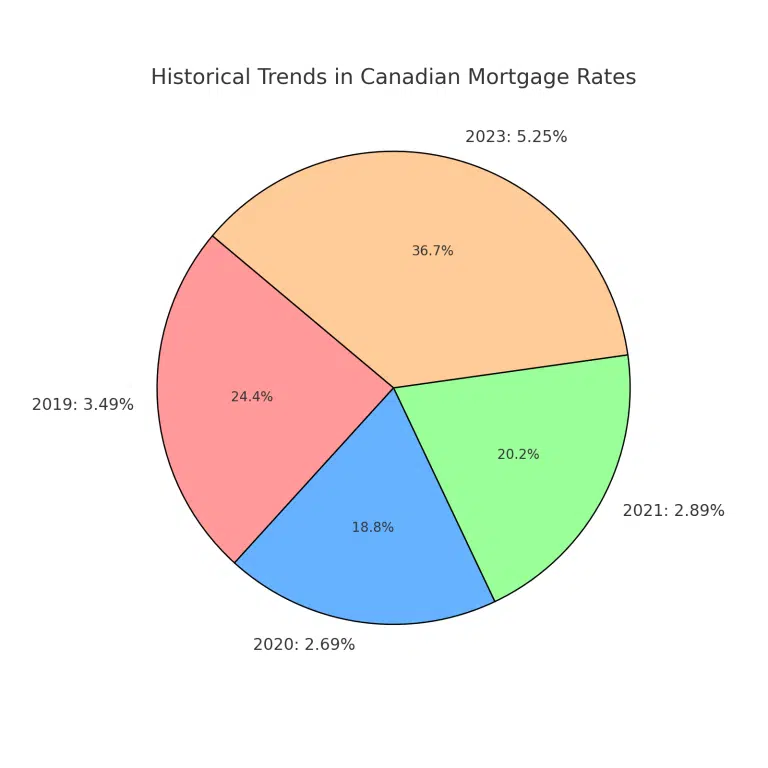

Historical Trends in Canadian Mortgage Rates

| Year | 5-Year Fixed Rate (%) | Bank of Canada Overnight Rate (%) |

|---|---|---|

| 2019 | 3.49% | 1.75% |

| 2020 | 2.69% | 0.25% |

| 2021 | 2.89% | 0.25% |

| 2023 | 5.25% | 4.50% |

Key Observations:

- Rates hit historic lows during the COVID-19 pandemic.

- The Bank of Canada began increasing rates in 2022 to combat inflation, leading to higher mortgage rates.

- The bank of Canada Prime Rate is key to watch for each rate annoucement.

Explore historical interest rates from Statistics Canada.

Current Mortgage Interest Rates in Canada 2025

| Term | Fixed Rate (%) | Variable Rate (%) |

|---|---|---|

| 1-Year Fixed | 6.00% – 6.50% | Not Available |

| 5-Year Fixed | 5.50% – 6.25% | 5.10% – 5.75% |

| 10-Year Fixed | 6.20% – 6.90% | Not Available |

Stay updated on daily rate trends from CMHC.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

Compare Mortgage Rates In Canada

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

How to Be Approved for the Best Mortgage Rates

Maintain a High Credit Score

- Aim for a score of 680 or higher to qualify for competitive rates.

Lower Your Debt-to-Income Ratio (DTI)

- Keep your total debt payments below 35% of gross income.

Save for a Larger Down Payment

- A 20% down payment reduces your loan-to-value ratio, improving your chances of approval.

Shop Around

- Compare offers from banks, credit unions, and mortgage brokers.

Interest Rate Forecast for 2025

Economists expect moderate adjustments in mortgage rates for 2024 as the Bank of Canada balances inflation control and economic growth.

- Short-Term Rates: Expected to stabilize, with minor fluctuations depending on inflation trends.

- Long-Term Rates: Gradual increases are anticipated, reflecting market adjustments to ongoing inflation pressures.

Projected Influencing Factors:

- Bank of Canada’s monetary policy.

- Global economic conditions.

- Canadian housing market dynamics.

- Bank of Canada’s Target Overnight Rate

Lowest Mortgage Rates In Canada

Documents Needed for Mortgage Approval in Canada

- Government ID: Driver’s license, passport, or permanent resident card.

- Proof of Income: Recent pay stubs, T4 slips, or self-employment income proof.

- Employment Verification: Letter from your employer detailing salary and position.

- Down Payment Proof: Bank statements or proof of savings.

- Credit Report Authorization: Permission for lenders to access your credit history.

Additional Documentation

- Other documents may be needed based on your unique situation. Our experienced mortgage agents at Citadel Mortgages will assist you in identifying and gathering any additional paperwork required to complete your second mortgage application.

Get a Mortgage with Citadel Mortgages

Navigate Interest Rate Trends with Confidence: Mortgage Solutions Tailored for You

At Citadel Mortgages, we recognize how important it is to stay informed about changing mortgage interest rates. Whether you’re purchasing your first home, refinancing, or renewing your mortgage, we’re here to guide you through the process with solutions that suit your financial needs, even in fluctuating rate environments.

Why Choose Our Mortgage Solutions?

Flexible Mortgage Options

From fixed to variable rates, we offer tailored solutions that help you secure the most competitive interest rates for your situation.

Expert Guidance on Rate Trends

Our team monitors the Canadian mortgage market to provide insights on current rates, helping you make informed decisions.

Approval Regardless of Credit History

We focus on finding solutions, even if you’ve faced credit challenges or financial setbacks.

Low-Income Friendly Options

Income constraints shouldn’t hold you back. We specialize in making homeownership accessible for Canadians in various financial situations.

Streamlined Application Process

Enjoy a smooth experience with quick approvals and clear communication every step of the way.

Benefits of Working with Citadel Mortgages

Rate Lock Protection

Secure today’s interest rates to avoid surprises if rates increase before your mortgage closes.

Debt Relief Options

Consolidate high-interest debt into a single, lower-interest mortgage payment, saving you money and simplifying your finances.

Customizable Payment Plans

Choose flexible payment terms that fit your budget, whether you prefer the stability of a fixed rate or the potential savings of a variable rate.

Quick Fund Access for Refinancing

Refinance your mortgage to tap into your home’s equity for renovations, debt consolidation, or investment opportunities.

Contact Us To Get Approved Now

Our Featured Rates

FREQUENTLY ASKED QUESTIONS ON MORTGAGE INTEREST RATES IN CANADA

How do interest rates affect monthly payments?

A higher interest rate increases monthly payments, while lower rates reduce overall costs.

Should I choose fixed or variable rates?

Fixed rates offer stability, while variable rates provide potential savings if market rates drop.

Can I refinance to secure a lower rate?

Yes, refinancing allows homeowners to take advantage of lower rates, depending on lender terms and fees.

Use Our Mortgage Calculator Today!

Understanding Your Mortgage Options

Use our mortgage calculator to gain a clearer picture of what you can expect in terms of monthly payments, interest costs, and amortization schedules. Simply input your loan amount, interest rate, and amortization period to get started. This tool provides estimates to help you make informed decisions as you explore different mortgage options.

Benefits of Using Our Mortgage Calculator

- Accurate Estimates: Get precise calculations on your potential second mortgage amount based on your home’s equity, current mortgage balance, and other financial factors.

- Financial Planning: Understand your monthly payment obligations and how they fit into your overall budget.

- Interest Rate Comparison: Compare different interest rates to see how they affect your monthly payments and total loan cost.

- Loan Scenarios: Explore various loan scenarios to determine the best option for your financial needs.

Final Thoughts - Mortgage Interest Rates in Canada

Mortgage rates remain a critical factor in home affordability for Canadians. By understanding current trends, leveraging the right tools, and working with a trusted partner like Citadel Mortgages, you can secure the best rates and achieve your financial goals.

Why Choose Citadel Mortgages

At Citadel Mortgages, we pride ourselves on offering expert, client-focused mortgage solutions that stand out in the industry. Here’s why you should choose us:

Expertise Across Canada

Our mortgage brokers are licensed and certified across multiple provinces, providing exceptional advice and service tailored to your unique needs. Our mortgage brokers are committed to delivering the highest standards of professionalism and expertise.

Client-Focused Service

Unlike traditional commission-based models, our mortgage agents are evaluated based on client satisfaction and the quality of their advice. This ensures that you receive impartial guidance on the best mortgage options for your situation.

Competitive Rates

Citadel Mortgages offers competitive rates that help you save money over the life of your mortgage. Our team works diligently to find the most favorable terms to suit your financial goals.

Transparent and Seamless Process

We are dedicated to transforming the mortgage industry by offering a transparent, seamless process. Our 100% digital platform ensures that you can manage your mortgage application from start to finish with ease and confidence.

Commitment to Excellence

At Citadel Mortgages, our mission is to provide a positive, empowering, and transparent property financing experience. We simplify the mortgage process to make it as straightforward and stress-free as possible.

Contact Us Today

For personalized advice and the best mortgage rates in Toronto, contact our licensed and knowledgeable mortgage experts at Citadel Mortgages.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.