Current BMO Mortgage Rates in Canada | Compare & Save with Citadel Mortgages

Find the Best BMO Bank Mortgage Rates in Canada

Today’s Mortgage Rates updated as of September 23, 2025 9:45 pm

For a property located in

5-year fixed*

3.84

5-year Variable*

3.99

(Prime -1.15%)

*Insured loans. Other conditions apply. Rate in effect as of today.

Our Awards Since 2018

Discover the Best BMO Mortgage Rates in Canada

At Citadel Mortgages, we help you secure the most competitive mortgage rates, including those offered by BMO (Bank of Montreal). Whether you’re a first-time homebuyer, refinancing, or renewing your mortgage, understanding current trends and available options helps you make informed financial decisions.

This guide focuses on helping you navigate the Canadian mortgage market, offering insights into current rates, strategies for securing the best deal, and regional trends.

Mortgage brokers play a pivotal role in helping Canadians find tailored financing options, providing expert advice, and navigating the often complex mortgage market.

For more detailed information on mortgage types, costs, and rights, consult the Government of Canada – Financial Consumer Agency of Canada (FCAC).

Current BMO Mortgage Rates

Compare BMO’s rates to other top lenders to ensure you’re getting the best deal. Contact us to explore all your options.

Learn more about today’s best mortgage rates in Canada.

Prime Rate | Variable Rates | Fixed Rates | Per Term | History | Checklist | Features

| How it Works | How To | Pre-Approval | Feature Comparison | FAQ

BMO Prime Rate

BMO’s prime rate is the base rate for its loans. Higher-risk customers and products get higher interest rates, whereas mortgages with a home as collateral present lower risk and therefore sit below the prime rate.

BMO Variable Mortgage Rates

BMO variable-rate mortgages have interest rates that change with their prime rate. However, you always pay the same amount for your mortgage payments. However, the interest rate determines how much of your mortgage payment goes to interest and how much goes to the mortgage’s principal. The lower the prime, the more of your payments go to the principal. Therefore, paying down your principal can take longer when interest rates are high.

BMO Fixed Mortgage Rates

With a fixed-rate mortgage, you always have the same interest rate and mortgage payments for the life of your mortgage.

Read about how fixed and variable rates compare on the Government of Canada website.

BMO Mortgage Rates As Per Term

BMO 5-Year Fixed and Variable Rate History

Here are the 5-year fixed and variable rates over the past few years:

- Year: 2020 Fixed: 2.69% Variable: 2.45%

- Year: 2021 Fixed: 2.34% Variable: 2.45%

- Year: 2022 Fixed: 4.36% Variable: 2.65%

Why Choose BMO Mortgages?

BMO is one of Canada’s leading mortgage providers, offering competitive rates and unique features to meet a variety of needs.

Key Benefits of BMO Mortgages

Rate Hold of Up to 120 Days

- Lock in today’s rate while you shop for your dream home.

Flexible Prepayment Privileges

- Pay up to 20% of your original mortgage amount annually without penalties.

Cashback Mortgages

- Receive cash upfront to cover closing costs or renovations.

Portability Options

- Move your mortgage to a new property without penalties.

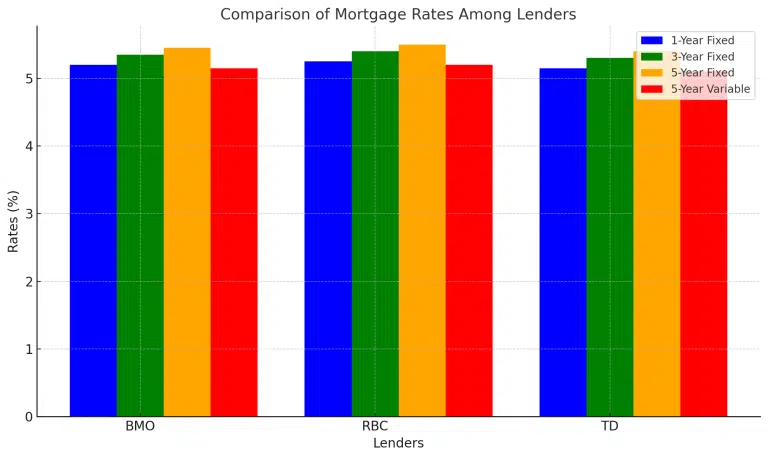

How BMO Mortgage Rates Compare to Other Lenders

| Lender | 1-Year Fixed | 3-Year Fixed | 5-Year Fixed | 5-Year Variable |

|---|---|---|---|---|

| BMO | 5.20% | 5.35% | 5.45% | 5.15% |

| RBC | 5.25% | 5.40% | 5.50% | 5.20% |

| TD | 5.15% | 5.30% | 5.40% | 5.10% |

This table highlights how BMO competes with other leading Canadian lenders, offering competitive rates and flexible terms.

Using a mortgage broker that has access to some of the lowest mortgage rates in Canada, is key to ensure you have the best approval rate.

BMO Mortgage Application Checklist

You will need the following information when applying for a BMO mortgage:

- Purchase and Sale Agreement(s), including all schedules and waivers

- MLS Listing with photo

- Property tax estimates, condo fees, and heating costs

- Contact information of your solicitor or notary

- Contact information of your real estate agent

- The individual who the appraiser can contact to coordinate access to the property

- Recent mortgage statement

- Most recent property tax assessment

- Current homeowner insurance policy

- Legal description of your property

- The individual who the appraiser can contact to coordinate access to the property

- Copy of latest pay slip with employer name

- Letter of employment signed by employer

- Most recent T4

- If you are either self-employed or have commission-based income, you’ll need the last two years of tax returns (T1 General) and corresponding Notice of Assessment AND any one of the following:

- Statement of business activities for the respective tax years

- Audited financial statements for the business for the respective tax years

- Financial statements accompanied by a Review Engagement

- Report signed by a practicing accountant

- Notice to Reader financial statements prepared by an accredited professional accountant for the respective tax years

- Most recent years’ tax returns (T1 General) and corresponding Notice of Assessment

- Savings and investment statement(s) with your name from within the last 90 days

- If you are selling an existing property – a copy of the sales agreement

- Gift Letter (if applicable) – a Gift Letter will be provided for you to be signed by the individual providing the funds

- Withdrawal from RRSP through the Home Buyer’s Plan (if applicable)

You should also have the following available:

- Your banking information or a void cheque

- Two pieces of valid personal identification (driver’s license, passport, or government-issued ID)

- If you are consolidating debt, please bring copies of your current statement(s) with balance and account details

BMO Mortgage Features

BMO offers a number of mortgage features that make your mortgage terms a bit more flexible or attractive, including:

Increase Your Mortgage Payments:

Each year, you can increase your monthly mortgage payment by up to 20% or up to 10% for a fixed mortgage. This makes it easy to pay your mortgage off more quickly while paying less interest over time.

Make a Lump Sum Payment:

You can also choose to make a lump sum payment once a year without penalty. With a regular BMO mortgage, you can pay up to 20% of your original mortgage balance or up to 10% for fixed mortgages. Again, over time you reduce how much you pay in interest by reducing your mortgage balance.

Increase Your Payment Frequency:

You can increase your payment frequency to reduce interest as well using one of their more frequent payment options, either bi-weekly or weekly. You reduce your mortgage balance more than you would with monthly payments, so you pay less interest and pay your mortgage off faster.

BMO Mortgage Protection Insurance:

You can opt to include mortgage protection insurance, including mortgage life insurance, critical illness insurance, disability insurance, and job-loss insurance. If any of these unexpected scenarios occur, you are covered, and your mortgage is automatically paid off. Your premiums never increase, but you do end up paying more for your mortgage payments. Ensure you get a final tally of your mortgage payments before opting in.

Property Tax Payments:

In most cases, you will pay BMO a monthly installment to cover your property taxes. The bank then pays them on your behalf. This ensures there are no tax liens on your property should you default on your mortgage. It is actually a good service, as it is one less thing to worry about, and it breaks your property taxes down into easy-to-manage payments.

BMO Mortgages: How It Works

A mortgage is simply a loan the bank provides you to purchase your home. It consists of the principal, which is the balance owed on the price of your home, less the down payment and the interest charged to the principal. As you pay down the mortgage, the amount you pay in interest shrinks along with your balance. Therefore, at the beginning of your mortgage, more goes towards the interest, and over time you eventually are strictly paying for the principal.

Equity

As you pay down your mortgage, you build equity, the amount of your home you own outright. The more equity you have in your home, the more money you get when you sell. As well you are also eligible to access more money via a home equity loan. Equity also builds or reduces based on current market prices.

Amortization & Term

Amortization is how long it takes to pay your entire mortgage balance. This differs from a mortgage term, as the term is how long that particular contract is in place. Your mortgage is renewed at the end of each term. The shorter the amortization, the higher your monthly payments, the quicker you pay the mortgage, and the less you pay in interest.

Factors That Influence BMO Mortgage Rates

Several factors impact the rates offered by BMO, including:

1. Economic Conditions

- The Bank of Canada’s overnight rate directly affects variable rates.

- Inflation and market trends can lead to fluctuations in fixed rates.

2. Personal Financial Profile

- A credit score of 680 or higher qualifies for the best rates.

- A low debt-to-income ratio increases your approval chances.

3. Mortgage Type and Term

- Fixed rates offer stability, while variable rates may provide savings when interest rates are low.

We compare mortgage rates from top lenders, including BMO mortgage rates, CIBC mortgage rates, RBC mortgage rates, TD Bank Mortgage Rates, and MCAP mortgage rates, alongside our exclusive Citadel Smart Home Plan mortgage rates. Let us simplify the process and help you secure approval quickly and stress-free!

How to Get a BMO Mortgage Pre-Approval

A mortgage pre-approval tells you whether you qualify for a BMO mortgage. BMO collects your income and credit history to conduct a check. They then either let you know how much they are willing to lend you or that your preapproval is denied. Preapproval makes it easier to buy a home because you know how much you can afford. It also locks in your interest rates for 130 days while you search for a home. If rates drop, BMO gives you the lower rate, but you are locked into the lower rate if they rise. You can apply for preapproval online if you:

- Are a Canadian resident

- Have reached the age of majority in your province or territory

- Intend to live in the home where you are applying for the mortgage

- Have been employed for at least 2 years

Open vs. Closed Mortgages: Feature Comparison

Here are the differences between open and closed mortgages:

Open

An open mortgage allows you to prepay or re-negotiate your mortgage at any time without having to pay additional fees. As a result, your mortgage is more flexible. You can pay your mortgage down faster, take advantage of lower interest rates, and enjoy more freedom to take advantage of your financial or market conditions. However, you will also pay higher interest rates for an open mortgage than a closed one.

Closed

Closed mortgages maintain the same conditions as those you agree to when you sign the mortgage. If you go outside the permitted payment differences, you are penalized. However, you will also pay lower interest rates.

FAQs: BMO Mortgage Rates

How often does BMO update its mortgage rates?

BMO updates its rates based on market conditions and changes in the Bank of Canada’s overnight rate.

Does BMO offer pre-approval for mortgages?

Yes, BMO provides pre-approvals that lock in your rate for up to 120 days.

Can I transfer my mortgage to BMO?

Yes, BMO allows mortgage transfers and may offer cashback incentives or cover transfer fees.

How do I talk to someone at BMO?

You can visit their website to find out how to speak to a customer service representative or pop into a branch near you.

Discover the average savings of current Citadel Mortgage clients when they choose Citadel Mortgages over the top banks!

While 33% of non-homeowners believe they’ll never own*, our Citadel mortgage brokers are 100% confident they can make it happen. How? With our expert advice and guidance.

$300,000

Mortgage Loan

$12,414

(5-years interest savings with Citadel Mortgages)**

$232/month

(Interest savings with Citadel Mortgages)

$500,000

Mortgage Loan

$17,090

(5-years interest savings with Citadel Mortgages)**

$290/month

(Interest savings with Citadel Mortgages)

Compare BMO Mortgage Rates

Final Thoughts - BMO MOrtgage rates

Securing the best mortgage rates, whether from BMO or other lenders, is crucial to achieving your financial goals. At Citadel Mortgages, we guide you through the process, ensuring you save money and make informed decisions.

At Citadel Mortgages, we specialize in helping Canadians navigate the complexities of mortgage rates and terms. Whether you’re looking for a 6-month fixed rate, a 5-year variable, or something in between, our team is here to provide personalized guidance and access to the best rates in Canada.

See Best Mortgages By Province

See Best Mortgages By City

Utilize our mortgage calculators to determine the home affordability that suits you best!

Become Mortgage Free Sooner

See how you can save and become mortgage-free sooner

Mortgage Payment Calculator

Calculate how much you’d spend each month to buy a home or renew or refinance your mortgage.

Cashback Mortgage Calculator

Discover how much cash back you could receive with our Cash Back Mortgage Calculator.